Carbon footprint accounting measures greenhouse gas emissions generated by an organization's activities, quantifying environmental impact primarily in carbon dioxide equivalents. Natural capital accounting assesses the value and stock of natural resources, including biodiversity, water, and soil, integrating ecological assets into financial decision-making. Explore further to understand how these accounting methods drive sustainability and corporate responsibility.

Why it is important

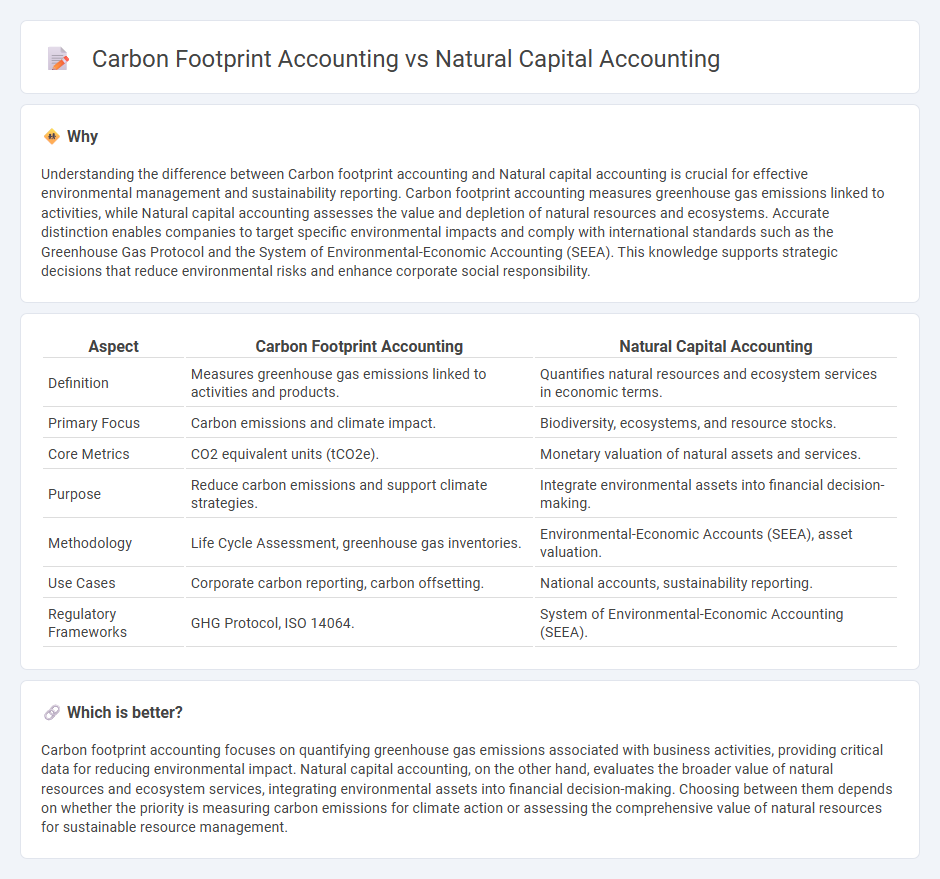

Understanding the difference between Carbon footprint accounting and Natural capital accounting is crucial for effective environmental management and sustainability reporting. Carbon footprint accounting measures greenhouse gas emissions linked to activities, while Natural capital accounting assesses the value and depletion of natural resources and ecosystems. Accurate distinction enables companies to target specific environmental impacts and comply with international standards such as the Greenhouse Gas Protocol and the System of Environmental-Economic Accounting (SEEA). This knowledge supports strategic decisions that reduce environmental risks and enhance corporate social responsibility.

Comparison Table

| Aspect | Carbon Footprint Accounting | Natural Capital Accounting |

|---|---|---|

| Definition | Measures greenhouse gas emissions linked to activities and products. | Quantifies natural resources and ecosystem services in economic terms. |

| Primary Focus | Carbon emissions and climate impact. | Biodiversity, ecosystems, and resource stocks. |

| Core Metrics | CO2 equivalent units (tCO2e). | Monetary valuation of natural assets and services. |

| Purpose | Reduce carbon emissions and support climate strategies. | Integrate environmental assets into financial decision-making. |

| Methodology | Life Cycle Assessment, greenhouse gas inventories. | Environmental-Economic Accounts (SEEA), asset valuation. |

| Use Cases | Corporate carbon reporting, carbon offsetting. | National accounts, sustainability reporting. |

| Regulatory Frameworks | GHG Protocol, ISO 14064. | System of Environmental-Economic Accounting (SEEA). |

Which is better?

Carbon footprint accounting focuses on quantifying greenhouse gas emissions associated with business activities, providing critical data for reducing environmental impact. Natural capital accounting, on the other hand, evaluates the broader value of natural resources and ecosystem services, integrating environmental assets into financial decision-making. Choosing between them depends on whether the priority is measuring carbon emissions for climate action or assessing the comprehensive value of natural resources for sustainable resource management.

Connection

Carbon footprint accounting quantifies greenhouse gas emissions associated with business activities, directly impacting natural capital by measuring resource depletion and environmental degradation. Natural capital accounting evaluates the stock and flow of natural resources, providing a comprehensive overview of ecosystem services affected by carbon emissions. Integrating both accounting methods enables organizations to assess environmental impacts holistically and support sustainable resource management strategies.

Key Terms

Natural capital accounting:

Natural capital accounting quantifies the value of natural resources and ecosystem services, integrating environmental assets into national and corporate economic accounts for sustainable decision-making. It encompasses biodiversity, water, soil, and air quality metrics, providing a comprehensive overview that supports long-term ecological and economic health beyond carbon emissions. Explore how natural capital accounting drives holistic environmental strategies and policy development.

Ecosystem services

Natural capital accounting quantifies the value of ecosystem services such as water purification, pollination, and soil fertility to support sustainable resource management. Carbon footprint accounting measures greenhouse gas emissions linked to activities, primarily focusing on carbon dioxide equivalents to address climate change. Explore further to understand how these methodologies complement each other in environmental decision-making.

Environmental assets

Natural capital accounting evaluates the value and stock of environmental assets such as forests, water, and minerals, providing a comprehensive measure of ecosystem services and their role in economic activities. Carbon footprint accounting quantifies greenhouse gas emissions associated with products, activities, or organizations, focusing specifically on carbon output and its impact on climate change. Explore further to understand how these approaches complement each other in sustainable environmental management.

Source and External Links

Natural capital accounting - European Commission - Natural capital accounting is a tool to measure changes in the stock and condition of natural ecosystems and to integrate ecosystem services' value into accounting and decision-making frameworks based on a standardized UN framework, supporting environmentally responsible business and policy practices.

Natural capital accounting - Wikipedia - It is the process of quantifying total stocks and flows of natural resources and ecosystem services in physical or monetary terms to inform government, corporate, and consumer decisions for sustainable resource management.

Natural Capital Accounting - WAVES Partnership - Natural capital accounts provide detailed statistics to better manage natural resources that underpin economic development by complementing GDP with wealth accounting of natural assets and supporting long-term sustainable growth strategies.

dowidth.com

dowidth.com