Microtransaction accounting focuses on accurately recording and categorizing small-value financial transactions within a company's ledger to ensure precise financial statements. Micropayment processing involves the technological systems and methods that enable the secure and efficient transfer of these minor payments, often in digital formats. Explore further to understand the critical distinctions and integration of these two essential components in the financial ecosystem.

Why it is important

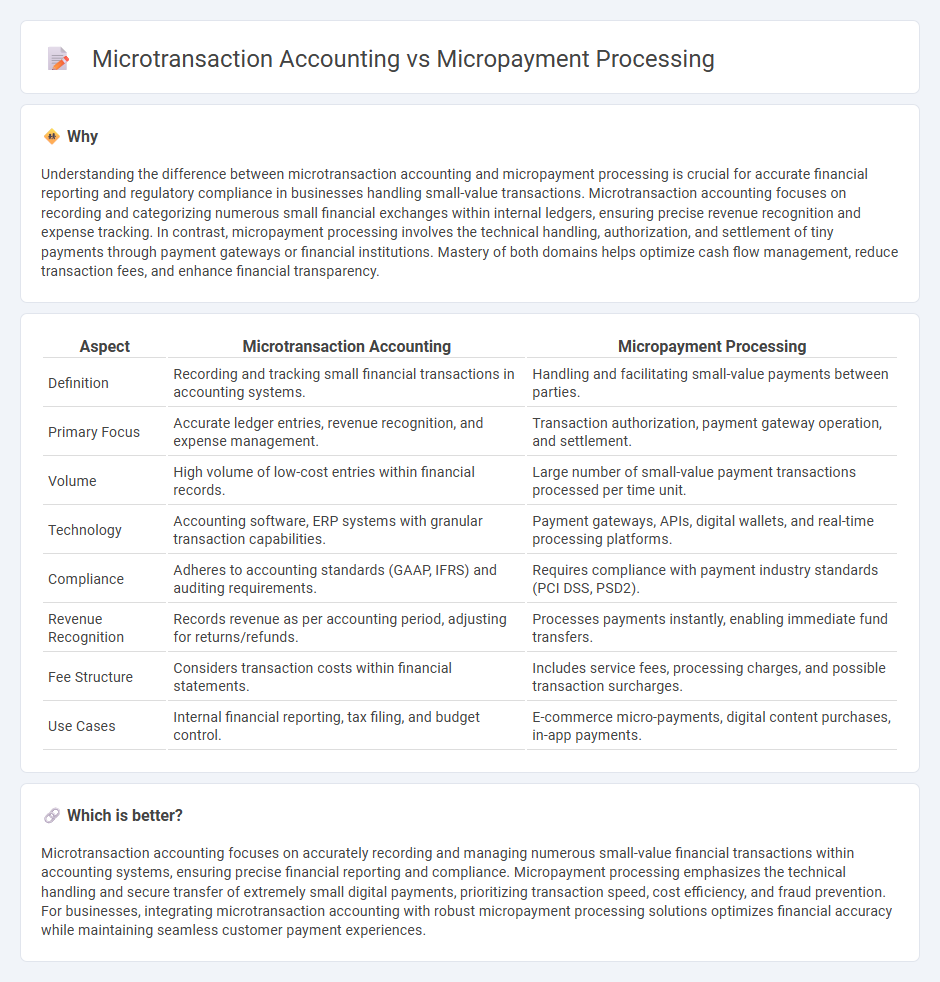

Understanding the difference between microtransaction accounting and micropayment processing is crucial for accurate financial reporting and regulatory compliance in businesses handling small-value transactions. Microtransaction accounting focuses on recording and categorizing numerous small financial exchanges within internal ledgers, ensuring precise revenue recognition and expense tracking. In contrast, micropayment processing involves the technical handling, authorization, and settlement of tiny payments through payment gateways or financial institutions. Mastery of both domains helps optimize cash flow management, reduce transaction fees, and enhance financial transparency.

Comparison Table

| Aspect | Microtransaction Accounting | Micropayment Processing |

|---|---|---|

| Definition | Recording and tracking small financial transactions in accounting systems. | Handling and facilitating small-value payments between parties. |

| Primary Focus | Accurate ledger entries, revenue recognition, and expense management. | Transaction authorization, payment gateway operation, and settlement. |

| Volume | High volume of low-cost entries within financial records. | Large number of small-value payment transactions processed per time unit. |

| Technology | Accounting software, ERP systems with granular transaction capabilities. | Payment gateways, APIs, digital wallets, and real-time processing platforms. |

| Compliance | Adheres to accounting standards (GAAP, IFRS) and auditing requirements. | Requires compliance with payment industry standards (PCI DSS, PSD2). |

| Revenue Recognition | Records revenue as per accounting period, adjusting for returns/refunds. | Processes payments instantly, enabling immediate fund transfers. |

| Fee Structure | Considers transaction costs within financial statements. | Includes service fees, processing charges, and possible transaction surcharges. |

| Use Cases | Internal financial reporting, tax filing, and budget control. | E-commerce micro-payments, digital content purchases, in-app payments. |

Which is better?

Microtransaction accounting focuses on accurately recording and managing numerous small-value financial transactions within accounting systems, ensuring precise financial reporting and compliance. Micropayment processing emphasizes the technical handling and secure transfer of extremely small digital payments, prioritizing transaction speed, cost efficiency, and fraud prevention. For businesses, integrating microtransaction accounting with robust micropayment processing solutions optimizes financial accuracy while maintaining seamless customer payment experiences.

Connection

Microtransaction accounting involves tracking and reconciling numerous small-value transactions, which requires precise methods to ensure accuracy and compliance. Micropayment processing enables these small transactions by utilizing specialized payment gateways and streamlined fee structures to handle high volumes efficiently. Together, they optimize financial reporting and cash flow management in businesses dealing with micro-scale digital purchases.

Key Terms

Transaction Fee Structure

Micropayment processing centers on handling small-value transactions efficiently, emphasizing minimal transaction fees to maintain profitability for high volumes of low-cost purchases. Microtransaction accounting involves tracking and recording these small payments with detailed fee structures to ensure transparency and compliance with financial regulations. Explore our in-depth analysis to understand how transaction fee structures impact both micropayment processing and microtransaction accounting.

Revenue Recognition

Micropayment processing involves handling small financial transactions accurately and efficiently, ensuring seamless customer experiences and compliance with payment regulations. Microtransaction accounting focuses on properly recording and recognizing revenue from these minor payments, adhering to standards like ASC 606 and IFRS 15 to reflect true financial performance. Explore the nuances of revenue recognition in micropayments to optimize your financial reporting and compliance strategies.

Aggregated Reporting

Micropayment processing involves handling numerous small-value transactions efficiently, while microtransaction accounting focuses on accurately recording and reconciling these transactions for financial reporting. Aggregated reporting plays a crucial role in summarizing individual micropayments into consolidated financial statements, improving transparency and compliance with accounting standards. Explore deeper insights into how aggregated reporting enhances both micropayment processing and microtransaction accounting.

Source and External Links

What is Micropayment & How Does it Work with Examples? - Razorpay - Micropayment processing involves an intermediary service provider who manages small-value transactions (usually less than Rs200), holding funds in escrow until confirmed and then distributing payments to sellers, often via mobile wallets or UPI for efficiency in digital commerce.

What Are Micropayments? Everything You Need to Know - Micropayment processing includes several models such as prepay (paying in advance), post-pay (charging after usage), and pay-as-you-go (paying per digital item), catering to different customer preferences and product types while facing challenges like transaction fees.

Micropayments 101: A guide to get businesses started - Stripe - Micropayment processing platforms typically require users to preload funds to aggregate transactions and reduce fees, enabling efficient small payments for digital content by transferring small amounts from a user's account to the seller's in a cost-effective manner.

dowidth.com

dowidth.com