Digital asset taxation involves complex valuation methods and regulatory considerations distinct from physical asset taxation, which relies on tangible possession and traditional appraisal standards. Cryptocurrency, NFTs, and other digital assets require careful tracking of transactions, cost basis, and capital gains under evolving tax laws. Explore the nuances of digital versus physical asset taxation to optimize your fiscal strategy and compliance.

Why it is important

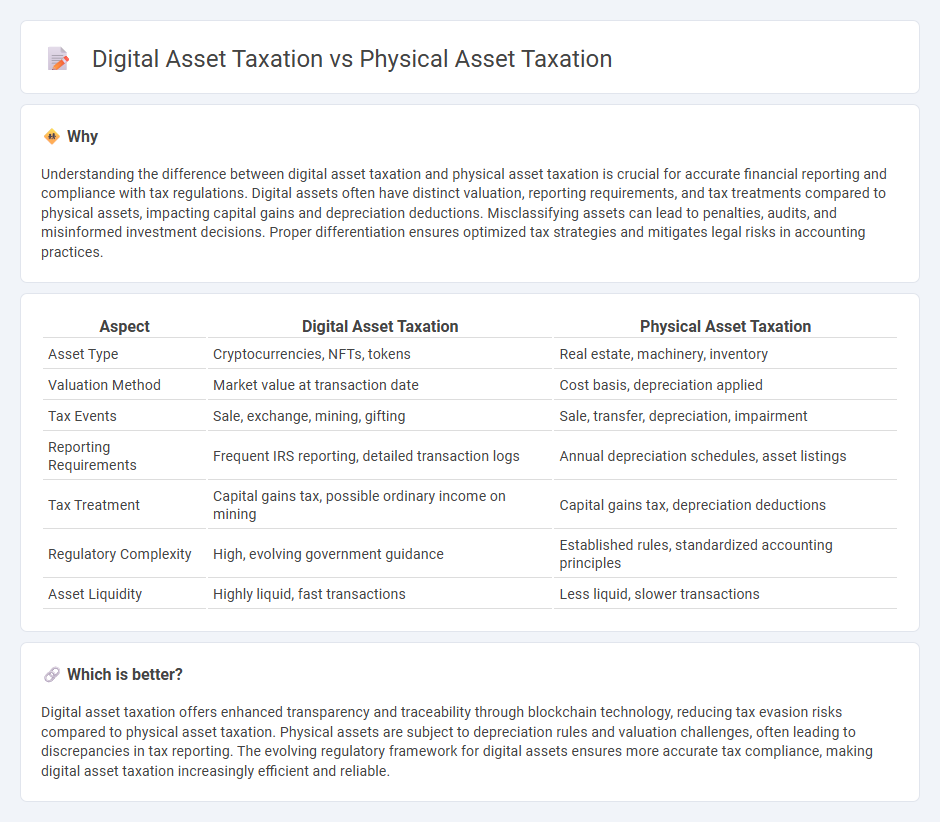

Understanding the difference between digital asset taxation and physical asset taxation is crucial for accurate financial reporting and compliance with tax regulations. Digital assets often have distinct valuation, reporting requirements, and tax treatments compared to physical assets, impacting capital gains and depreciation deductions. Misclassifying assets can lead to penalties, audits, and misinformed investment decisions. Proper differentiation ensures optimized tax strategies and mitigates legal risks in accounting practices.

Comparison Table

| Aspect | Digital Asset Taxation | Physical Asset Taxation |

|---|---|---|

| Asset Type | Cryptocurrencies, NFTs, tokens | Real estate, machinery, inventory |

| Valuation Method | Market value at transaction date | Cost basis, depreciation applied |

| Tax Events | Sale, exchange, mining, gifting | Sale, transfer, depreciation, impairment |

| Reporting Requirements | Frequent IRS reporting, detailed transaction logs | Annual depreciation schedules, asset listings |

| Tax Treatment | Capital gains tax, possible ordinary income on mining | Capital gains tax, depreciation deductions |

| Regulatory Complexity | High, evolving government guidance | Established rules, standardized accounting principles |

| Asset Liquidity | Highly liquid, fast transactions | Less liquid, slower transactions |

Which is better?

Digital asset taxation offers enhanced transparency and traceability through blockchain technology, reducing tax evasion risks compared to physical asset taxation. Physical assets are subject to depreciation rules and valuation challenges, often leading to discrepancies in tax reporting. The evolving regulatory framework for digital assets ensures more accurate tax compliance, making digital asset taxation increasingly efficient and reliable.

Connection

Digital asset taxation and physical asset taxation are connected through the underlying principles of property valuation, capital gains recognition, and tax reporting requirements enforced by tax authorities like the IRS. Both forms of taxation necessitate accurate record-keeping of acquisition dates, fair market values, and transaction outcomes to determine taxable income or losses. The integration of blockchain technology for digital assets simplifies tracking provenance and ownership, echoing established accounting practices for physical assets.

Key Terms

Depreciation (Physical) vs. Amortization (Digital)

Depreciation applies to physical assets by gradually reducing their taxable value over time due to wear and tear, while amortization pertains to digital assets, allowing the systematic expense recognition of intangible items such as software or intellectual property. Physical asset depreciation uses methods like straight-line or declining balance, whereas digital asset amortization typically follows a set useful life based on asset type or legal considerations. Explore detailed guidelines and tax strategies to optimize asset value and compliance in your financial planning.

Property Tax (Physical) vs. Capital Gains Tax (Digital)

Property tax applies to physical assets like real estate, calculated based on the assessed value of the property and paid annually to local governments. Capital gains tax affects digital assets such as cryptocurrencies and NFTs, levied on the profit made from selling or exchanging these assets, with rates varying depending on the holding period and jurisdiction. Explore detailed distinctions and tax strategies for optimizing liabilities in physical versus digital asset ownership.

Tangible Asset Valuation vs. Intangible Asset Valuation

Tangible asset valuation in physical asset taxation involves assessing the market, cost, or income approaches to determine the worth of assets like real estate, machinery, or vehicles, which have a physical presence and depreciation schedules. Intangible asset valuation in digital asset taxation focuses on non-physical assets such as intellectual property, software, patents, trademarks, and digital currencies, using methods like relief-from-royalty or excess earnings models to estimate value based on future economic benefits. Explore comprehensive frameworks and methodologies to optimize asset valuation strategies for both physical and digital tax compliance.

Source and External Links

Understanding tangible personal property tax: a guide to compliance - Tangible personal property (movable physical assets) is taxable in up to 43 US states with tax assessments based on fair market value taking into account depreciation, whereas real property (land and buildings) is taxed differently and requires no return filing.

How to Structure a Business Asset Purchase with Taxes in Mind - In a taxable asset purchase, the cost of physical assets is allocated and sets their tax basis, which affects depreciation and taxable gains when sold or converted to cash.

Publication 551 (12/2024), Basis of Assets - The tax basis of physical assets is used to determine depreciation and gain/loss calculations, with specific rules for modifications, demolitions, and subdivisions of property affecting the asset's tax basis.

dowidth.com

dowidth.com