Digital asset valuation involves assessing the worth of cryptocurrencies, NFTs, and blockchain-based tokens using market demand, liquidity, and technological factors. Financial instrument valuation focuses on traditional assets like stocks, bonds, and derivatives, applying models such as discounted cash flow and market comparables for accurate pricing. Explore more to understand the distinct methodologies and complexities in valuing these asset classes.

Why it is important

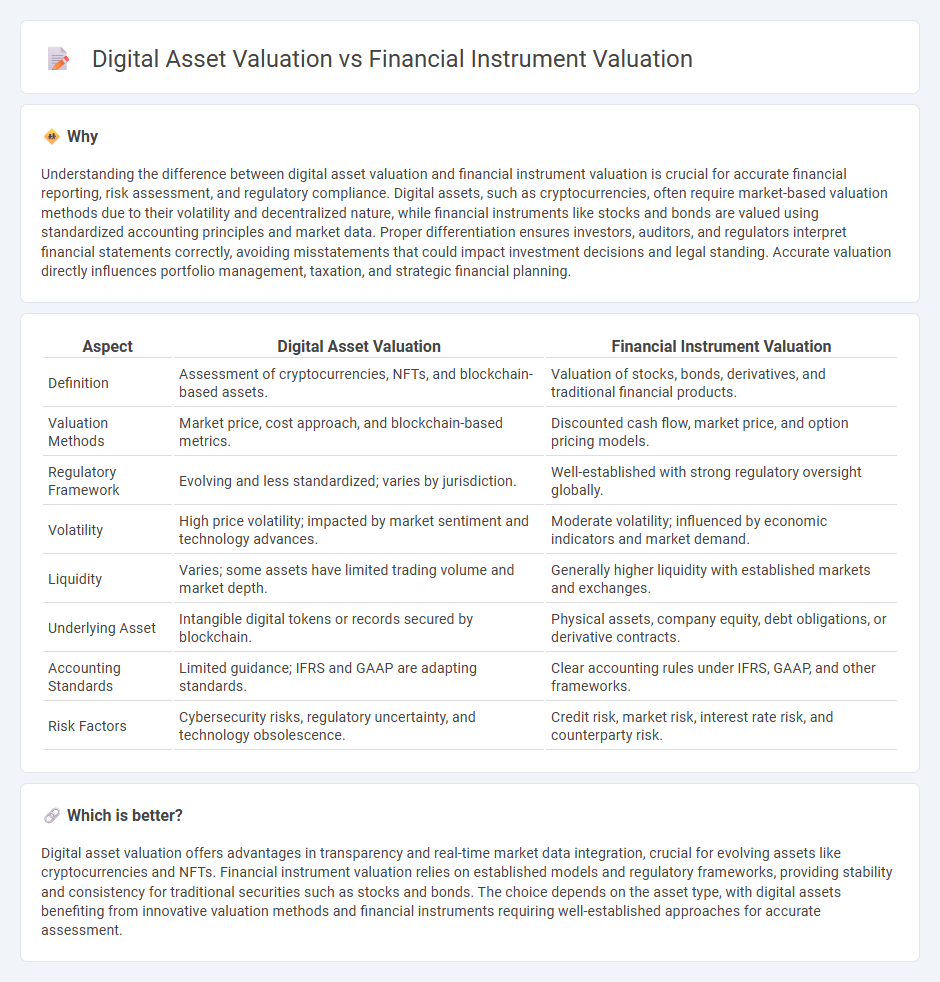

Understanding the difference between digital asset valuation and financial instrument valuation is crucial for accurate financial reporting, risk assessment, and regulatory compliance. Digital assets, such as cryptocurrencies, often require market-based valuation methods due to their volatility and decentralized nature, while financial instruments like stocks and bonds are valued using standardized accounting principles and market data. Proper differentiation ensures investors, auditors, and regulators interpret financial statements correctly, avoiding misstatements that could impact investment decisions and legal standing. Accurate valuation directly influences portfolio management, taxation, and strategic financial planning.

Comparison Table

| Aspect | Digital Asset Valuation | Financial Instrument Valuation |

|---|---|---|

| Definition | Assessment of cryptocurrencies, NFTs, and blockchain-based assets. | Valuation of stocks, bonds, derivatives, and traditional financial products. |

| Valuation Methods | Market price, cost approach, and blockchain-based metrics. | Discounted cash flow, market price, and option pricing models. |

| Regulatory Framework | Evolving and less standardized; varies by jurisdiction. | Well-established with strong regulatory oversight globally. |

| Volatility | High price volatility; impacted by market sentiment and technology advances. | Moderate volatility; influenced by economic indicators and market demand. |

| Liquidity | Varies; some assets have limited trading volume and market depth. | Generally higher liquidity with established markets and exchanges. |

| Underlying Asset | Intangible digital tokens or records secured by blockchain. | Physical assets, company equity, debt obligations, or derivative contracts. |

| Accounting Standards | Limited guidance; IFRS and GAAP are adapting standards. | Clear accounting rules under IFRS, GAAP, and other frameworks. |

| Risk Factors | Cybersecurity risks, regulatory uncertainty, and technology obsolescence. | Credit risk, market risk, interest rate risk, and counterparty risk. |

Which is better?

Digital asset valuation offers advantages in transparency and real-time market data integration, crucial for evolving assets like cryptocurrencies and NFTs. Financial instrument valuation relies on established models and regulatory frameworks, providing stability and consistency for traditional securities such as stocks and bonds. The choice depends on the asset type, with digital assets benefiting from innovative valuation methods and financial instruments requiring well-established approaches for accurate assessment.

Connection

Digital asset valuation and financial instrument valuation are interconnected through their reliance on market data, risk assessment models, and regulatory frameworks to determine fair value. Both processes employ discounted cash flow analysis, comparable market transactions, and volatility metrics to quantify value accurately. Integration of blockchain technology in digital assets enhances transparency and auditability, aligning valuation practices with traditional financial instruments.

Key Terms

Fair Value

Fair value measurement in financial instrument valuation typically relies on market-based inputs, including observable quotes from active markets and pricing models adhering to IFRS 13 or ASC 820 standards. In contrast, digital asset valuation faces challenges due to market volatility, lack of standardized pricing frameworks, and varying regulatory treatments that impact fair value determination. Explore deeper insights into the methodologies and frameworks shaping fair value assessment across these asset classes.

Market Liquidity

Market liquidity significantly influences financial instrument valuation by ensuring quick, efficient transactions with minimal price distortion, enhancing price stability and reliability. In digital asset valuation, market liquidity is often more volatile, leading to higher price swings and challenges in determining accurate value due to limited participants and exchange fragmentation. Explore the impact of market liquidity on these valuation models and understand how liquidity metrics shape asset pricing in diverse markets.

Volatility

Volatility plays a crucial role in the valuation of both financial instruments and digital assets, with financial instruments often exhibiting more historical data to model risk and price fluctuations accurately. Digital assets, such as cryptocurrencies, tend to show higher volatility due to market nascence, lower liquidity, and regulatory uncertainty, which complicates predictive modeling. Explore the latest methodologies and comparative analyses to understand how volatility impacts valuation metrics across these asset classes.

Source and External Links

How Are Financial Instruments Valued? - Financial instruments valuation varies by type, with cash instruments valued based on market conditions and derivative instruments requiring more complex methods often handled by professionals.

Fair value of financial instruments - Fair value measurement techniques include present value methods, discounted cash flows, and option pricing models depending on the instrument type, with inputs like observable market data and risk premiums.

5.5 Financial Instruments - Valuation of financial instruments, particularly complex or non-traded ones, often requires judgments, controls, and might call for independent specialists to determine fair value accurately.

dowidth.com

dowidth.com