Cryptofinance reconciliation involves verifying cryptocurrency transactions and balances across digital wallets and exchanges to ensure accuracy and prevent discrepancies, leveraging blockchain data for transparency. Subsidiary ledger reconciliation focuses on matching detailed accounts, such as accounts receivable or payable, with general ledger entries to maintain precise financial records. Discover more about how these reconciliation methods optimize financial accuracy in evolving accounting practices.

Why it is important

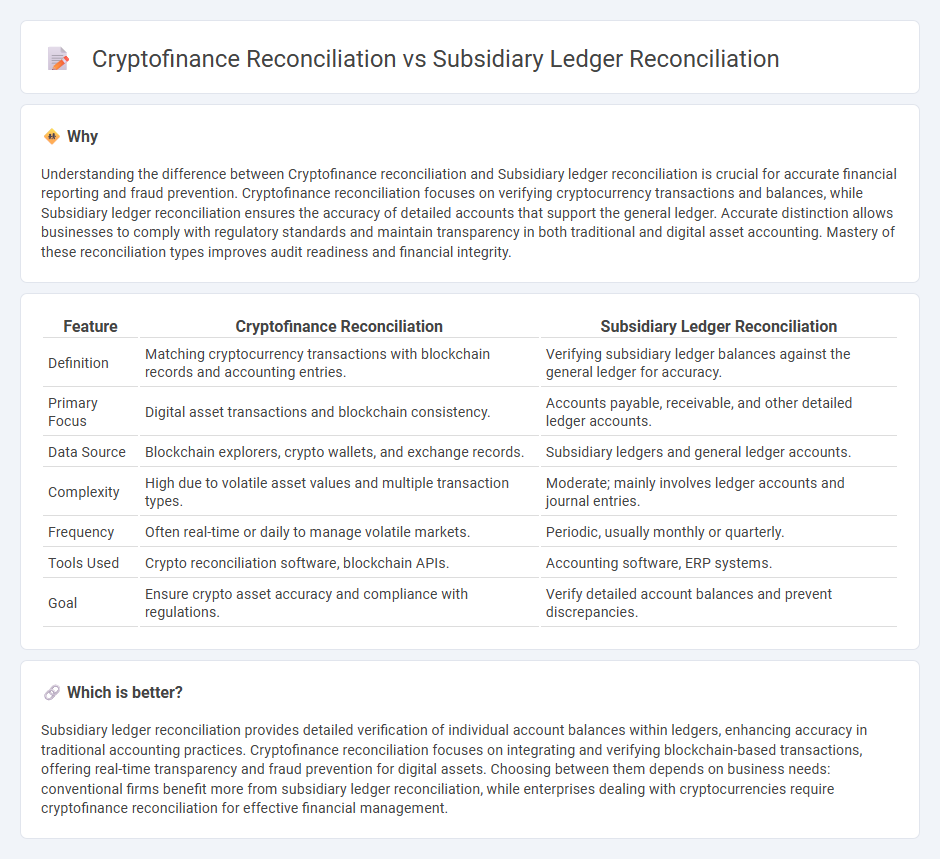

Understanding the difference between Cryptofinance reconciliation and Subsidiary ledger reconciliation is crucial for accurate financial reporting and fraud prevention. Cryptofinance reconciliation focuses on verifying cryptocurrency transactions and balances, while Subsidiary ledger reconciliation ensures the accuracy of detailed accounts that support the general ledger. Accurate distinction allows businesses to comply with regulatory standards and maintain transparency in both traditional and digital asset accounting. Mastery of these reconciliation types improves audit readiness and financial integrity.

Comparison Table

| Feature | Cryptofinance Reconciliation | Subsidiary Ledger Reconciliation |

|---|---|---|

| Definition | Matching cryptocurrency transactions with blockchain records and accounting entries. | Verifying subsidiary ledger balances against the general ledger for accuracy. |

| Primary Focus | Digital asset transactions and blockchain consistency. | Accounts payable, receivable, and other detailed ledger accounts. |

| Data Source | Blockchain explorers, crypto wallets, and exchange records. | Subsidiary ledgers and general ledger accounts. |

| Complexity | High due to volatile asset values and multiple transaction types. | Moderate; mainly involves ledger accounts and journal entries. |

| Frequency | Often real-time or daily to manage volatile markets. | Periodic, usually monthly or quarterly. |

| Tools Used | Crypto reconciliation software, blockchain APIs. | Accounting software, ERP systems. |

| Goal | Ensure crypto asset accuracy and compliance with regulations. | Verify detailed account balances and prevent discrepancies. |

Which is better?

Subsidiary ledger reconciliation provides detailed verification of individual account balances within ledgers, enhancing accuracy in traditional accounting practices. Cryptofinance reconciliation focuses on integrating and verifying blockchain-based transactions, offering real-time transparency and fraud prevention for digital assets. Choosing between them depends on business needs: conventional firms benefit more from subsidiary ledger reconciliation, while enterprises dealing with cryptocurrencies require cryptofinance reconciliation for effective financial management.

Connection

Cryptofinance reconciliation and subsidiary ledger reconciliation are connected through their roles in ensuring the accuracy and integrity of financial records. Cryptofinance reconciliation involves verifying transactions on blockchain ledgers against internal records, while subsidiary ledger reconciliation focuses on matching detailed account entries with general ledger balances. Together, they enhance transparency and accuracy in accounting by validating transaction histories and maintaining consistent subsidiary records.

Key Terms

**Subsidiary Ledger Reconciliation:**

Subsidiary ledger reconciliation involves matching and verifying detailed account records that support the general ledger, ensuring accuracy in accounts payable, accounts receivable, or inventory management. It helps identify discrepancies, prevent errors, and maintain financial integrity by cross-referencing individual subsidiary accounts with the overall ledger balance. Discover more about how subsidiary ledger reconciliation enhances financial reporting accuracy and internal controls.

Control Account

Subsidiary ledger reconciliation ensures accuracy between individual account balances and the control account in the general ledger, maintaining precise financial records. Cryptofinance reconciliation involves verifying digital asset transactions against blockchain records to secure control account integrity amid decentralized ledgers. Explore detailed methodologies to enhance control account reliability in both traditional and crypto finance realms.

Detail Transactions

Subsidiary ledger reconciliation involves verifying detailed transactions within specific accounts, such as accounts receivable or payable, to ensure accuracy and completeness against the general ledger. Cryptofinance reconciliation focuses on matching blockchain-based transactions and wallet balances with recorded financial data, addressing complexities like transaction hashes, confirmations, and volatility. Explore further on optimizing reconciliation processes for detailed transaction accuracy in both traditional and crypto finance contexts.

Source and External Links

A Guide for General Ledger to Subledger Reconciliation - Leapfin - Subsidiary ledger reconciliation requires comparing balances between general and subledgers, investigating discrepancies, and making necessary adjustments to align both records.

Subledger Reconciliation | HighRadius(tm) | A/R Management Software - This process involves verifying that the detailed transaction totals in subsidiary ledgers match the summarized control account balances in the general ledger for accuracy.

Subledger vs. General Ledger: A Detailed Comparison - HubiFi - Regular reconciliation ensures that individual transactions in subledgers accurately roll up to the corresponding general ledger accounts, maintaining reliable financial reporting.

dowidth.com

dowidth.com