Continuous close accounting streamlines month-end processes by integrating tasks throughout the period, reducing bottlenecks and improving accuracy. Real-time close, on the other hand, provides instant financial insights by continuously updating accounting records as transactions occur. Explore the differences and benefits of each approach to enhance your organization's financial close strategy.

Why it is important

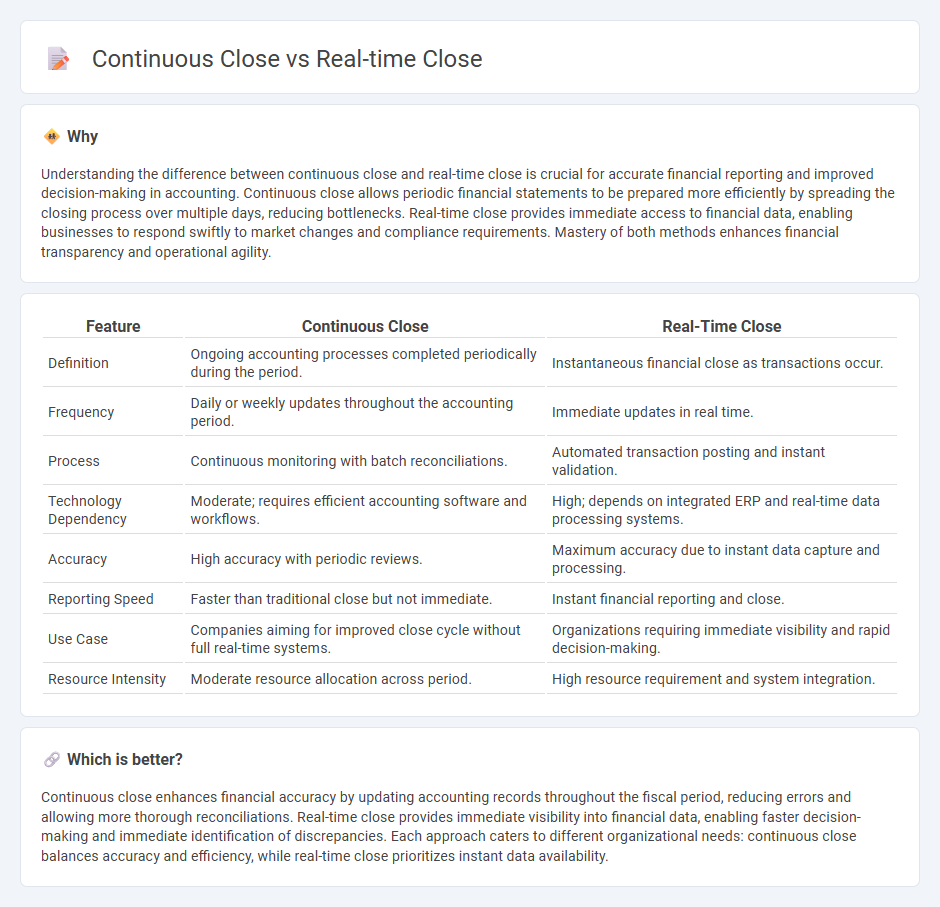

Understanding the difference between continuous close and real-time close is crucial for accurate financial reporting and improved decision-making in accounting. Continuous close allows periodic financial statements to be prepared more efficiently by spreading the closing process over multiple days, reducing bottlenecks. Real-time close provides immediate access to financial data, enabling businesses to respond swiftly to market changes and compliance requirements. Mastery of both methods enhances financial transparency and operational agility.

Comparison Table

| Feature | Continuous Close | Real-Time Close |

|---|---|---|

| Definition | Ongoing accounting processes completed periodically during the period. | Instantaneous financial close as transactions occur. |

| Frequency | Daily or weekly updates throughout the accounting period. | Immediate updates in real time. |

| Process | Continuous monitoring with batch reconciliations. | Automated transaction posting and instant validation. |

| Technology Dependency | Moderate; requires efficient accounting software and workflows. | High; depends on integrated ERP and real-time data processing systems. |

| Accuracy | High accuracy with periodic reviews. | Maximum accuracy due to instant data capture and processing. |

| Reporting Speed | Faster than traditional close but not immediate. | Instant financial reporting and close. |

| Use Case | Companies aiming for improved close cycle without full real-time systems. | Organizations requiring immediate visibility and rapid decision-making. |

| Resource Intensity | Moderate resource allocation across period. | High resource requirement and system integration. |

Which is better?

Continuous close enhances financial accuracy by updating accounting records throughout the fiscal period, reducing errors and allowing more thorough reconciliations. Real-time close provides immediate visibility into financial data, enabling faster decision-making and immediate identification of discrepancies. Each approach caters to different organizational needs: continuous close balances accuracy and efficiency, while real-time close prioritizes instant data availability.

Connection

Continuous close and real-time close are connected through their emphasis on accelerating financial reporting by integrating data processing into daily operations. Continuous close leverages automated accounting systems and cloud-based platforms to update financial records regularly, while real-time close focuses on instant data synchronization to provide immediate visibility into financial performance. Both techniques enhance accuracy and agility in accounting, enabling timely decision-making and compliance with evolving regulatory standards.

Key Terms

Automation

Real-time close automates financial close processes by continuously updating transactions, enabling immediate visibility into financial results, while continuous close emphasizes seamless integration of workflows throughout the accounting period to reduce bottlenecks and manual intervention. Automation in real-time close leverages AI and advanced analytics to detect anomalies and ensure accuracy instantly, enhancing compliance and decision-making speed. Explore more to understand how these automation strategies transform financial closing efficiency.

Data Integration

Real-time close accelerates financial consolidation by integrating data instantly as transactions occur, minimizing delays and enhancing accuracy in reporting. Continuous close maintains ongoing data processing and reconciliation throughout the accounting period, ensuring up-to-date information without waiting for period-end batch processes. Explore how advanced data integration platforms facilitate both close methods to optimize financial workflows and decision-making.

Reconciliation

Real-time close enables immediate financial reconciliation by updating transaction and ledger data instantly, reducing the risk of discrepancies and facilitating faster decision-making. Continuous close extends this by automating ongoing reconciliation processes across multiple systems and periods, ensuring comprehensive accuracy and compliance without waiting for month-end. Explore deeper insights on how these closing methods transform reconciliation efficiency and accuracy.

Source and External Links

Real-time closing: Insights in real time | Deloitte US - Real-time close shifts an organization from end-of-month closing to continuous accounting, real-time reporting, and predictive analytics, enabling accurate, up-to-date financial information and faster decision-making supported by cultural change and technology enhancement.

How to Improve Month-End Close by using Real-Time Data? - Using real-time data allows companies to pre-close accounts throughout the month, reducing errors, effort, and the overall duration of the month-end close process by eliminating batch processing delays.

How A Continuous Close Leads To More Accurate Forecasting ... - Continuous close keeps the books updated in real time through automation, overcoming limitations of monthly close cycles and empowering finance teams with timely, accurate financial data for agile planning and forecasting.

dowidth.com

dowidth.com