Digital twin accounting leverages real-time data integration and advanced simulations to create virtual replicas of financial systems, enabling proactive decision-making and risk assessment. Forensic accounting focuses on investigating financial discrepancies, fraud detection, and legal compliance through detailed analysis of historical financial records. Explore the distinct advantages and applications of digital twin accounting compared to forensic accounting for deeper financial insights.

Why it is important

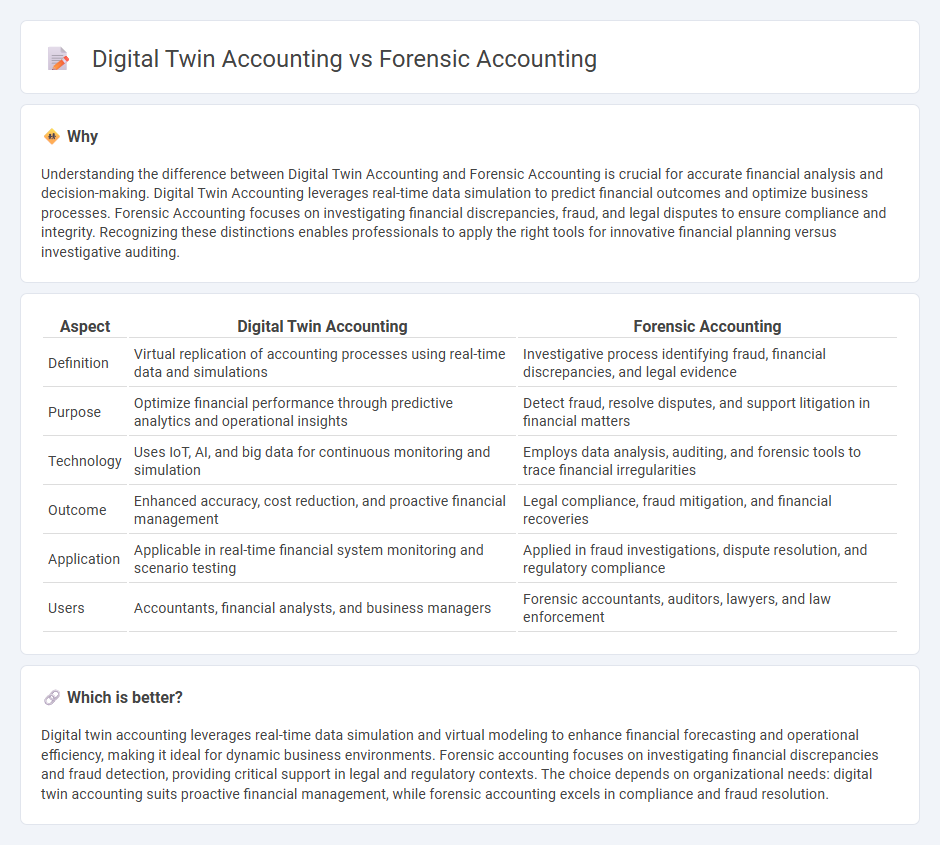

Understanding the difference between Digital Twin Accounting and Forensic Accounting is crucial for accurate financial analysis and decision-making. Digital Twin Accounting leverages real-time data simulation to predict financial outcomes and optimize business processes. Forensic Accounting focuses on investigating financial discrepancies, fraud, and legal disputes to ensure compliance and integrity. Recognizing these distinctions enables professionals to apply the right tools for innovative financial planning versus investigative auditing.

Comparison Table

| Aspect | Digital Twin Accounting | Forensic Accounting |

|---|---|---|

| Definition | Virtual replication of accounting processes using real-time data and simulations | Investigative process identifying fraud, financial discrepancies, and legal evidence |

| Purpose | Optimize financial performance through predictive analytics and operational insights | Detect fraud, resolve disputes, and support litigation in financial matters |

| Technology | Uses IoT, AI, and big data for continuous monitoring and simulation | Employs data analysis, auditing, and forensic tools to trace financial irregularities |

| Outcome | Enhanced accuracy, cost reduction, and proactive financial management | Legal compliance, fraud mitigation, and financial recoveries |

| Application | Applicable in real-time financial system monitoring and scenario testing | Applied in fraud investigations, dispute resolution, and regulatory compliance |

| Users | Accountants, financial analysts, and business managers | Forensic accountants, auditors, lawyers, and law enforcement |

Which is better?

Digital twin accounting leverages real-time data simulation and virtual modeling to enhance financial forecasting and operational efficiency, making it ideal for dynamic business environments. Forensic accounting focuses on investigating financial discrepancies and fraud detection, providing critical support in legal and regulatory contexts. The choice depends on organizational needs: digital twin accounting suits proactive financial management, while forensic accounting excels in compliance and fraud resolution.

Connection

Digital twin accounting creates virtual replicas of financial processes, enabling real-time monitoring and anomaly detection, which enhances the precision of forensic accounting investigations. Forensic accounting leverages insights from digital twins to trace discrepancies, detect fraud, and validate financial data integrity with high accuracy. Integrating digital twin technology accelerates forensic audits by providing detailed simulations and analysis of complex transactions.

Key Terms

Forensic accounting:

Forensic accounting specializes in investigating financial fraud, litigation support, and uncovering financial discrepancies through detailed audits and transaction analysis. It involves examining financial documents, tracing illicit activities, and providing evidence for legal proceedings. Discover more about how forensic accounting safeguards organizations against financial crimes.

Fraud detection

Forensic accounting specializes in detecting, investigating, and preventing financial fraud by analyzing historical financial records and transactions for discrepancies. Digital twin accounting employs real-time simulation of financial processes through a dynamic digital replica, enabling proactive identification and prevention of anomalies before fraudulent activities occur. Explore how integrating these approaches enhances fraud detection accuracy and efficiency.

Litigation support

Forensic accounting specializes in investigating financial discrepancies, fraud, and providing litigation support through detailed examination of financial records and expert testimony. Digital twin accounting leverages advanced simulation models of financial processes to predict outcomes and identify risks in real-time, enhancing accuracy and strategic decision-making during litigation. Explore how integrating forensic accounting with digital twin technology can revolutionize litigation support efficiency and insights.

Source and External Links

Forensic Accounting Career Overview - Forensic accountants investigate financial records to detect crimes like fraud or embezzlement and often support legal cases through expert testimony, requiring strong skills in accounting principles, auditing standards, and financial laws.

What is Forensic Accounting? - NICE Actimize - Forensic accounting involves examining financial records to uncover and prevent fraud and financial misconduct, playing a crucial role in tracking suspicious transactions and supporting law enforcement and legal proceedings.

What Is Forensic Accounting? - MVNU - Forensic accountants apply accounting skills in legal and investigative contexts to follow the money trail in cases of financial crime, prepare expert witness reports, and assess damages related to fraud, theft, or embezzlement.

dowidth.com

dowidth.com