Intercompany automation streamlines financial processes by automatically reconciling transactions between subsidiaries, reducing errors and improving accuracy across multiple entities. Automatic journal entry focuses on generating necessary accounting entries within a single ledger system, enhancing efficiency and consistency in financial reporting. Explore how these accounting technologies can optimize your organization's financial management.

Why it is important

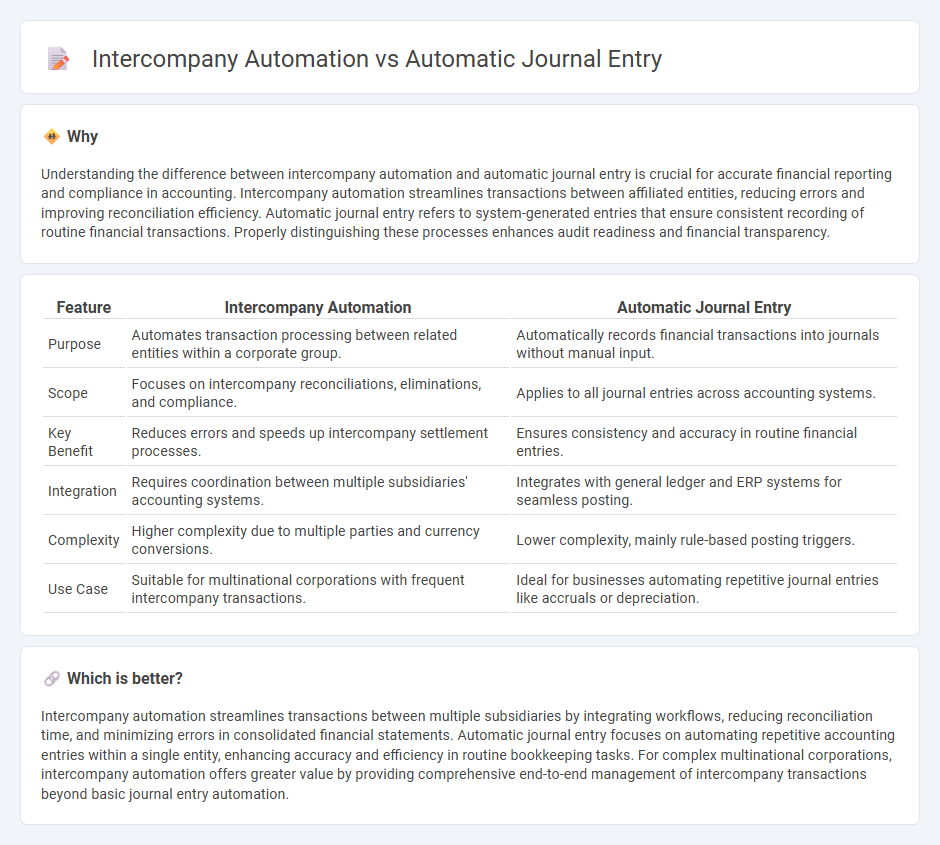

Understanding the difference between intercompany automation and automatic journal entry is crucial for accurate financial reporting and compliance in accounting. Intercompany automation streamlines transactions between affiliated entities, reducing errors and improving reconciliation efficiency. Automatic journal entry refers to system-generated entries that ensure consistent recording of routine financial transactions. Properly distinguishing these processes enhances audit readiness and financial transparency.

Comparison Table

| Feature | Intercompany Automation | Automatic Journal Entry |

|---|---|---|

| Purpose | Automates transaction processing between related entities within a corporate group. | Automatically records financial transactions into journals without manual input. |

| Scope | Focuses on intercompany reconciliations, eliminations, and compliance. | Applies to all journal entries across accounting systems. |

| Key Benefit | Reduces errors and speeds up intercompany settlement processes. | Ensures consistency and accuracy in routine financial entries. |

| Integration | Requires coordination between multiple subsidiaries' accounting systems. | Integrates with general ledger and ERP systems for seamless posting. |

| Complexity | Higher complexity due to multiple parties and currency conversions. | Lower complexity, mainly rule-based posting triggers. |

| Use Case | Suitable for multinational corporations with frequent intercompany transactions. | Ideal for businesses automating repetitive journal entries like accruals or depreciation. |

Which is better?

Intercompany automation streamlines transactions between multiple subsidiaries by integrating workflows, reducing reconciliation time, and minimizing errors in consolidated financial statements. Automatic journal entry focuses on automating repetitive accounting entries within a single entity, enhancing accuracy and efficiency in routine bookkeeping tasks. For complex multinational corporations, intercompany automation offers greater value by providing comprehensive end-to-end management of intercompany transactions beyond basic journal entry automation.

Connection

Intercompany automation streamlines the reconciliation process by automatically matching and eliminating intercompany transactions across multiple entities, improving accuracy and efficiency. Automatic journal entry systems generate and record standardized accounting entries based on predefined rules, reducing manual errors and processing time. Together, these technologies enhance financial consolidation by ensuring consistent, timely, and reliable intercompany accounting data.

Key Terms

**Automatic Journal Entry:**

Automatic journal entry streamlines financial processes by recording routine transactions such as accruals, depreciation, and recurring expenses without manual intervention, enhancing accuracy and efficiency. This automation relies on predefined rules and templates within accounting software to minimize errors and ensure compliance with accounting standards. Discover how automatic journal entry can transform your financial operations with precise, timely data.

Workflow Automation

Automatic journal entry streamlines financial data posting by eliminating manual input errors and accelerating transaction recording, enhancing accuracy in general ledger management. Intercompany automation optimizes the reconciliation process between subsidiaries by automatically matching, consolidating, and eliminating intercompany transactions to ensure compliance and reduce closing cycles. Explore detailed benefits and implementation strategies to enhance your workflow automation effectiveness.

Ledger Posting

Automatic journal entry systems streamline ledger posting by generating transactions based on predefined rules, enhancing accuracy and efficiency in general ledger updates. Intercompany automation specifically addresses transactions between subsidiaries, ensuring consistent and reconciled ledger entries across entities to comply with consolidation standards. Explore deeper insights on optimizing ledger posting through targeted automation solutions.

Source and External Links

Journal Entry Automation Benefits, Software & FAQs - Automatic journal entries are created by importing data from internal and external sources and rely on templates, preset rules, and AI to enhance accuracy, speed accounting closes, reduce labor, and improve workflow without eliminating the need for accountants to review and analyze data.

Journal Entry Automation - Specialized accounting software automates journal entry creation, validation, and posting, improving efficiency, consistency, and compliance through features like automated templates, approval workflows, fraud prevention, and audit trails.

Automate Your Journal Entries to Drive Efficiency & Scalability - Automatic journal entries are defined by predefined rules and triggers in accounting software to automate routine accounting tasks, reducing human error, saving time, ensuring prompt updates, enhancing compliance, and supporting complex transaction needs in modern financial operations.

dowidth.com

dowidth.com