Fair value measurement reports assets and liabilities at their current market value, reflecting real-time financial conditions. Amortized cost calculates the value by gradually adjusting the initial cost for principal repayments and interest accruals over time. Explore the key differences and applications of these methods in modern accounting standards.

Why it is important

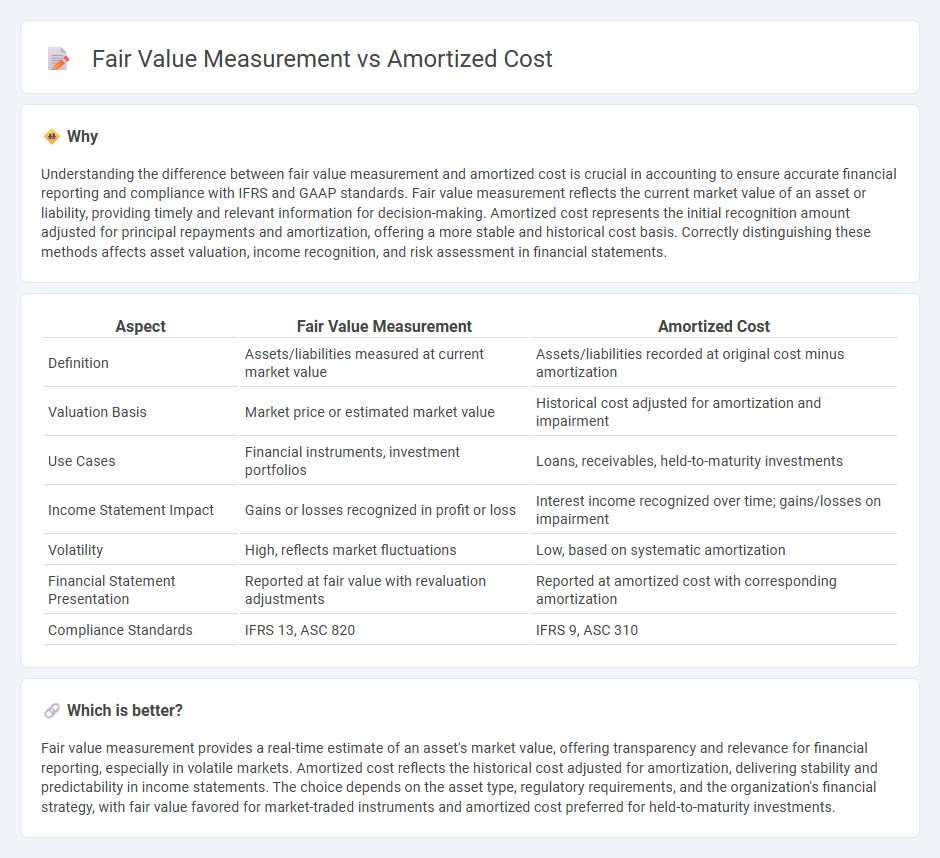

Understanding the difference between fair value measurement and amortized cost is crucial in accounting to ensure accurate financial reporting and compliance with IFRS and GAAP standards. Fair value measurement reflects the current market value of an asset or liability, providing timely and relevant information for decision-making. Amortized cost represents the initial recognition amount adjusted for principal repayments and amortization, offering a more stable and historical cost basis. Correctly distinguishing these methods affects asset valuation, income recognition, and risk assessment in financial statements.

Comparison Table

| Aspect | Fair Value Measurement | Amortized Cost |

|---|---|---|

| Definition | Assets/liabilities measured at current market value | Assets/liabilities recorded at original cost minus amortization |

| Valuation Basis | Market price or estimated market value | Historical cost adjusted for amortization and impairment |

| Use Cases | Financial instruments, investment portfolios | Loans, receivables, held-to-maturity investments |

| Income Statement Impact | Gains or losses recognized in profit or loss | Interest income recognized over time; gains/losses on impairment |

| Volatility | High, reflects market fluctuations | Low, based on systematic amortization |

| Financial Statement Presentation | Reported at fair value with revaluation adjustments | Reported at amortized cost with corresponding amortization |

| Compliance Standards | IFRS 13, ASC 820 | IFRS 9, ASC 310 |

Which is better?

Fair value measurement provides a real-time estimate of an asset's market value, offering transparency and relevance for financial reporting, especially in volatile markets. Amortized cost reflects the historical cost adjusted for amortization, delivering stability and predictability in income statements. The choice depends on the asset type, regulatory requirements, and the organization's financial strategy, with fair value favored for market-traded instruments and amortized cost preferred for held-to-maturity investments.

Connection

Fair value measurement and amortized cost are connected through their roles in financial reporting under accounting standards such as IFRS 9. Financial assets are classified and measured based on their business model and contractual cash flow characteristics, leading to either fair value through profit or loss, fair value through other comprehensive income, or amortized cost. Amortized cost reflects the asset's initial recognition amount minus principal repayments and adjusted for any impairment, while fair value measurement provides a current market-based valuation, influencing asset classification and subsequent measurement.

Key Terms

Initial Recognition

Initial recognition under amortized cost involves recording financial instruments at their transaction price, adjusted for transaction costs and premiums or discounts, reflecting the instrument's initial carrying amount. Fair value measurement requires recording assets or liabilities at their current market price, providing real-time valuation that captures market fluctuations and credit risk. Explore more to understand how these methods impact financial reporting and decision-making.

Subsequent Measurement

Subsequent measurement under amortized cost involves recording financial assets at their initial recognition amount, adjusted for principal repayments, amortization, and impairment losses, providing a stable and predictable valuation. Fair value measurement reflects assets at market value changes, incorporating unrealized gains or losses, which can lead to higher volatility in financial statements. Explore detailed comparisons to understand the implications of these measurement bases for accurate financial reporting.

Impairment

Amortized cost measurement reflects the initial recognition of a financial asset minus principal repayments and adjusted for any impairment losses, which are recognized when there is objective evidence of a decline in credit quality. Fair value measurement involves valuing assets at their market price, with impairment recognized through changes in fair value recorded in profit or loss or other comprehensive income, depending on the asset classification. Explore our detailed analysis to understand how impairment impacts financial reporting under both measurement bases.

Source and External Links

What is Amortized Cost? - Vintti - Amortized cost is the purchase price of an asset adjusted over time for factors like interest expense and principal repayments, commonly calculated using the effective interest rate method or straight-line amortization over the asset's useful life.

Amortized Costs - Infracost - Amortized cost is a financial accounting method that spreads the expense of an asset over its expected useful life, often calculated by dividing the initial cost minus residual value by the useful life, with applications in areas like cloud resource cost allocation.

Amortized cost definition - AccountingTools - Amortized cost refers to the portion of a fixed asset's recorded cost that has been expensed over time through amortization or depreciation, reflecting the accumulated expense charged thus far on tangible or intangible assets.

dowidth.com

dowidth.com