Deep learning forecasting leverages neural networks to analyze complex financial data patterns and predict future trends with high accuracy, outperforming traditional methods. Moving averages smooth out price data by calculating average values over specified periods, offering simpler, less dynamic trend analysis. Explore how integrating deep learning with moving averages can enhance your accounting forecasts.

Why it is important

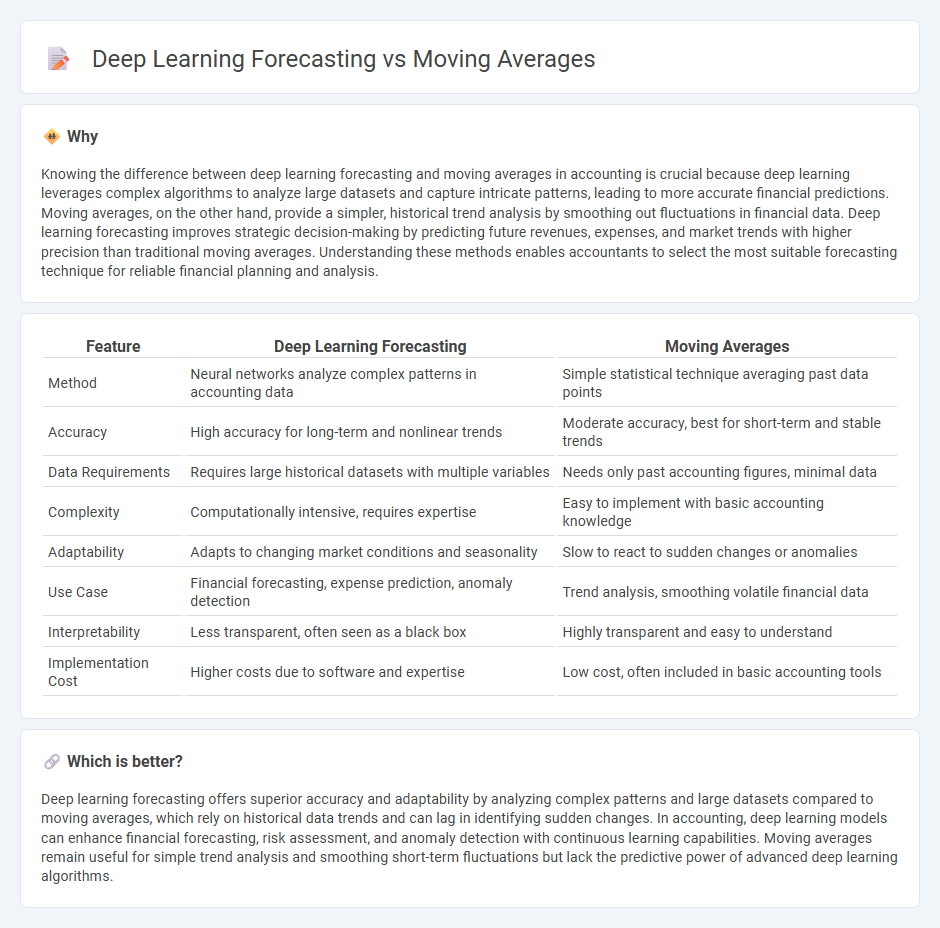

Knowing the difference between deep learning forecasting and moving averages in accounting is crucial because deep learning leverages complex algorithms to analyze large datasets and capture intricate patterns, leading to more accurate financial predictions. Moving averages, on the other hand, provide a simpler, historical trend analysis by smoothing out fluctuations in financial data. Deep learning forecasting improves strategic decision-making by predicting future revenues, expenses, and market trends with higher precision than traditional moving averages. Understanding these methods enables accountants to select the most suitable forecasting technique for reliable financial planning and analysis.

Comparison Table

| Feature | Deep Learning Forecasting | Moving Averages |

|---|---|---|

| Method | Neural networks analyze complex patterns in accounting data | Simple statistical technique averaging past data points |

| Accuracy | High accuracy for long-term and nonlinear trends | Moderate accuracy, best for short-term and stable trends |

| Data Requirements | Requires large historical datasets with multiple variables | Needs only past accounting figures, minimal data |

| Complexity | Computationally intensive, requires expertise | Easy to implement with basic accounting knowledge |

| Adaptability | Adapts to changing market conditions and seasonality | Slow to react to sudden changes or anomalies |

| Use Case | Financial forecasting, expense prediction, anomaly detection | Trend analysis, smoothing volatile financial data |

| Interpretability | Less transparent, often seen as a black box | Highly transparent and easy to understand |

| Implementation Cost | Higher costs due to software and expertise | Low cost, often included in basic accounting tools |

Which is better?

Deep learning forecasting offers superior accuracy and adaptability by analyzing complex patterns and large datasets compared to moving averages, which rely on historical data trends and can lag in identifying sudden changes. In accounting, deep learning models can enhance financial forecasting, risk assessment, and anomaly detection with continuous learning capabilities. Moving averages remain useful for simple trend analysis and smoothing short-term fluctuations but lack the predictive power of advanced deep learning algorithms.

Connection

Deep learning forecasting in accounting leverages neural networks to analyze complex financial data patterns for accurate predictions of future revenues, expenses, and cash flows. Moving averages serve as a foundational technique for smoothing time series data, enabling deep learning models to better identify trends and seasonal variations in accounting metrics. Integrating moving averages with deep learning enhances forecasting precision by reducing noise and improving the interpretability of financial forecasts.

Key Terms

Time Series

Moving averages smooth time series data by averaging past observations, providing simple trend estimation but limited adaptability to complex patterns. Deep learning forecasting employs neural networks to capture intricate temporal dependencies and non-linear relationships, significantly improving prediction accuracy in volatile or multi-factor time series. Explore cutting-edge models and applications to enhance your forecasting strategy with advanced time series analysis.

Smoothing

Moving averages offer a straightforward smoothing technique that reduces noise by averaging past data points, ideal for identifying short-term trends in time series forecasting. Deep learning forecasting models, such as LSTM networks, inherently learn smoothing patterns through complex nonlinear representations, capturing long-term dependencies beyond simple moving averages. Explore deeper insights into how smoothing impacts forecasting accuracy and model performance for your data-driven decisions.

Neural Networks

Neural networks in deep learning offer superior forecasting accuracy by capturing complex nonlinear patterns in data, unlike moving averages which rely on simple, linear trend smoothing techniques. Deep learning models, such as recurrent neural networks (RNNs) and long short-term memory (LSTM) networks, handle sequential data effectively, making them ideal for time series forecasting in finance and weather prediction. Explore more about how neural networks outperform traditional methods in predictive analytics and enhance decision-making.

Source and External Links

Moving average - Wikipedia - A moving average is a statistical calculation used to analyze data by creating a series of averages of different subsets of the full data set, often used in time series analysis.

What is a moving average, and why is it useful? - This article explains how moving averages are used to smooth data, such as in COVID case tracking, by averaging values over a fixed period.

Moving Average - Overview, Types and Examples, EMA vs SMA - Moving averages are technical indicators used in finance to determine the direction of trends and reduce price volatility impacts.

dowidth.com

dowidth.com