Digital twin accounting integrates real-time data from digital replicas of physical assets to enhance financial accuracy and operational efficiency, while cost accounting focuses on tracking and analyzing expenses to control and optimize business costs. Leveraging IoT and AI technologies, digital twin accounting provides dynamic insights that traditional cost accounting methods cannot match. Explore how these innovative approaches redefine financial management for modern enterprises.

Why it is important

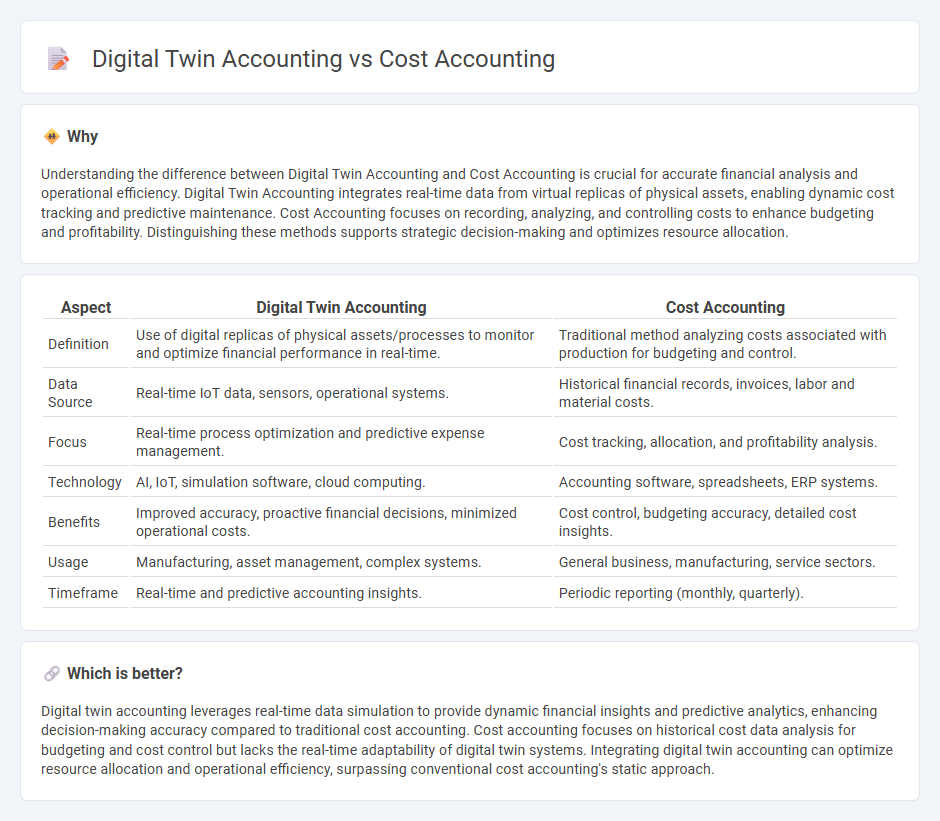

Understanding the difference between Digital Twin Accounting and Cost Accounting is crucial for accurate financial analysis and operational efficiency. Digital Twin Accounting integrates real-time data from virtual replicas of physical assets, enabling dynamic cost tracking and predictive maintenance. Cost Accounting focuses on recording, analyzing, and controlling costs to enhance budgeting and profitability. Distinguishing these methods supports strategic decision-making and optimizes resource allocation.

Comparison Table

| Aspect | Digital Twin Accounting | Cost Accounting |

|---|---|---|

| Definition | Use of digital replicas of physical assets/processes to monitor and optimize financial performance in real-time. | Traditional method analyzing costs associated with production for budgeting and control. |

| Data Source | Real-time IoT data, sensors, operational systems. | Historical financial records, invoices, labor and material costs. |

| Focus | Real-time process optimization and predictive expense management. | Cost tracking, allocation, and profitability analysis. |

| Technology | AI, IoT, simulation software, cloud computing. | Accounting software, spreadsheets, ERP systems. |

| Benefits | Improved accuracy, proactive financial decisions, minimized operational costs. | Cost control, budgeting accuracy, detailed cost insights. |

| Usage | Manufacturing, asset management, complex systems. | General business, manufacturing, service sectors. |

| Timeframe | Real-time and predictive accounting insights. | Periodic reporting (monthly, quarterly). |

Which is better?

Digital twin accounting leverages real-time data simulation to provide dynamic financial insights and predictive analytics, enhancing decision-making accuracy compared to traditional cost accounting. Cost accounting focuses on historical cost data analysis for budgeting and cost control but lacks the real-time adaptability of digital twin systems. Integrating digital twin accounting can optimize resource allocation and operational efficiency, surpassing conventional cost accounting's static approach.

Connection

Digital twin accounting integrates real-time data simulation to enhance cost accounting accuracy by providing dynamic insights into resource consumption and operational expenses. This connection enables businesses to track and predict costs more effectively, optimizing budgeting and financial decision-making. Leveraging digital twin technology in cost accounting supports continuous monitoring and adjustment of cost drivers for improved financial performance.

Key Terms

Cost Accounting:

Cost accounting involves tracking, recording, and analyzing costs associated with production to help businesses control expenses and improve profitability. It emphasizes traditional methods such as standard costing, variance analysis, and budgeting to allocate costs accurately and optimize resource utilization. Discover how digital twin accounting enhances these processes by integrating real-time data and simulation for more precise cost management.

Overhead Allocation

Cost accounting allocates overhead by tracing indirect costs to products using traditional methods like activity-based costing or predetermined rates. Digital twin accounting enhances this process by simulating real-time operational data through virtual replicas, providing dynamic and precise overhead allocation. Explore how integrating digital twins can revolutionize your overhead cost management.

Standard Costing

Standard Costing in cost accounting involves assigning predetermined costs to products to measure performance and control expenses efficiently. Digital twin accounting enhances this process by integrating real-time data and simulation models to create dynamic, accurate cost forecasts and variance analyses. Explore how digital twin technology revolutionizes traditional standard costing for deeper financial insights.

Source and External Links

What Is Cost Accounting | A Guide for Businesses - BPM - Cost accounting is a specialized form of accounting that tracks, analyzes, and manages all costs involved in producing goods or services to help businesses set prices, eliminate waste, and improve profitability by providing detailed insights for internal decision-making, without needing to follow GAAP.

Cost Accounting Defined: What It Is & Why It Matters - NetSuite - Cost accounting involves tracking and summarizing fixed and variable costs related to production or service delivery to help internal management make better pricing and efficiency decisions, differing from financial accounting by focusing on internal use and flexible methods.

Cost accounting - Wikipedia - Cost accounting is a systematic method of recording and reporting manufacturing and service costs, including techniques like standard costing that compare actual costs to predefined costs for managing and reporting expenses in alignment with accounting principles such as GAAP.

dowidth.com

dowidth.com