Blockchain reconciliation offers enhanced transparency and immutability by recording transactions on a decentralized ledger, reducing discrepancies and fraud risks. ERP-based reconciliation relies on centralized systems integrating various financial processes, enabling streamlined data management but sometimes facing delays and manual errors. Explore the key differences and benefits of each method to improve your accounting accuracy and efficiency.

Why it is important

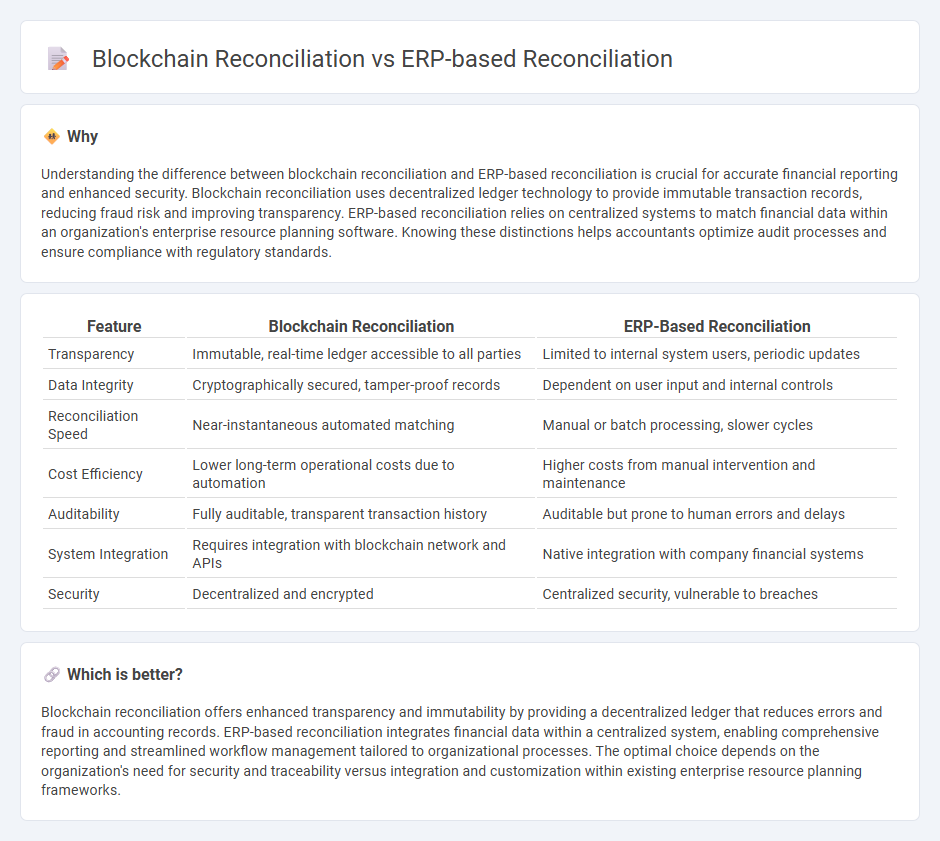

Understanding the difference between blockchain reconciliation and ERP-based reconciliation is crucial for accurate financial reporting and enhanced security. Blockchain reconciliation uses decentralized ledger technology to provide immutable transaction records, reducing fraud risk and improving transparency. ERP-based reconciliation relies on centralized systems to match financial data within an organization's enterprise resource planning software. Knowing these distinctions helps accountants optimize audit processes and ensure compliance with regulatory standards.

Comparison Table

| Feature | Blockchain Reconciliation | ERP-Based Reconciliation |

|---|---|---|

| Transparency | Immutable, real-time ledger accessible to all parties | Limited to internal system users, periodic updates |

| Data Integrity | Cryptographically secured, tamper-proof records | Dependent on user input and internal controls |

| Reconciliation Speed | Near-instantaneous automated matching | Manual or batch processing, slower cycles |

| Cost Efficiency | Lower long-term operational costs due to automation | Higher costs from manual intervention and maintenance |

| Auditability | Fully auditable, transparent transaction history | Auditable but prone to human errors and delays |

| System Integration | Requires integration with blockchain network and APIs | Native integration with company financial systems |

| Security | Decentralized and encrypted | Centralized security, vulnerable to breaches |

Which is better?

Blockchain reconciliation offers enhanced transparency and immutability by providing a decentralized ledger that reduces errors and fraud in accounting records. ERP-based reconciliation integrates financial data within a centralized system, enabling comprehensive reporting and streamlined workflow management tailored to organizational processes. The optimal choice depends on the organization's need for security and traceability versus integration and customization within existing enterprise resource planning frameworks.

Connection

Blockchain reconciliation enhances ERP-based reconciliation by providing an immutable ledger that ensures data accuracy and transparency throughout financial processes. ERP systems leverage blockchain technology to automate the verification of transactions, reducing manual errors and improving auditability. Integrating blockchain with ERP streamlines reconciliation workflows, enabling real-time synchronization of financial records across distributed networks.

Key Terms

Centralized Ledger

ERP-based reconciliation relies on a centralized ledger managed by a single authority, enabling streamlined transaction tracking and reduced data discrepancies within organizational boundaries. In contrast, blockchain reconciliation utilizes a decentralized ledger distributed across multiple nodes, enhancing transparency and immutability but requiring complex consensus mechanisms. Explore the detailed differences and benefits of centralized versus decentralized ledger systems to optimize your reconciliation processes.

Decentralized Ledger

ERP-based reconciliation relies on centralized databases where transaction records are managed and verified within an organization's internal system, often leading to delays and manual errors. Blockchain reconciliation utilizes a decentralized ledger, enhancing transparency and security by allowing all participants to access a shared, immutable record of transactions, reducing the risk of fraud and discrepancies. Explore how integrating decentralized ledger technology can revolutionize your reconciliation processes with greater efficiency and trust.

Immutability

ERP-based reconciliation relies on centralized ledgers where data can be modified or deleted by authorized personnel, potentially leading to discrepancies or fraud. Blockchain reconciliation enforces immutability through cryptographic hashing and consensus mechanisms, ensuring that once transactions are recorded, they cannot be altered or tampered with. Explore the advantages of immutable blockchain reconciliation to enhance transparency and trust in financial audits.

Source and External Links

ERP Reconciliation - Cointab - ERP-based reconciliation automates verifying transactions across multiple sources within ERP systems to reduce errors, improve efficiency, and provide real-time financial accuracy by centralizing data and eliminating manual tracking errors.

Automating bank reconciliation in ERP | Zone & Co - ERP-based reconciliation automation includes direct bank feeds, automated transaction imports, and intelligent matching rules within the ERP to reduce manual work and speed up the financial close process.

Oracle Cloud EPM Account Reconciliation - ERP reconciliation solutions automate account reconciliations and transaction matching, enable risk-based workflow management, and improve financial statement accuracy and compliance through integrated dashboards and audit trails.

dowidth.com

dowidth.com