Continuous close accounting streamlines the financial close process by updating records in real-time, reducing bottlenecks and ensuring up-to-date data for decision-making. Hybrid close combines traditional period-end closing with continuous activities to balance accuracy and efficiency, particularly in complex organizations. Explore further to understand which approach aligns best with your business needs.

Why it is important

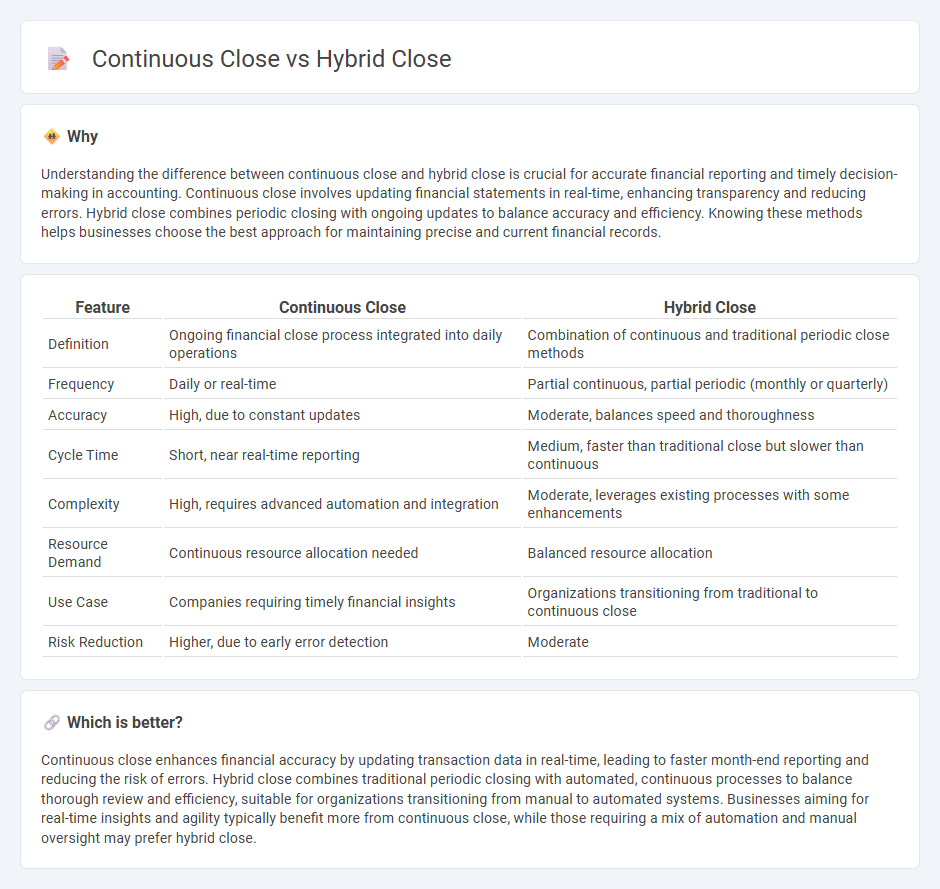

Understanding the difference between continuous close and hybrid close is crucial for accurate financial reporting and timely decision-making in accounting. Continuous close involves updating financial statements in real-time, enhancing transparency and reducing errors. Hybrid close combines periodic closing with ongoing updates to balance accuracy and efficiency. Knowing these methods helps businesses choose the best approach for maintaining precise and current financial records.

Comparison Table

| Feature | Continuous Close | Hybrid Close |

|---|---|---|

| Definition | Ongoing financial close process integrated into daily operations | Combination of continuous and traditional periodic close methods |

| Frequency | Daily or real-time | Partial continuous, partial periodic (monthly or quarterly) |

| Accuracy | High, due to constant updates | Moderate, balances speed and thoroughness |

| Cycle Time | Short, near real-time reporting | Medium, faster than traditional close but slower than continuous |

| Complexity | High, requires advanced automation and integration | Moderate, leverages existing processes with some enhancements |

| Resource Demand | Continuous resource allocation needed | Balanced resource allocation |

| Use Case | Companies requiring timely financial insights | Organizations transitioning from traditional to continuous close |

| Risk Reduction | Higher, due to early error detection | Moderate |

Which is better?

Continuous close enhances financial accuracy by updating transaction data in real-time, leading to faster month-end reporting and reducing the risk of errors. Hybrid close combines traditional periodic closing with automated, continuous processes to balance thorough review and efficiency, suitable for organizations transitioning from manual to automated systems. Businesses aiming for real-time insights and agility typically benefit more from continuous close, while those requiring a mix of automation and manual oversight may prefer hybrid close.

Connection

Continuous close and hybrid close are connected through their shared goal of improving the efficiency and accuracy of financial reporting. Continuous close streamlines the accounting process by updating financial records in real time throughout the accounting period, while hybrid close combines elements of both continuous and traditional month-end closing methods to balance speed and thorough review. Together, these approaches help organizations reduce closing cycle time and enhance the reliability of financial statements.

Key Terms

Closing Process

Hybrid close combines elements of both periodic and continuous closing processes by updating financial records more frequently than traditional periodic methods but not in real-time as continuous close does. Continuous close emphasizes real-time data integration and ongoing transaction validation, enabling faster financial reporting and improved accuracy during the closing process. Discover more about how these closing strategies optimize financial efficiency and accuracy in corporate accounting.

Real-Time Data

Hybrid close integrates batch processing with real-time data updates, enabling faster and more accurate financial reporting compared to traditional batch-only methods. Continuous close relies entirely on real-time data integration, offering perpetual visibility into financial metrics and facilitating immediate decision-making. Explore the advantages of hybrid and continuous close to optimize your financial close process with real-time data insights.

Automation

Hybrid close combines manual processes with automation to enhance accuracy in financial closing, reducing errors while allowing human oversight. Continuous close leverages full automation and real-time data integration to accelerate closing cycles, enabling faster financial reporting and increased transparency. Explore how these automation strategies can transform your closing process for greater efficiency and compliance.

Source and External Links

What is a Hybrid Closing and How Does it Work? - A hybrid closing is a digital closing process where some loan documents are signed electronically while others require wet signatures, often necessitating an in-person meeting for notarization.

The Benefits of Hybrid Closing for Mortgage Professionals - Hybrid closing combines digital and traditional methods to improve efficiency in real estate transactions by allowing borrowers to electronically sign most documents before an in-person meeting for notarization.

Hybrid Closed Loop systems, the Dexcom way - Hybrid Closed Loop systems, also known as Automated Insulin Delivery, use continuous glucose monitoring and insulin pumps to mimic the pancreas's function by automatically adjusting insulin levels based on real-time glucose data.

dowidth.com

dowidth.com