Cryptofinance reconciliation involves verifying cryptocurrency transactions, ensuring accuracy between blockchain records and internal ledgers, while cash reconciliation focuses on matching physical cash or bank account balances against accounting entries. Both processes aim to detect discrepancies, prevent fraud, and maintain financial integrity, but cryptofinance requires specialized tools due to the decentralized nature of digital assets. Explore further to understand the unique challenges and solutions in cryptofinance versus traditional cash reconciliation.

Why it is important

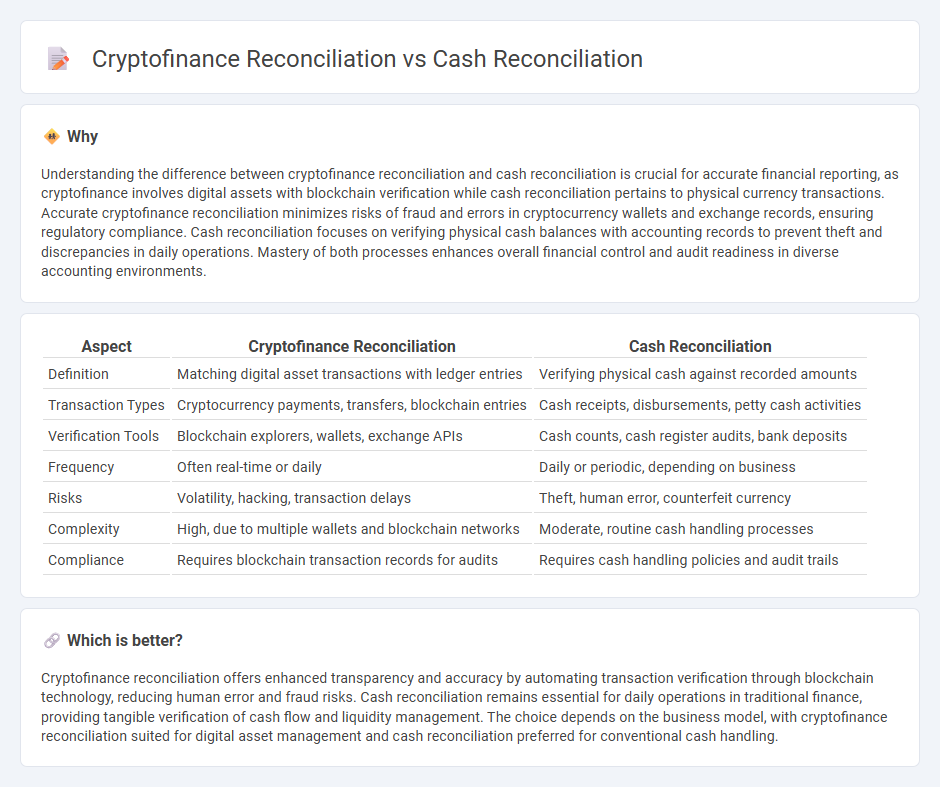

Understanding the difference between cryptofinance reconciliation and cash reconciliation is crucial for accurate financial reporting, as cryptofinance involves digital assets with blockchain verification while cash reconciliation pertains to physical currency transactions. Accurate cryptofinance reconciliation minimizes risks of fraud and errors in cryptocurrency wallets and exchange records, ensuring regulatory compliance. Cash reconciliation focuses on verifying physical cash balances with accounting records to prevent theft and discrepancies in daily operations. Mastery of both processes enhances overall financial control and audit readiness in diverse accounting environments.

Comparison Table

| Aspect | Cryptofinance Reconciliation | Cash Reconciliation |

|---|---|---|

| Definition | Matching digital asset transactions with ledger entries | Verifying physical cash against recorded amounts |

| Transaction Types | Cryptocurrency payments, transfers, blockchain entries | Cash receipts, disbursements, petty cash activities |

| Verification Tools | Blockchain explorers, wallets, exchange APIs | Cash counts, cash register audits, bank deposits |

| Frequency | Often real-time or daily | Daily or periodic, depending on business |

| Risks | Volatility, hacking, transaction delays | Theft, human error, counterfeit currency |

| Complexity | High, due to multiple wallets and blockchain networks | Moderate, routine cash handling processes |

| Compliance | Requires blockchain transaction records for audits | Requires cash handling policies and audit trails |

Which is better?

Cryptofinance reconciliation offers enhanced transparency and accuracy by automating transaction verification through blockchain technology, reducing human error and fraud risks. Cash reconciliation remains essential for daily operations in traditional finance, providing tangible verification of cash flow and liquidity management. The choice depends on the business model, with cryptofinance reconciliation suited for digital asset management and cash reconciliation preferred for conventional cash handling.

Connection

Cryptofinance reconciliation and Cash reconciliation are interconnected processes essential for accurate financial accounting and reporting. Cryptofinance reconciliation involves verifying blockchain transactions and digital asset balances against accounting records, while Cash reconciliation focuses on matching physical and electronic cash flow with ledger entries. Together, they ensure comprehensive validation of both traditional cash holdings and cryptocurrency assets, reducing discrepancies and enhancing financial transparency.

Key Terms

Bank Statement Matching

Cash reconciliation primarily involves matching bank statements with internal cash records to ensure accuracy and detect discrepancies. Cryptofinance reconciliation extends this process to digital assets, incorporating blockchain transaction verifications alongside traditional bank statement matching. Explore deeper insights into how blockchain technology enhances reconciliation accuracy and efficiency.

Blockchain Transaction Validation

Cash reconciliation involves verifying and matching traditional banking transactions and cash flow records to ensure accuracy and prevent discrepancies. Cryptofinance reconciliation, particularly with blockchain transaction validation, utilizes decentralized ledgers and cryptographic proof to confirm transaction authenticity and immutability, reducing fraud risks and enhancing transparency. Explore how blockchain transaction validation transforms reconciliation processes by offering secure, real-time verification in modern finance.

Reconciliation Discrepancy Analysis

Cash reconciliation involves verifying physical cash records against accounting ledgers, ensuring all transactions match and discrepancies are minimal, typically handled in traditional banking or retail environments. Cryptofinance reconciliation compares blockchain-based transactions with internal records, addressing unique challenges such as transaction delays, smart contract errors, and wallet address mismatches for accurate ledger alignment. Explore detailed strategies for effective reconciliation discrepancy analysis in both cash and cryptofinance to enhance financial accuracy and compliance.

Source and External Links

What is Cash Reconciliation: Steps, Examples and Implementation - This article provides a comprehensive guide on cash reconciliation, including steps like obtaining bank statements, matching cash balances, and preparing reconciliation entries.

How to Perform a Cash Reconciliation: A Step-By-Step Guide for Accountants - This guide outlines a step-by-step process for performing cash reconciliation, including determining the accounting period and downloading necessary financial reports.

Cash Reconciliation Defined & Its Importance - NetSuite - This resource defines cash reconciliation as verifying that sales receipts match the actual cash on hand, and outlines its importance in maintaining financial accuracy.

dowidth.com

dowidth.com