Digital asset taxation involves specific regulations governing profits from cryptocurrencies and other blockchain-based assets, often treated differently from traditional capital gains. Capital gains taxation applies to the profit realized from the sale of tangible and intangible property, following established tax codes with set rates and exemptions. Explore the distinctions between these tax types to optimize compliance and financial planning strategies.

Why it is important

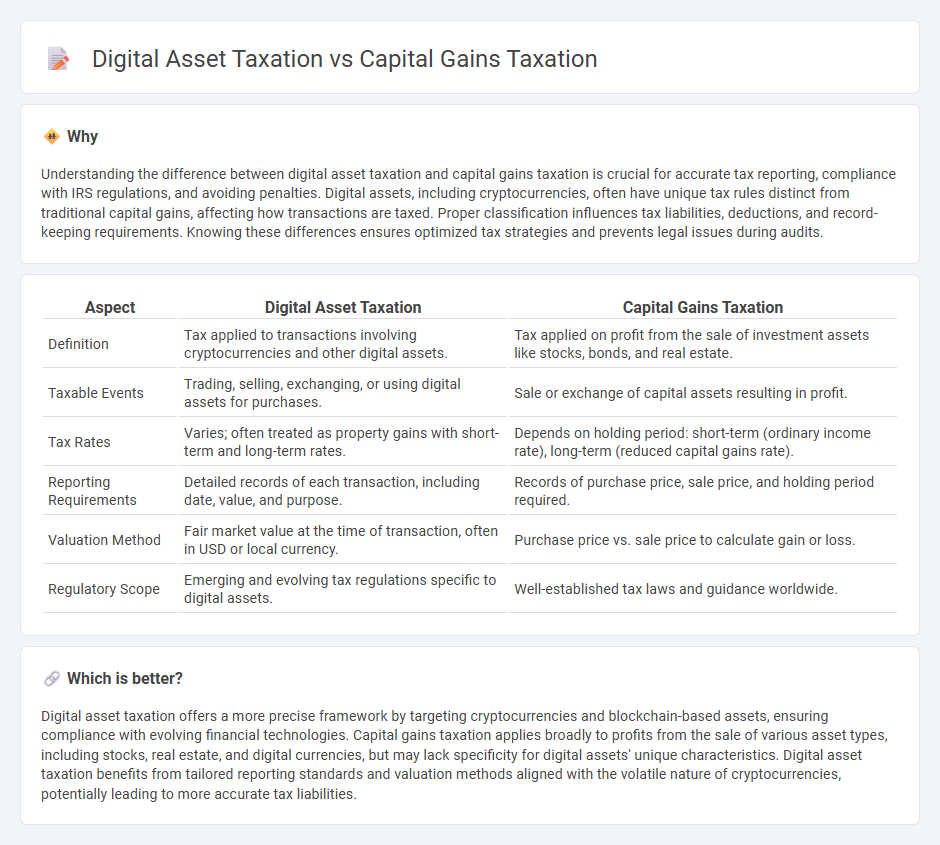

Understanding the difference between digital asset taxation and capital gains taxation is crucial for accurate tax reporting, compliance with IRS regulations, and avoiding penalties. Digital assets, including cryptocurrencies, often have unique tax rules distinct from traditional capital gains, affecting how transactions are taxed. Proper classification influences tax liabilities, deductions, and record-keeping requirements. Knowing these differences ensures optimized tax strategies and prevents legal issues during audits.

Comparison Table

| Aspect | Digital Asset Taxation | Capital Gains Taxation |

|---|---|---|

| Definition | Tax applied to transactions involving cryptocurrencies and other digital assets. | Tax applied on profit from the sale of investment assets like stocks, bonds, and real estate. |

| Taxable Events | Trading, selling, exchanging, or using digital assets for purchases. | Sale or exchange of capital assets resulting in profit. |

| Tax Rates | Varies; often treated as property gains with short-term and long-term rates. | Depends on holding period: short-term (ordinary income rate), long-term (reduced capital gains rate). |

| Reporting Requirements | Detailed records of each transaction, including date, value, and purpose. | Records of purchase price, sale price, and holding period required. |

| Valuation Method | Fair market value at the time of transaction, often in USD or local currency. | Purchase price vs. sale price to calculate gain or loss. |

| Regulatory Scope | Emerging and evolving tax regulations specific to digital assets. | Well-established tax laws and guidance worldwide. |

Which is better?

Digital asset taxation offers a more precise framework by targeting cryptocurrencies and blockchain-based assets, ensuring compliance with evolving financial technologies. Capital gains taxation applies broadly to profits from the sale of various asset types, including stocks, real estate, and digital currencies, but may lack specificity for digital assets' unique characteristics. Digital asset taxation benefits from tailored reporting standards and valuation methods aligned with the volatile nature of cryptocurrencies, potentially leading to more accurate tax liabilities.

Connection

Digital asset taxation intersects with capital gains taxation as cryptocurrencies and other digital assets are classified as property by tax authorities, triggering capital gains tax upon their sale or exchange. The calculation of capital gains involves assessing the difference between the purchase price (cost basis) and the sale price of the digital asset, necessitating meticulous record-keeping for accurate reporting. Taxpayers must comply with jurisdiction-specific regulations on digital asset transactions to avoid penalties and ensure proper declaration of taxable capital gains.

Key Terms

Capital Gains

Capital gains taxation primarily applies to profits realized from the sale of traditional assets such as stocks, real estate, and bonds, with tax rates varying based on holding period and income levels. Digital asset taxation, while increasingly incorporating capital gains principles, often presents unique challenges due to asset classification, transaction tracking, and regulatory uncertainty. Explore comprehensive resources to understand the nuances and implications of capital gains taxation on digital assets.

Cost Basis

Capital gains taxation on traditional assets hinges on accurately identifying the cost basis to determine taxable profit, while digital asset taxation presents unique challenges due to frequent transactions and fluctuating valuations. Digital assets often require meticulous tracking of acquisition dates, amounts, and specific identification methods (FIFO, LIFO, or specific identification) to calculate precise capital gains or losses. Explore detailed strategies to optimize cost basis reporting and compliance in the evolving landscape of digital asset taxation.

Cryptocurrency

Capital gains taxation on cryptocurrency treats digital assets as property, subjecting profits from sales or trades to similar tax rates as stocks and real estate, with rates depending on holding period and income level. Digital asset taxation includes specific rules addressing mining income, hard forks, airdrops, and usage for goods or services, with the IRS categorizing cryptocurrencies under taxable events that can complicate compliance. Explore detailed guidelines and practical strategies to optimize your tax obligations on cryptocurrency transactions.

Source and External Links

Capital Gains and Losses - This webpage provides detailed information on capital gains tax rates and the thresholds for different filing statuses.

Capital Gains Tax - This Vanguard webpage explains what capital gains tax is, how it applies to investments, and strategies to minimize it.

How Are Capital Gains Taxed - This webpage offers insights into the taxation of capital gains, including differences between short-term and long-term gains.

dowidth.com

dowidth.com