Tokenized assets accounting involves recording digital representations of physical or financial assets on a blockchain, enabling fractional ownership and enhanced transparency. Non-fungible tokens (NFTs) accounting focuses on unique digital items with distinct value, requiring specialized valuation and impairment considerations. Explore the nuanced differences to optimize your accounting strategies in the evolving digital asset landscape.

Why it is important

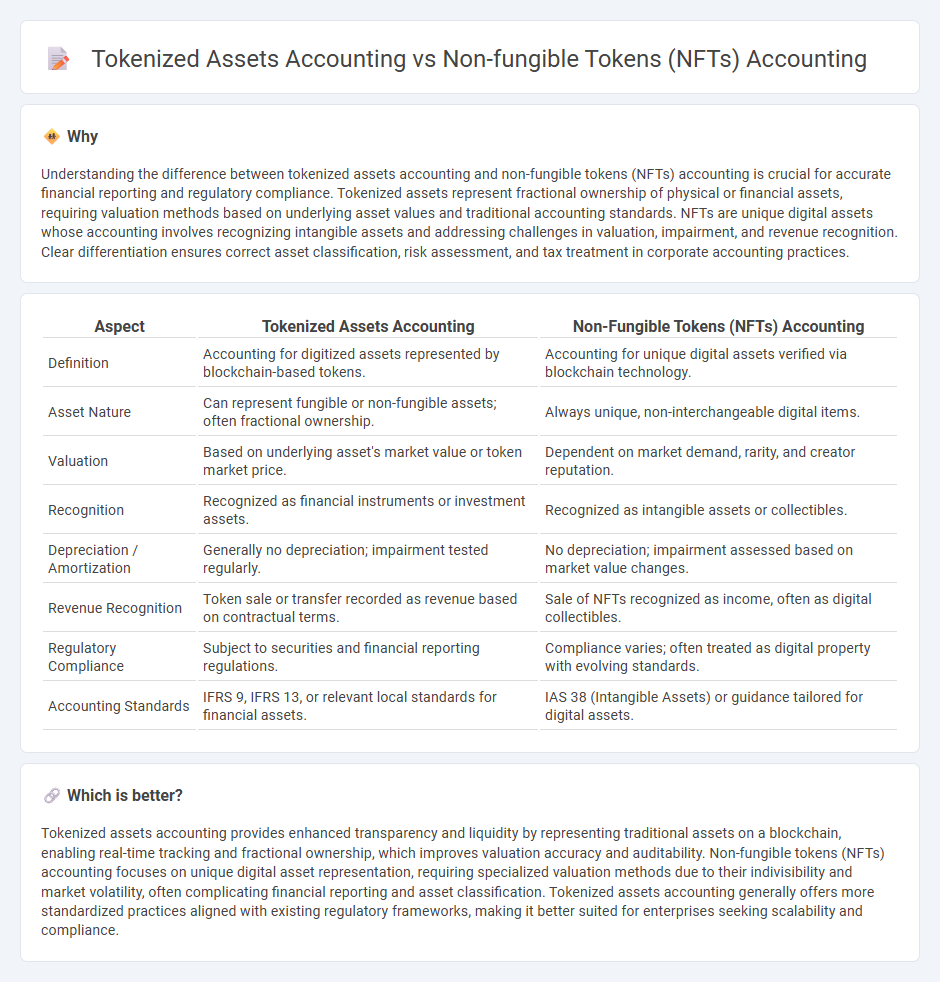

Understanding the difference between tokenized assets accounting and non-fungible tokens (NFTs) accounting is crucial for accurate financial reporting and regulatory compliance. Tokenized assets represent fractional ownership of physical or financial assets, requiring valuation methods based on underlying asset values and traditional accounting standards. NFTs are unique digital assets whose accounting involves recognizing intangible assets and addressing challenges in valuation, impairment, and revenue recognition. Clear differentiation ensures correct asset classification, risk assessment, and tax treatment in corporate accounting practices.

Comparison Table

| Aspect | Tokenized Assets Accounting | Non-Fungible Tokens (NFTs) Accounting |

|---|---|---|

| Definition | Accounting for digitized assets represented by blockchain-based tokens. | Accounting for unique digital assets verified via blockchain technology. |

| Asset Nature | Can represent fungible or non-fungible assets; often fractional ownership. | Always unique, non-interchangeable digital items. |

| Valuation | Based on underlying asset's market value or token market price. | Dependent on market demand, rarity, and creator reputation. |

| Recognition | Recognized as financial instruments or investment assets. | Recognized as intangible assets or collectibles. |

| Depreciation / Amortization | Generally no depreciation; impairment tested regularly. | No depreciation; impairment assessed based on market value changes. |

| Revenue Recognition | Token sale or transfer recorded as revenue based on contractual terms. | Sale of NFTs recognized as income, often as digital collectibles. |

| Regulatory Compliance | Subject to securities and financial reporting regulations. | Compliance varies; often treated as digital property with evolving standards. |

| Accounting Standards | IFRS 9, IFRS 13, or relevant local standards for financial assets. | IAS 38 (Intangible Assets) or guidance tailored for digital assets. |

Which is better?

Tokenized assets accounting provides enhanced transparency and liquidity by representing traditional assets on a blockchain, enabling real-time tracking and fractional ownership, which improves valuation accuracy and auditability. Non-fungible tokens (NFTs) accounting focuses on unique digital asset representation, requiring specialized valuation methods due to their indivisibility and market volatility, often complicating financial reporting and asset classification. Tokenized assets accounting generally offers more standardized practices aligned with existing regulatory frameworks, making it better suited for enterprises seeking scalability and compliance.

Connection

Tokenized assets accounting and Non-fungible tokens (NFTs) accounting are interconnected through the digital representation of ownership and value on blockchain technology, requiring specialized recognition and valuation methods. Both involve tracking provenance, ensuring compliance with regulatory standards, and managing the distinct classification of digital assets on financial statements. Efficient accounting practices for tokenized assets and NFTs facilitate transparent reporting, risk assessment, and seamless integration into traditional financial systems.

Key Terms

Asset Classification

NFTs accounting requires unique asset classification due to their distinct, non-interchangeable nature on blockchain, impacting valuation and ownership recording. Tokenized assets accounting classifies tokens representing fractional ownership of tangible or intangible assets, influencing financial reporting and compliance differently. Explore detailed distinctions in asset classification to maximize accuracy and regulatory adherence in emerging digital finance.

Fair Value Measurement

Non-fungible tokens (NFTs) accounting requires precise fair value measurement due to their unique digital ownership and lack of liquidity, contrasting with tokenized assets that often represent standardized, fungible securities or real-world assets. Tokenized assets accounting focuses on market-based valuations and regulatory compliance, while NFTs leverage blockchain transparency but pose challenges in establishing objective fair values given limited comparables. Explore deeper insights into fair value measurement methodologies and evolving accounting standards for both NFTs and tokenized assets.

Revenue Recognition

Non-fungible tokens (NFTs) accounting involves recognizing revenue based on unique digital asset sales with distinct ownership and transfer records, while tokenized assets accounting requires revenue recognition tied to fractional ownership of underlying physical or financial assets. Revenue from NFTs is typically recognized at the point of sale, reflecting the transfer of token ownership on blockchain platforms, whereas tokenized assets may recognize revenue proportionally over time through dividends or asset appreciation. Explore detailed frameworks and best practices for distinguishing revenue recognition in NFTs and tokenized asset accounting.

Source and External Links

A Guide to Tax & Accounting for NFTs - NFTs present substantial challenges in accounting due to the lack of specific US GAAP and IFRS guidance, often being treated as indefinite-lived intangible assets with difficulties in impairment and fair value measurement.

6 Things To Know About Accounting For NFTs - NFTs are typically recorded as intangible assets but require individual analysis since accounting treatment may vary based on underlying rights and characteristics, with no clear consensus under US GAAP.

Accounting for nonfungible tokens (NFTs) - This resource outlines accounting challenges for NFT sellers, purchasers, and marketplaces, emphasizing the need for careful consideration in financial reporting across different roles involving NFTs.

dowidth.com

dowidth.com