Digital asset valuation involves assessing cryptocurrencies, tokens, and blockchain-based assets using specialized models like discounted cash flow or market comparables, reflecting their unique volatility and regulatory challenges. Investment property appraisal focuses on determining real estate value through approaches such as income capitalization, cost, and sales comparison, considering factors like location, condition, and market trends. Explore the distinct methodologies and criteria that differentiate digital asset valuation from investment property appraisal to enhance your accounting expertise.

Why it is important

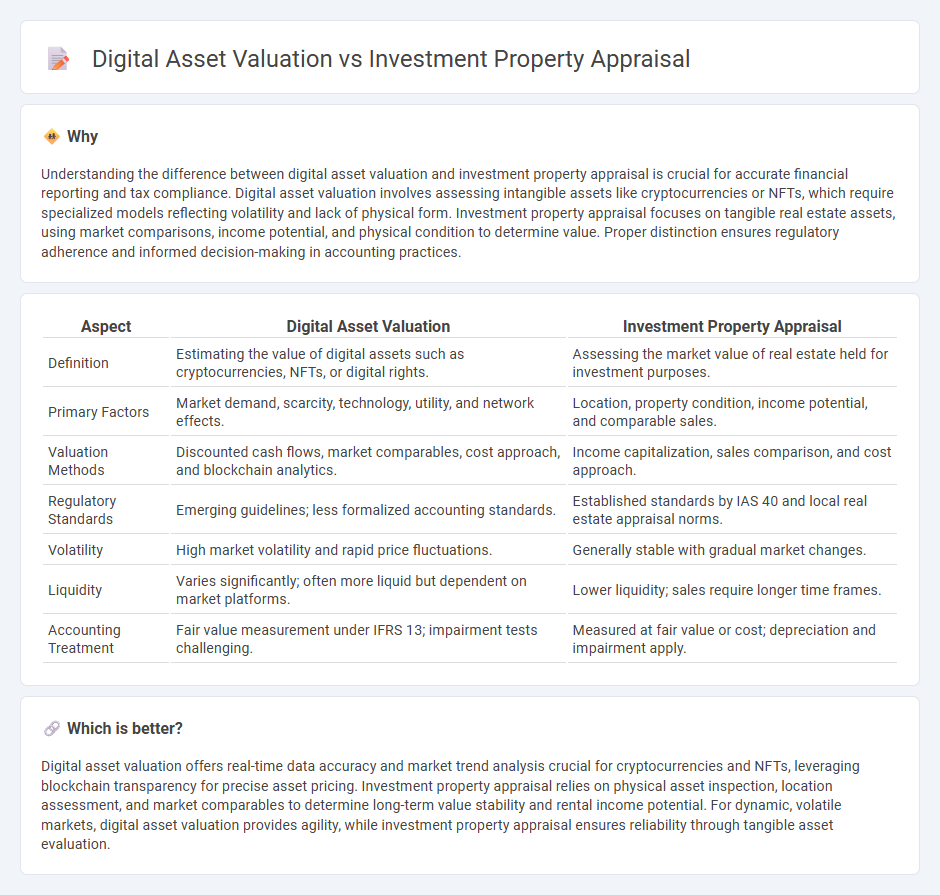

Understanding the difference between digital asset valuation and investment property appraisal is crucial for accurate financial reporting and tax compliance. Digital asset valuation involves assessing intangible assets like cryptocurrencies or NFTs, which require specialized models reflecting volatility and lack of physical form. Investment property appraisal focuses on tangible real estate assets, using market comparisons, income potential, and physical condition to determine value. Proper distinction ensures regulatory adherence and informed decision-making in accounting practices.

Comparison Table

| Aspect | Digital Asset Valuation | Investment Property Appraisal |

|---|---|---|

| Definition | Estimating the value of digital assets such as cryptocurrencies, NFTs, or digital rights. | Assessing the market value of real estate held for investment purposes. |

| Primary Factors | Market demand, scarcity, technology, utility, and network effects. | Location, property condition, income potential, and comparable sales. |

| Valuation Methods | Discounted cash flows, market comparables, cost approach, and blockchain analytics. | Income capitalization, sales comparison, and cost approach. |

| Regulatory Standards | Emerging guidelines; less formalized accounting standards. | Established standards by IAS 40 and local real estate appraisal norms. |

| Volatility | High market volatility and rapid price fluctuations. | Generally stable with gradual market changes. |

| Liquidity | Varies significantly; often more liquid but dependent on market platforms. | Lower liquidity; sales require longer time frames. |

| Accounting Treatment | Fair value measurement under IFRS 13; impairment tests challenging. | Measured at fair value or cost; depreciation and impairment apply. |

Which is better?

Digital asset valuation offers real-time data accuracy and market trend analysis crucial for cryptocurrencies and NFTs, leveraging blockchain transparency for precise asset pricing. Investment property appraisal relies on physical asset inspection, location assessment, and market comparables to determine long-term value stability and rental income potential. For dynamic, volatile markets, digital asset valuation provides agility, while investment property appraisal ensures reliability through tangible asset evaluation.

Connection

Digital asset valuation and investment property appraisal intersect through their shared reliance on market data analysis and risk assessment models to determine accurate asset worth. Both processes require understanding fluctuating market conditions, comparable sales or trades, and future income potential to establish fair valuation metrics. Integration of advanced analytics and blockchain transparency enhances precision and confidence in evaluating diverse asset classes within dynamic financial environments.

Key Terms

Fair Value

Investment property appraisal determines Fair Value based on market comparables, income potential, and physical condition, aligning with international accounting standards like IFRS 13. Digital asset valuation relies on blockchain data, market demand, and technological utility, often using discounted cash flow or market approach methods tailored to cryptocurrencies and NFTs. Explore comprehensive methodologies for accurate Fair Value determination in diverse asset classes.

Market Approach

The Market Approach in investment property appraisal relies on comparable sales data, recent transactions, and market trends to estimate property value, emphasizing physical assets and location-specific factors. In digital asset valuation, the Market Approach assesses value based on comparable digital asset transactions, user engagement, and platform demand, focusing on virtual market dynamics and intangible attributes. Explore in-depth strategies and methodologies behind these valuation techniques to enhance your understanding.

Intangible Assets

Investment property appraisal evaluates tangible real estate assets based on location, market trends, and physical condition, providing a concrete framework for asset valuation. Digital asset valuation focuses on intangible assets such as intellectual property, digital currencies, and software, employing metrics like market demand, user engagement, and technological innovation. Explore further to understand the distinct methodologies and challenges in valuing these diverse asset types.

Source and External Links

Get The Guide: Appraisals For Investment Properties - Investment property appraisals commonly use sales comparison, cost analysis, and income capitalization approaches to determine value, with appraisers inspecting the property's interior and exterior before deciding on the best method.

Appraising Small Income Properties - McKissock Learning - Accurate investment property appraisals start with establishing gross rent multiplier and market rent, considering vacancy rates carefully, and verifying leases and rentable condition of units to properly reflect income potential.

Investment Property Appraisals Made Simple - Appraisals determine rental property's market value through methods such as sales comparison, income approach focusing on income potential, and cost approach accounting for replacement cost minus depreciation.

dowidth.com

dowidth.com