Payroll crypto taxation involves calculating and reporting the tax obligations related to employee compensation paid in cryptocurrencies, focusing on compliance with IRS guidelines and accurate valuation at the time of payment. Payroll reconciliation ensures alignment between payroll records and financial statements, verifying that all payments, deductions, and withholdings are accurately recorded and reconciled with bank statements. Explore the nuances of managing payroll crypto taxation alongside reconciliation to optimize your accounting processes.

Why it is important

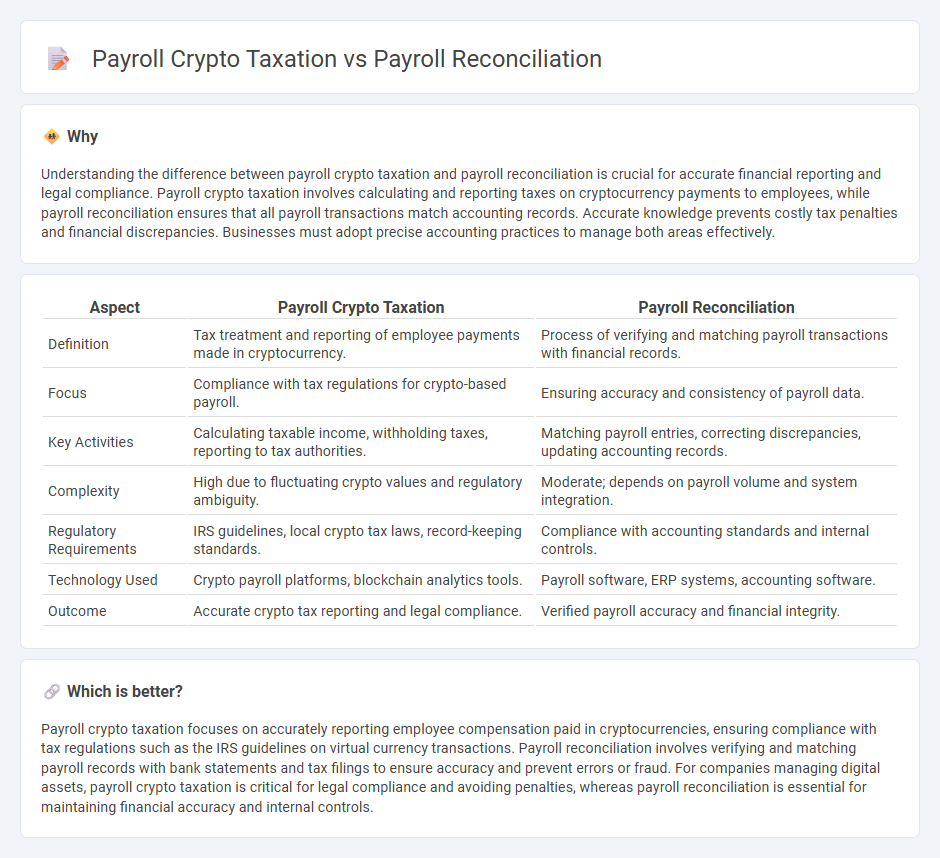

Understanding the difference between payroll crypto taxation and payroll reconciliation is crucial for accurate financial reporting and legal compliance. Payroll crypto taxation involves calculating and reporting taxes on cryptocurrency payments to employees, while payroll reconciliation ensures that all payroll transactions match accounting records. Accurate knowledge prevents costly tax penalties and financial discrepancies. Businesses must adopt precise accounting practices to manage both areas effectively.

Comparison Table

| Aspect | Payroll Crypto Taxation | Payroll Reconciliation |

|---|---|---|

| Definition | Tax treatment and reporting of employee payments made in cryptocurrency. | Process of verifying and matching payroll transactions with financial records. |

| Focus | Compliance with tax regulations for crypto-based payroll. | Ensuring accuracy and consistency of payroll data. |

| Key Activities | Calculating taxable income, withholding taxes, reporting to tax authorities. | Matching payroll entries, correcting discrepancies, updating accounting records. |

| Complexity | High due to fluctuating crypto values and regulatory ambiguity. | Moderate; depends on payroll volume and system integration. |

| Regulatory Requirements | IRS guidelines, local crypto tax laws, record-keeping standards. | Compliance with accounting standards and internal controls. |

| Technology Used | Crypto payroll platforms, blockchain analytics tools. | Payroll software, ERP systems, accounting software. |

| Outcome | Accurate crypto tax reporting and legal compliance. | Verified payroll accuracy and financial integrity. |

Which is better?

Payroll crypto taxation focuses on accurately reporting employee compensation paid in cryptocurrencies, ensuring compliance with tax regulations such as the IRS guidelines on virtual currency transactions. Payroll reconciliation involves verifying and matching payroll records with bank statements and tax filings to ensure accuracy and prevent errors or fraud. For companies managing digital assets, payroll crypto taxation is critical for legal compliance and avoiding penalties, whereas payroll reconciliation is essential for maintaining financial accuracy and internal controls.

Connection

Payroll crypto taxation directly impacts payroll reconciliation by requiring accurate tracking and reporting of cryptocurrency payments to employees for tax compliance. Effective payroll reconciliation ensures that cryptocurrency wages, tax withholdings, and employer contributions are correctly recorded and aligned with tax regulations. This connection helps organizations maintain accurate financial records, avoid tax penalties, and streamline the auditing process.

Key Terms

**Payroll Reconciliation:**

Payroll reconciliation involves verifying and matching payroll records to ensure accurate employee compensation and tax withholdings, minimizing errors and discrepancies. This process is critical for compliance with financial regulations and for maintaining precise accounting records, which directly impacts company audits and financial reporting. Explore more to understand how effective payroll reconciliation strategies can enhance your payroll accuracy and regulatory compliance.

Gross Payroll

Gross payroll represents the total earnings of employees before deductions, serving as a critical basis for accurately reconciling payroll records and ensuring compliance with tax obligations. Payroll reconciliation involves verifying that all reported wages and taxes align with payroll data, while payroll crypto taxation requires careful tracking of cryptocurrency payments to ensure they are properly included in gross payroll calculations. Explore more to understand the nuances of managing gross payroll in traditional and crypto tax environments.

Deductions

Payroll reconciliation involves verifying employee payments, deductions, and employer contributions to ensure accuracy and compliance with tax laws. Payroll crypto taxation focuses on correctly reporting and withholding taxes on cryptocurrency wages, including specific deductions related to crypto transactions and their fair market value. Explore key strategies and regulations for managing payroll deductions in both traditional and crypto payroll systems.

Source and External Links

What is Payroll Reconciliation | F&A Glossary - BlackLine - Payroll reconciliation is the process of verifying the accuracy of records related to employee compensation, ensuring payroll register details and time sheet data match correctly in each pay period.

A detailed Guide on Payroll Reconciliation Process - Payroll reconciliation compares and verifies financial records of employee pay and benefits with other data sources to identify discrepancies and ensure compliance with tax and labor laws.

6 Steps for Hassle Free Payroll Reconciliation in Accounting - Payroll reconciliation ensures payroll records align with payments and financial statements, helping avoid errors, legal issues, and maintaining financial integrity by confirming gross pay, deductions, and net pay.

dowidth.com

dowidth.com