Crypto asset valuation requires specialized methods distinct from traditional cost models due to market volatility and unique asset characteristics. While the cost model records assets at initial purchase price less depreciation, crypto valuation often involves fair value measurement reflecting current market prices. Explore detailed approaches to accurately value crypto assets within accounting frameworks.

Why it is important

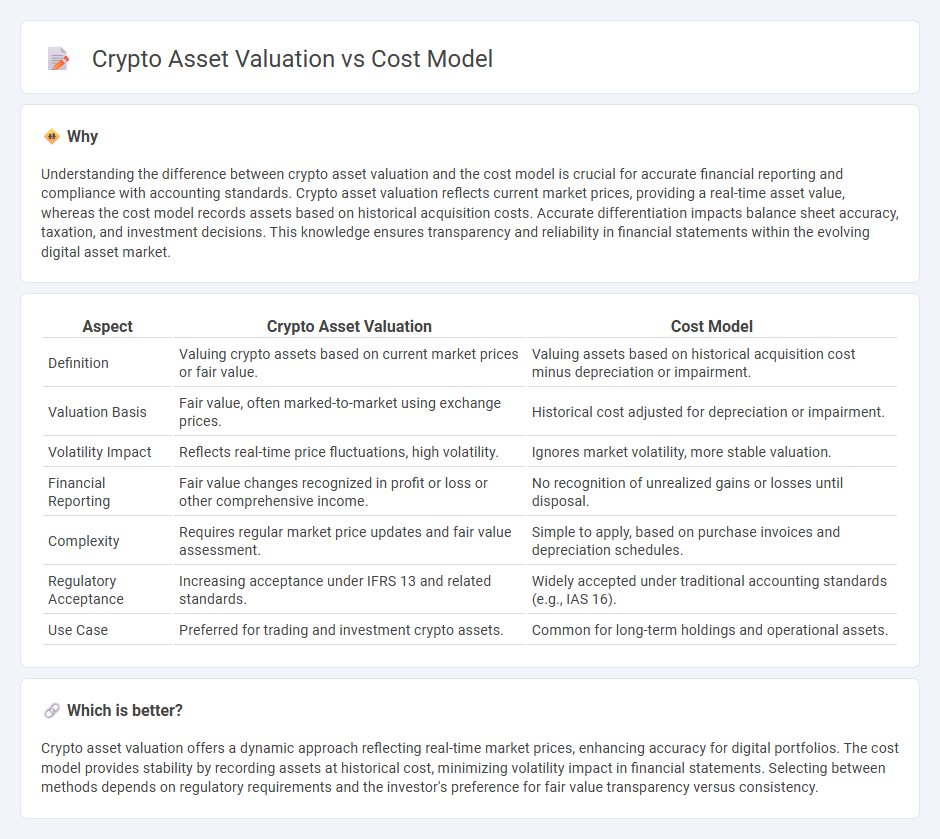

Understanding the difference between crypto asset valuation and the cost model is crucial for accurate financial reporting and compliance with accounting standards. Crypto asset valuation reflects current market prices, providing a real-time asset value, whereas the cost model records assets based on historical acquisition costs. Accurate differentiation impacts balance sheet accuracy, taxation, and investment decisions. This knowledge ensures transparency and reliability in financial statements within the evolving digital asset market.

Comparison Table

| Aspect | Crypto Asset Valuation | Cost Model |

|---|---|---|

| Definition | Valuing crypto assets based on current market prices or fair value. | Valuing assets based on historical acquisition cost minus depreciation or impairment. |

| Valuation Basis | Fair value, often marked-to-market using exchange prices. | Historical cost adjusted for depreciation or impairment. |

| Volatility Impact | Reflects real-time price fluctuations, high volatility. | Ignores market volatility, more stable valuation. |

| Financial Reporting | Fair value changes recognized in profit or loss or other comprehensive income. | No recognition of unrealized gains or losses until disposal. |

| Complexity | Requires regular market price updates and fair value assessment. | Simple to apply, based on purchase invoices and depreciation schedules. |

| Regulatory Acceptance | Increasing acceptance under IFRS 13 and related standards. | Widely accepted under traditional accounting standards (e.g., IAS 16). |

| Use Case | Preferred for trading and investment crypto assets. | Common for long-term holdings and operational assets. |

Which is better?

Crypto asset valuation offers a dynamic approach reflecting real-time market prices, enhancing accuracy for digital portfolios. The cost model provides stability by recording assets at historical cost, minimizing volatility impact in financial statements. Selecting between methods depends on regulatory requirements and the investor's preference for fair value transparency versus consistency.

Connection

Crypto asset valuation relies heavily on the cost model, which records assets at their historical purchase price minus any accumulated depreciation or impairment losses. This approach ensures accurate financial statements by reflecting the initial acquisition cost while adjusting for market fluctuations and asset impairments over time. Applying the cost model to crypto assets helps maintain consistency in valuation despite their volatility, supporting reliable accounting and audit processes.

Key Terms

Historical Cost

Historical cost in crypto asset valuation emphasizes the original purchase price recorded on the ledger, offering a transparent and verifiable basis for accounting but potentially understating current market values. This cost model provides stability and regulatory compliance, particularly useful for institutional investors prioritizing asset consistency over speculative fluctuations. Explore further to understand how historical cost integrates with other valuation approaches like fair value and market-based models.

Fair Value

Fair value measurement in crypto asset valuation contrasts sharply with traditional cost models by emphasizing current market conditions and investor sentiment rather than historical cost or production expenses. While cost models account for the initial acquisition or creation cost, fair value reflects real-time prices and potential liquidity, offering a more dynamic and realistic financial insight. Explore how adopting fair value approaches can enhance transparency and investment decision-making in the evolving cryptocurrency landscape.

Impairment

Impairment plays a critical role in distinguishing cost model accounting from crypto asset valuation, as the cost model records assets at historical cost less accumulated impairment losses, while crypto assets require continuous fair value assessment under IFRS 13 standards. The cost model focuses on recognizing impairment only when indicators exist, ensuring assets are not overstated on financial statements, whereas crypto asset valuation demands real-time market data to reflect volatile price fluctuations accurately. Explore detailed methodologies and implications of impairment recognition in cost model versus crypto asset valuation to enhance your financial reporting accuracy.

Source and External Links

What is a Cost Model? A Guide for Effective Budgeting - CathCap - A cost model is a detailed tool used by businesses to understand and estimate all costs involved in producing goods or services, which supports budgeting, pricing, and strategic planning by defining scope, gathering data, segmenting costs, and analyzing cost drivers.

Recommendations for creating a cost model - Microsoft Azure Well ... - A cost model estimates all costs related to workloads including infrastructure, licenses, and personnel, aligning cost estimates to key drivers and associating them with business metrics for better expense prediction and resource utilization.

Three Core Concepts in Building a Cost Model - FocusCFO - A cost model acts as a framework to calculate business costs by capturing expenses like wages and capital costs and understanding cost-volume relationships to accurately calculate margins while keeping the model simple for regular updates.

dowidth.com

dowidth.com