Forensic accounting involves the investigation of financial records to detect fraud, embezzlement, and other financial crimes, utilizing techniques such as data analysis and auditing. Cost accounting focuses on tracking, analyzing, and controlling costs related to production and operations to maximize profitability and efficiency. Explore more to understand how these accounting specializations impact financial decision-making and risk management.

Why it is important

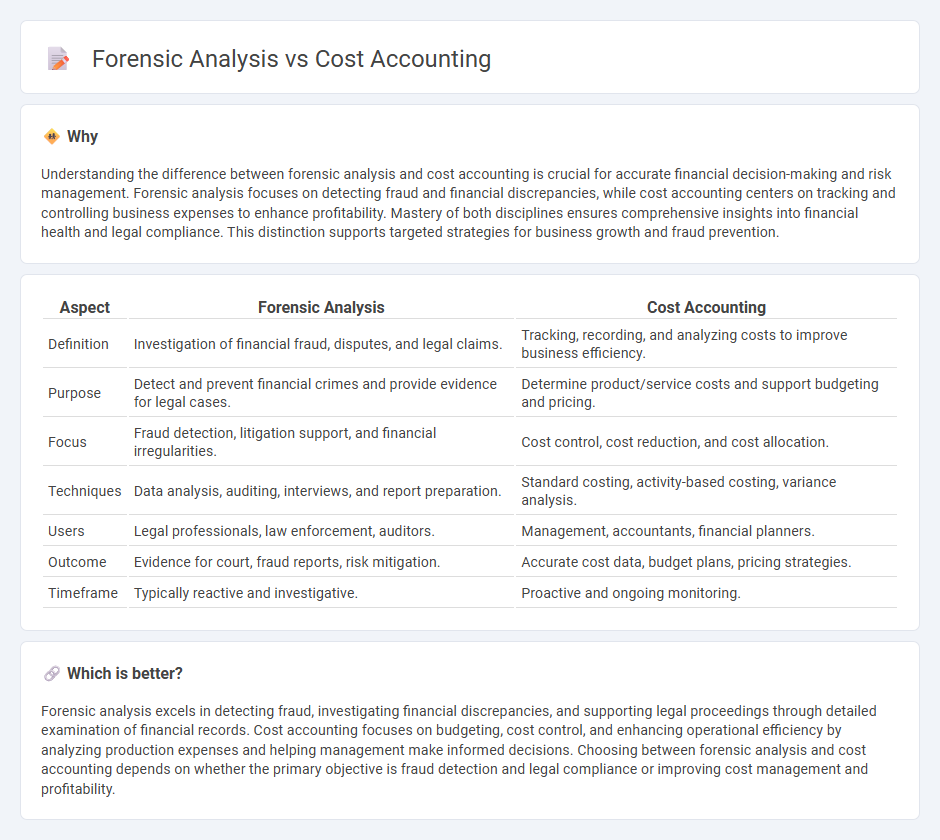

Understanding the difference between forensic analysis and cost accounting is crucial for accurate financial decision-making and risk management. Forensic analysis focuses on detecting fraud and financial discrepancies, while cost accounting centers on tracking and controlling business expenses to enhance profitability. Mastery of both disciplines ensures comprehensive insights into financial health and legal compliance. This distinction supports targeted strategies for business growth and fraud prevention.

Comparison Table

| Aspect | Forensic Analysis | Cost Accounting |

|---|---|---|

| Definition | Investigation of financial fraud, disputes, and legal claims. | Tracking, recording, and analyzing costs to improve business efficiency. |

| Purpose | Detect and prevent financial crimes and provide evidence for legal cases. | Determine product/service costs and support budgeting and pricing. |

| Focus | Fraud detection, litigation support, and financial irregularities. | Cost control, cost reduction, and cost allocation. |

| Techniques | Data analysis, auditing, interviews, and report preparation. | Standard costing, activity-based costing, variance analysis. |

| Users | Legal professionals, law enforcement, auditors. | Management, accountants, financial planners. |

| Outcome | Evidence for court, fraud reports, risk mitigation. | Accurate cost data, budget plans, pricing strategies. |

| Timeframe | Typically reactive and investigative. | Proactive and ongoing monitoring. |

Which is better?

Forensic analysis excels in detecting fraud, investigating financial discrepancies, and supporting legal proceedings through detailed examination of financial records. Cost accounting focuses on budgeting, cost control, and enhancing operational efficiency by analyzing production expenses and helping management make informed decisions. Choosing between forensic analysis and cost accounting depends on whether the primary objective is fraud detection and legal compliance or improving cost management and profitability.

Connection

Forensic analysis and cost accounting intersect through their focus on detailed financial scrutiny to detect discrepancies and ensure accuracy in business operations. Cost accounting provides granular insights into production expenses and resource allocation, enabling forensic analysts to identify irregularities such as fraud or misappropriation. By leveraging cost accounting data, forensic experts enhance the precision of audits and financial investigations, strengthening overall financial integrity.

Key Terms

**Cost Accounting:**

Cost accounting systematically tracks, records, and analyzes production costs to optimize budgeting and improve financial efficiency in manufacturing and service industries. It focuses on direct and indirect costs, cost control, and variance analysis to support managerial decision-making and enhance profitability. Discover how cost accounting drives strategic business planning and operational success.

Overhead Allocation

Cost accounting allocates overhead costs to products or services using methods like activity-based costing, ensuring accurate product costing and profitability analysis. Forensic analysis examines overhead allocation for potential fraud, discrepancies, or misstatements in financial records to support legal investigations. Explore comprehensive insights on overhead allocation techniques and forensic accounting applications to enhance financial accuracy and compliance.

Standard Costing

Standard costing in cost accounting involves setting predetermined costs for production components to measure performance and control expenses effectively. Forensic analysis uses standard costing data to detect discrepancies, fraud, and variances that may indicate financial misconduct within an organization. Explore how integrating standard costing enhances both cost management and forensic investigations.

Source and External Links

What Is Cost Accounting | A Guide for Businesses - BPM - Cost accounting is a specialized field that analyzes, standardizes, and compares cost data to determine the true cost of products or services, helping businesses enhance profitability and operational performance.

Cost Accounting Defined: What It Is & Why It Matters - Cost accounting involves tracking and summarizing all fixed and variable input costs related to production or service delivery, providing internal management with customized insights for cost control and pricing.

How to Become a Cost Accountant - Cost accounting manages company expenses, budgets, and financial performance to increase profits, with professionals focusing on internal cost tracking and reduction across various industries.

dowidth.com

dowidth.com