Embedded finance compliance ensures regulatory adherence by integrating financial services within non-financial platforms, reducing legal risks and enhancing trust. Fraud detection leverages advanced analytics and machine learning to identify suspicious transactions, safeguarding assets and maintaining operational integrity. Explore deeper insights into how these mechanisms strengthen financial ecosystems.

Why it is important

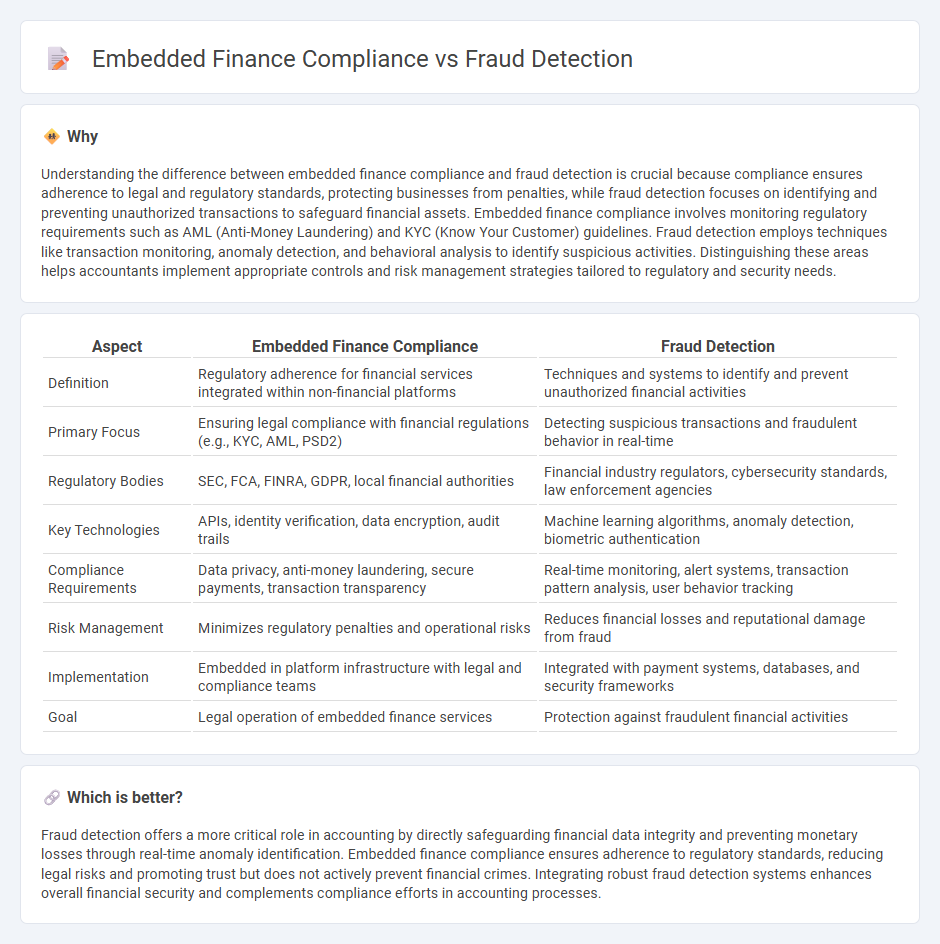

Understanding the difference between embedded finance compliance and fraud detection is crucial because compliance ensures adherence to legal and regulatory standards, protecting businesses from penalties, while fraud detection focuses on identifying and preventing unauthorized transactions to safeguard financial assets. Embedded finance compliance involves monitoring regulatory requirements such as AML (Anti-Money Laundering) and KYC (Know Your Customer) guidelines. Fraud detection employs techniques like transaction monitoring, anomaly detection, and behavioral analysis to identify suspicious activities. Distinguishing these areas helps accountants implement appropriate controls and risk management strategies tailored to regulatory and security needs.

Comparison Table

| Aspect | Embedded Finance Compliance | Fraud Detection |

|---|---|---|

| Definition | Regulatory adherence for financial services integrated within non-financial platforms | Techniques and systems to identify and prevent unauthorized financial activities |

| Primary Focus | Ensuring legal compliance with financial regulations (e.g., KYC, AML, PSD2) | Detecting suspicious transactions and fraudulent behavior in real-time |

| Regulatory Bodies | SEC, FCA, FINRA, GDPR, local financial authorities | Financial industry regulators, cybersecurity standards, law enforcement agencies |

| Key Technologies | APIs, identity verification, data encryption, audit trails | Machine learning algorithms, anomaly detection, biometric authentication |

| Compliance Requirements | Data privacy, anti-money laundering, secure payments, transaction transparency | Real-time monitoring, alert systems, transaction pattern analysis, user behavior tracking |

| Risk Management | Minimizes regulatory penalties and operational risks | Reduces financial losses and reputational damage from fraud |

| Implementation | Embedded in platform infrastructure with legal and compliance teams | Integrated with payment systems, databases, and security frameworks |

| Goal | Legal operation of embedded finance services | Protection against fraudulent financial activities |

Which is better?

Fraud detection offers a more critical role in accounting by directly safeguarding financial data integrity and preventing monetary losses through real-time anomaly identification. Embedded finance compliance ensures adherence to regulatory standards, reducing legal risks and promoting trust but does not actively prevent financial crimes. Integrating robust fraud detection systems enhances overall financial security and complements compliance efforts in accounting processes.

Connection

Embedded finance compliance ensures that financial services integrated into non-financial platforms adhere to regulatory standards, which is crucial for maintaining data security and transaction integrity. Fraud detection systems leverage compliance frameworks to identify suspicious activities early, minimizing risks associated with financial crimes. The synergy between embedded finance compliance and fraud detection creates a robust defense mechanism that protects both consumers and businesses from fraudulent transactions.

Key Terms

Fraud detection:

Fraud detection in embedded finance leverages advanced machine learning algorithms and real-time transaction monitoring to identify suspicious activities and prevent financial fraud effectively. Key tools include AI-driven anomaly detection, biometric authentication, and behavioral analytics, ensuring robust security while maintaining user experience. Explore more to understand how cutting-edge technologies enhance fraud prevention in embedded finance ecosystems.

Anomaly Detection

Fraud detection in embedded finance primarily relies on anomaly detection techniques to identify irregular transaction patterns that deviate from established user behavior, enhancing real-time security measures. Embedded finance compliance integrates these techniques with regulatory requirements such as AML (Anti-Money Laundering) and KYC (Know Your Customer) to ensure that suspicious activities are flagged and reported efficiently. Explore advanced anomaly detection methods to strengthen fraud prevention and compliance strategies in embedded financial services.

Forensic Auditing

Fraud detection in forensic auditing involves identifying suspicious transactions and patterns to prevent financial losses, while embedded finance compliance ensures integrated financial services adhere to legal and regulatory standards. Forensic auditing applies advanced data analytics and transactional monitoring to detect anomalies within embedded finance platforms, enhancing risk management and regulatory adherence. Discover more about how forensic auditing strengthens fraud defense and compliance in embedded finance ecosystems.

dowidth.com

dowidth.com