Cryptocurrency auditing focuses on verifying digital asset transactions, blockchain integrity, and compliance with emerging regulations, while operational auditing evaluates internal processes, risk management, and efficiency within an organization's financial operations. Both audit types require specialized knowledge, but cryptocurrency auditing demands expertise in cryptographic technologies and decentralized finance systems. Explore further to understand how these audit approaches safeguard financial transparency and security in evolving markets.

Why it is important

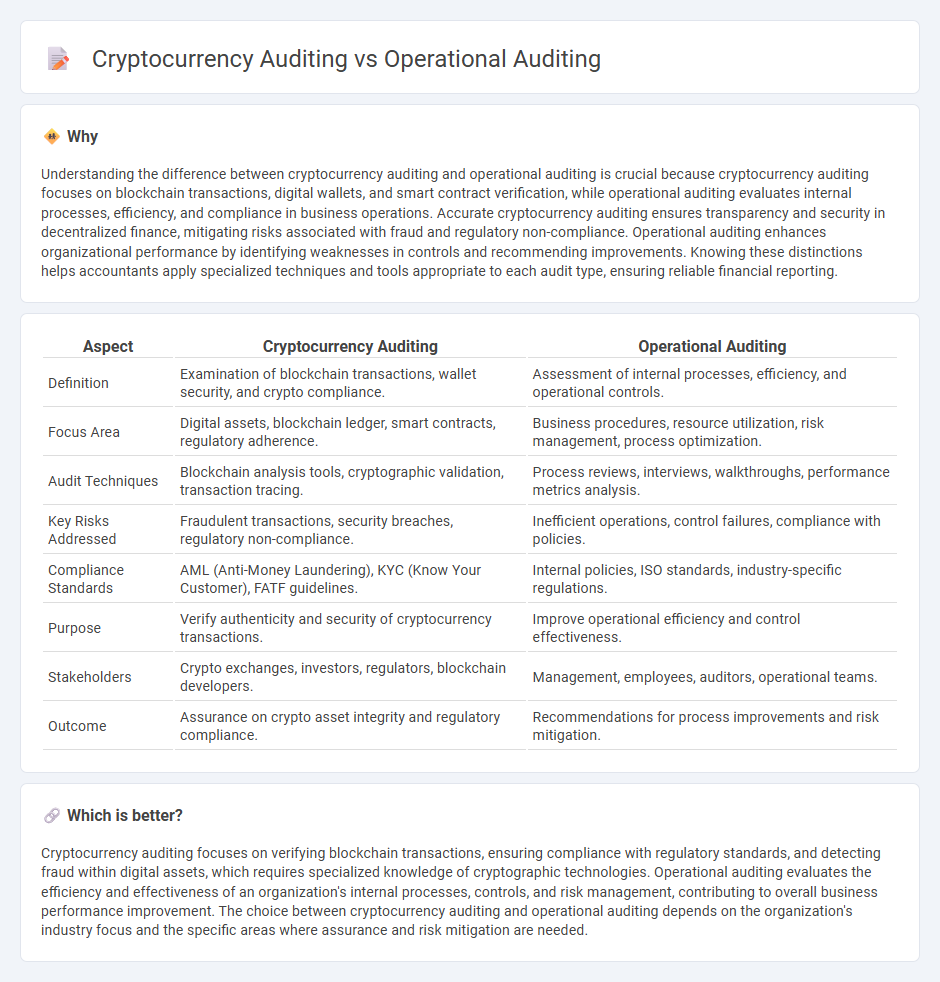

Understanding the difference between cryptocurrency auditing and operational auditing is crucial because cryptocurrency auditing focuses on blockchain transactions, digital wallets, and smart contract verification, while operational auditing evaluates internal processes, efficiency, and compliance in business operations. Accurate cryptocurrency auditing ensures transparency and security in decentralized finance, mitigating risks associated with fraud and regulatory non-compliance. Operational auditing enhances organizational performance by identifying weaknesses in controls and recommending improvements. Knowing these distinctions helps accountants apply specialized techniques and tools appropriate to each audit type, ensuring reliable financial reporting.

Comparison Table

| Aspect | Cryptocurrency Auditing | Operational Auditing |

|---|---|---|

| Definition | Examination of blockchain transactions, wallet security, and crypto compliance. | Assessment of internal processes, efficiency, and operational controls. |

| Focus Area | Digital assets, blockchain ledger, smart contracts, regulatory adherence. | Business procedures, resource utilization, risk management, process optimization. |

| Audit Techniques | Blockchain analysis tools, cryptographic validation, transaction tracing. | Process reviews, interviews, walkthroughs, performance metrics analysis. |

| Key Risks Addressed | Fraudulent transactions, security breaches, regulatory non-compliance. | Inefficient operations, control failures, compliance with policies. |

| Compliance Standards | AML (Anti-Money Laundering), KYC (Know Your Customer), FATF guidelines. | Internal policies, ISO standards, industry-specific regulations. |

| Purpose | Verify authenticity and security of cryptocurrency transactions. | Improve operational efficiency and control effectiveness. |

| Stakeholders | Crypto exchanges, investors, regulators, blockchain developers. | Management, employees, auditors, operational teams. |

| Outcome | Assurance on crypto asset integrity and regulatory compliance. | Recommendations for process improvements and risk mitigation. |

Which is better?

Cryptocurrency auditing focuses on verifying blockchain transactions, ensuring compliance with regulatory standards, and detecting fraud within digital assets, which requires specialized knowledge of cryptographic technologies. Operational auditing evaluates the efficiency and effectiveness of an organization's internal processes, controls, and risk management, contributing to overall business performance improvement. The choice between cryptocurrency auditing and operational auditing depends on the organization's industry focus and the specific areas where assurance and risk mitigation are needed.

Connection

Cryptocurrency auditing involves verifying digital asset transactions on blockchain ledgers to ensure accuracy and compliance with regulatory standards. Operational auditing assesses the efficiency and effectiveness of processes within a business, including the management of cryptocurrency assets and related controls. Together, these audits provide a comprehensive evaluation of both the technical integrity and operational risk management in organizations handling cryptocurrency.

Key Terms

**Operational Auditing:**

Operational auditing evaluates the efficiency, effectiveness, and economy of an organization's processes, aiming to enhance overall corporate performance through thorough risk assessments and internal controls review. In contrast, cryptocurrency auditing specializes in verifying blockchain transactions, smart contracts, and digital asset security to ensure transparency and compliance with evolving regulatory standards. Explore further to understand how operational auditing methodologies can be integrated with emerging cryptocurrency frameworks.

Internal Controls

Operational auditing emphasizes evaluating internal controls to ensure efficient processes, compliance, and risk management within traditional organizational frameworks. Cryptocurrency auditing focuses on verifying blockchain transactions, smart contract integrity, and security protocols to safeguard digital assets and prevent fraud. Explore more to understand how internal control mechanisms differ between these auditing approaches.

Risk Assessment

Operational auditing emphasizes evaluating internal controls, financial processes, and compliance to identify risks within an organization's operations, ensuring accuracy and efficiency. Cryptocurrency auditing focuses on assessing blockchain security, transaction integrity, and compliance with regulatory frameworks to mitigate fraud and cyber threats inherent in digital assets. Explore the key differences and methodologies to enhance your understanding of risk assessment in these auditing domains.

Source and External Links

Operational Audit: Overview and Guide - Operational audits evaluate internal processes, controls, and procedures to identify inefficiencies, ensure regulatory compliance, and recommend improvements for organizational effectiveness.

A practical guide to operational audits - These audits systematically assess internal controls, collect and analyze operational data, and produce actionable reports to strengthen risk management and operational efficiency.

What Is an Operational Audit? - The process involves defining scope, gathering evidence through interviews and documentation, testing controls, and providing management with concrete recommendations for enhancing business operations.

dowidth.com

dowidth.com