Taxonomy alignment in accounting ensures consistent classification and reporting of financial data across various frameworks, enhancing comparability and regulatory compliance. Inventory valuation methods, such as FIFO, LIFO, and weighted average, determine the cost of goods sold and ending inventory value, directly impacting financial statements and tax obligations. Explore these concepts further to understand their critical roles in accurate financial reporting and decision-making.

Why it is important

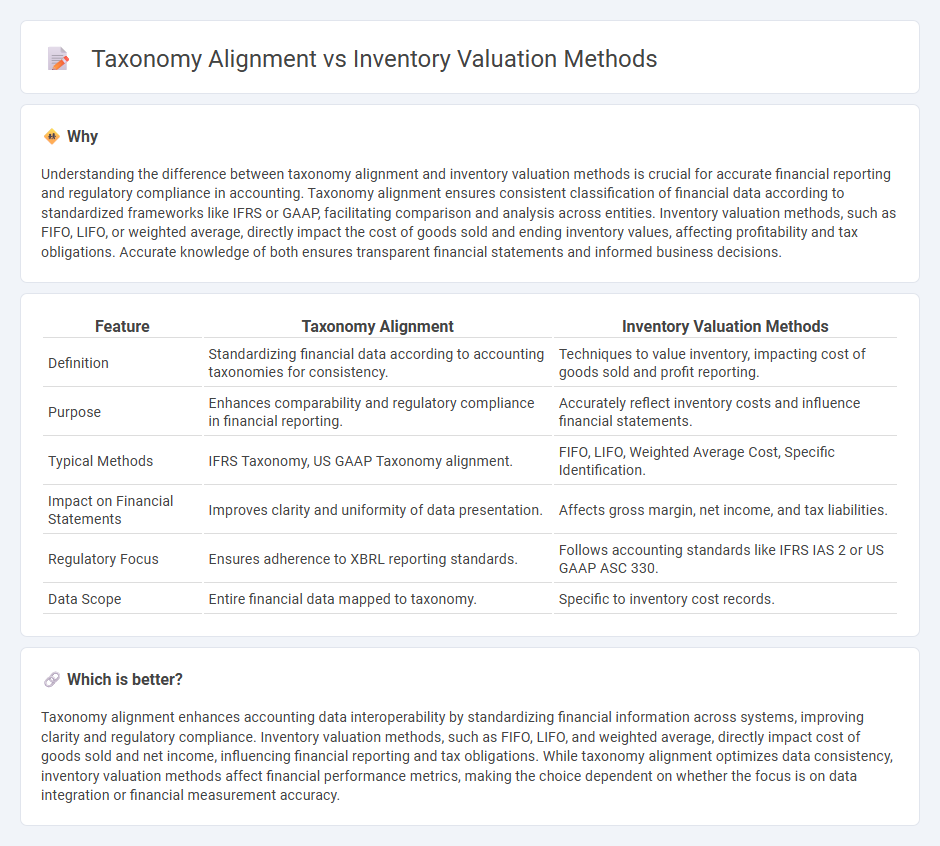

Understanding the difference between taxonomy alignment and inventory valuation methods is crucial for accurate financial reporting and regulatory compliance in accounting. Taxonomy alignment ensures consistent classification of financial data according to standardized frameworks like IFRS or GAAP, facilitating comparison and analysis across entities. Inventory valuation methods, such as FIFO, LIFO, or weighted average, directly impact the cost of goods sold and ending inventory values, affecting profitability and tax obligations. Accurate knowledge of both ensures transparent financial statements and informed business decisions.

Comparison Table

| Feature | Taxonomy Alignment | Inventory Valuation Methods |

|---|---|---|

| Definition | Standardizing financial data according to accounting taxonomies for consistency. | Techniques to value inventory, impacting cost of goods sold and profit reporting. |

| Purpose | Enhances comparability and regulatory compliance in financial reporting. | Accurately reflect inventory costs and influence financial statements. |

| Typical Methods | IFRS Taxonomy, US GAAP Taxonomy alignment. | FIFO, LIFO, Weighted Average Cost, Specific Identification. |

| Impact on Financial Statements | Improves clarity and uniformity of data presentation. | Affects gross margin, net income, and tax liabilities. |

| Regulatory Focus | Ensures adherence to XBRL reporting standards. | Follows accounting standards like IFRS IAS 2 or US GAAP ASC 330. |

| Data Scope | Entire financial data mapped to taxonomy. | Specific to inventory cost records. |

Which is better?

Taxonomy alignment enhances accounting data interoperability by standardizing financial information across systems, improving clarity and regulatory compliance. Inventory valuation methods, such as FIFO, LIFO, and weighted average, directly impact cost of goods sold and net income, influencing financial reporting and tax obligations. While taxonomy alignment optimizes data consistency, inventory valuation methods affect financial performance metrics, making the choice dependent on whether the focus is on data integration or financial measurement accuracy.

Connection

Taxonomy alignment in accounting ensures consistency in financial data representation, enabling accurate inventory valuation across different standards. Inventory valuation methods such as FIFO, LIFO, and weighted average depend on taxonomy alignment to classify and report assets correctly in financial statements. Proper alignment enhances transparency and comparability of inventory costs, impacting profitability analysis and regulatory compliance.

Key Terms

FIFO (First-In, First-Out)

FIFO (First-In, First-Out) inventory valuation method assumes that the oldest inventory items are sold first, impacting cost of goods sold and ending inventory valuation. Aligning FIFO with taxonomy requires mapping inventory data accurately to standardized financial reporting frameworks such as IFRS or GAAP for consistency and compliance. Explore detailed strategies to integrate FIFO into your taxonomy alignment for enhanced financial transparency and decision-making.

LIFO (Last-In, First-Out)

LIFO (Last-In, First-Out) inventory valuation assumes the most recent inventory purchases are sold first, impacting financial statements by reducing taxable income during inflationary periods. This method contrasts with taxonomy alignment in data management, which categorizes and standardizes inventory terms for consistency across systems, enhancing accuracy in cost flow and reporting. Explore how integrating LIFO principles with taxonomy frameworks can optimize inventory management strategies.

XBRL (eXtensible Business Reporting Language)

Inventory valuation methods such as FIFO, LIFO, and weighted average cost directly impact financial reporting, requiring precise taxonomy alignment in XBRL frameworks to ensure consistent and accurate data representation. XBRL taxonomy elements must accurately classify inventory valuation details to maintain compliance and facilitate automated financial analysis. Explore how aligning inventory valuation methods with XBRL taxonomy enhances transparency and reporting efficiency.

Source and External Links

Inventory valuation - AccountingTools - The main inventory valuation methods include Specific Identification, FIFO (First In, First Out), LIFO (Last In, First Out), and Weighted Average, each affecting financial reporting and tax outcomes differently.

What is inventory valuation? | Importance, Methods and Examples - Inventory valuation methods primarily include FIFO, LIFO, and Weighted Average Cost, with the choice depending on financial goals and market conditions.

Inventory Valuation Methods: A 2025 Guide - Impact Analytics - Specific Identification is precise for unique high-value items; FIFO, LIFO, and Weighted Average are common methods, while Retail Inventory Method offers quick estimates for retailers.

dowidth.com

dowidth.com