Forensic accounting software specializes in detecting fraud, analyzing financial discrepancies, and tracing illicit transactions by leveraging advanced data analytics and audit trails. Fixed asset management software focuses on tracking asset lifecycle, depreciation schedules, maintenance, and compliance to optimize asset utilization and financial reporting. Explore deeper insights into how each software strengthens accounting accuracy and efficiency.

Why it is important

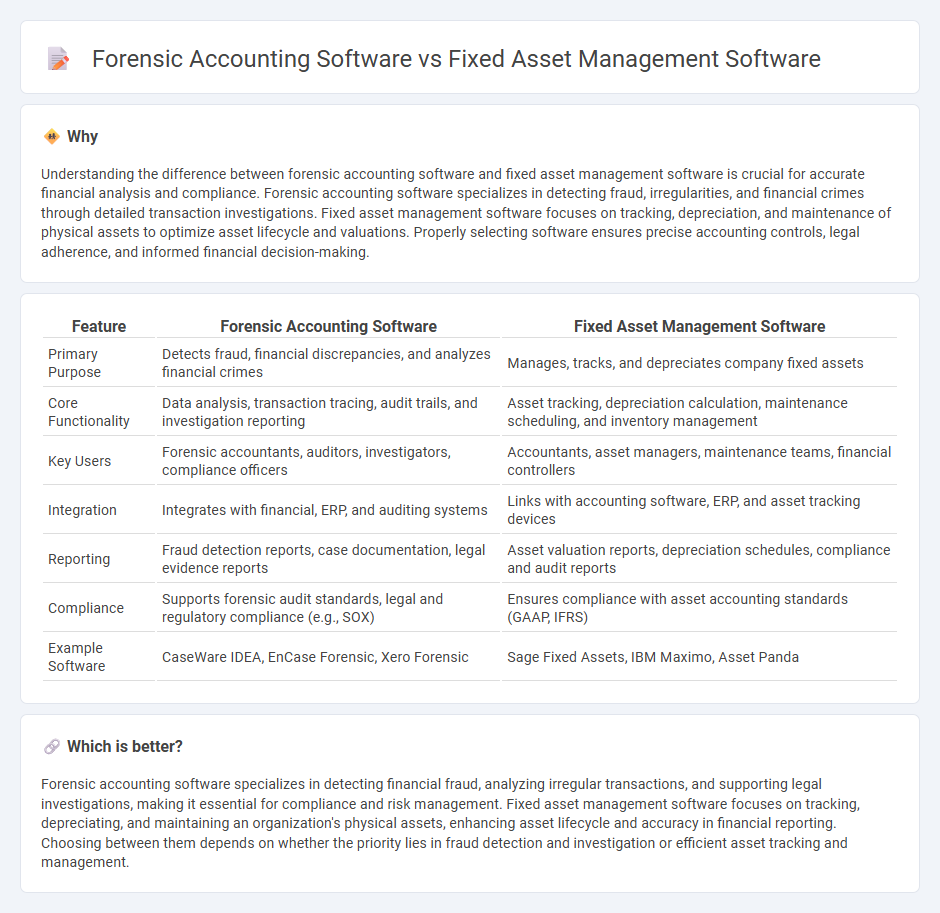

Understanding the difference between forensic accounting software and fixed asset management software is crucial for accurate financial analysis and compliance. Forensic accounting software specializes in detecting fraud, irregularities, and financial crimes through detailed transaction investigations. Fixed asset management software focuses on tracking, depreciation, and maintenance of physical assets to optimize asset lifecycle and valuations. Properly selecting software ensures precise accounting controls, legal adherence, and informed financial decision-making.

Comparison Table

| Feature | Forensic Accounting Software | Fixed Asset Management Software |

|---|---|---|

| Primary Purpose | Detects fraud, financial discrepancies, and analyzes financial crimes | Manages, tracks, and depreciates company fixed assets |

| Core Functionality | Data analysis, transaction tracing, audit trails, and investigation reporting | Asset tracking, depreciation calculation, maintenance scheduling, and inventory management |

| Key Users | Forensic accountants, auditors, investigators, compliance officers | Accountants, asset managers, maintenance teams, financial controllers |

| Integration | Integrates with financial, ERP, and auditing systems | Links with accounting software, ERP, and asset tracking devices |

| Reporting | Fraud detection reports, case documentation, legal evidence reports | Asset valuation reports, depreciation schedules, compliance and audit reports |

| Compliance | Supports forensic audit standards, legal and regulatory compliance (e.g., SOX) | Ensures compliance with asset accounting standards (GAAP, IFRS) |

| Example Software | CaseWare IDEA, EnCase Forensic, Xero Forensic | Sage Fixed Assets, IBM Maximo, Asset Panda |

Which is better?

Forensic accounting software specializes in detecting financial fraud, analyzing irregular transactions, and supporting legal investigations, making it essential for compliance and risk management. Fixed asset management software focuses on tracking, depreciating, and maintaining an organization's physical assets, enhancing asset lifecycle and accuracy in financial reporting. Choosing between them depends on whether the priority lies in fraud detection and investigation or efficient asset tracking and management.

Connection

Forensic accounting software and fixed asset management software intersect through the accurate tracking and verification of asset-related financial data, aiding in fraud detection and compliance audits. Forensic accounting tools analyze transaction records and asset valuations to uncover discrepancies or misappropriation of fixed assets. Integrating these systems enhances the integrity of financial reporting and streamlines asset audit processes.

Key Terms

Depreciation

Fixed asset management software optimizes tracking and calculating depreciation schedules based on asset lifespan and usage, ensuring accurate financial reporting and compliance with accounting standards. Forensic accounting software, on the other hand, utilizes detailed depreciation data to detect discrepancies, fraud, or misstatement in asset valuation during audits or investigations. Explore how these specialized tools enhance financial accuracy and investigative efficiency by delving deeper into their functionalities and applications.

Audit Trail

Fixed asset management software tracks the acquisition, depreciation, and disposal of company assets with detailed audit trails ensuring compliance and transparency in financial reporting. Forensic accounting software emphasizes the analysis and investigation of financial evidence, using audit trails to detect fraud, irregularities, and discrepancies in transactions. Discover the key differences and applications of audit trails in these specialized software solutions to enhance your financial oversight.

Asset Tracking

Fixed asset management software offers comprehensive asset tracking capabilities by providing real-time inventory updates, depreciation calculations, and audit trails to ensure accurate financial reporting. Forensic accounting software, while primarily designed for detecting fraud and analyzing financial discrepancies, includes asset tracking features that support investigation of asset misappropriation or valuation. Explore our detailed comparison to understand which software best suits your asset tracking and financial oversight needs.

Source and External Links

FOUNDATION Fixed Assets Tracking Module - Helps contractors manage long-term assets like buildings and equipment through customizable depreciation methods and detailed reporting.

Newgen Fixed Assets Management Software - Streamlines asset management with digitized records, end-to-end tracking, and AI-driven alerts for efficient lifecycle management.

Thomson Reuters Fixed Assets CS - Offers comprehensive depreciation and asset management tools with customizable treatments and reporting capabilities.

dowidth.com

dowidth.com