Greenwashing detection focuses on identifying misleading claims about a company's environmental practices by analyzing financial disclosures, marketing materials, and sustainability reports. Integrated reporting evaluation assesses the comprehensiveness and transparency of a company's combined financial and non-financial performance to provide a holistic view of its value creation. Explore more to understand the critical role of these approaches in promoting corporate accountability and sustainable business practices.

Why it is important

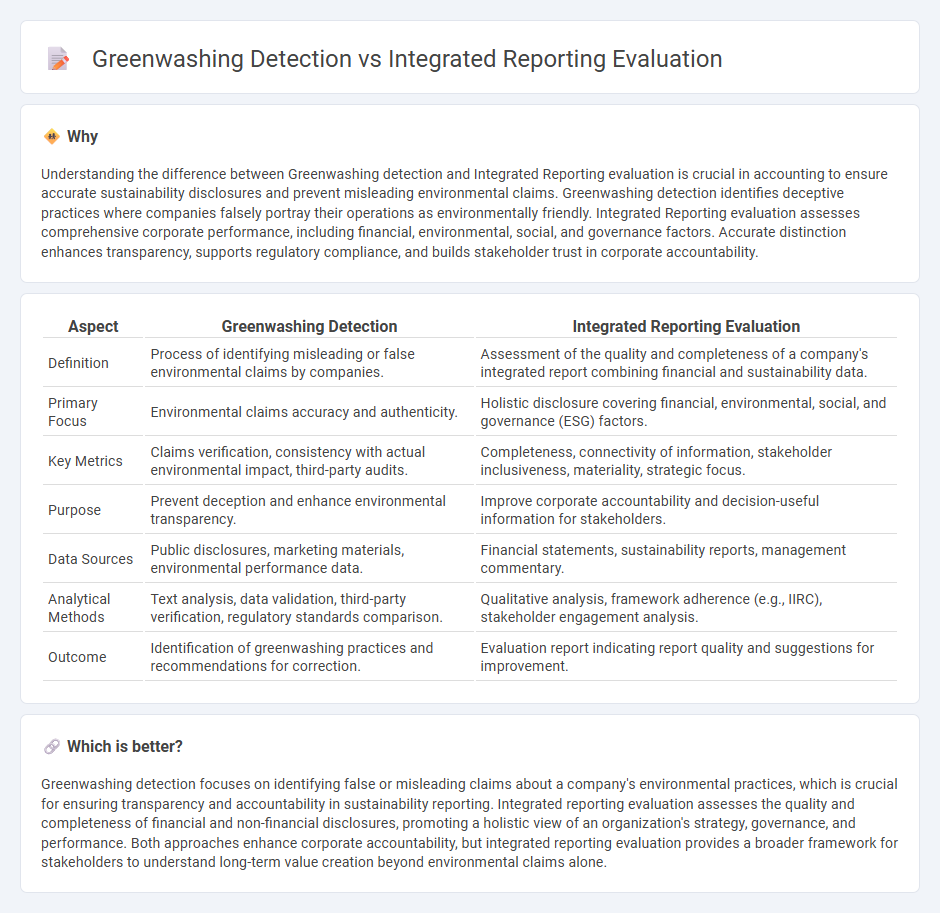

Understanding the difference between Greenwashing detection and Integrated Reporting evaluation is crucial in accounting to ensure accurate sustainability disclosures and prevent misleading environmental claims. Greenwashing detection identifies deceptive practices where companies falsely portray their operations as environmentally friendly. Integrated Reporting evaluation assesses comprehensive corporate performance, including financial, environmental, social, and governance factors. Accurate distinction enhances transparency, supports regulatory compliance, and builds stakeholder trust in corporate accountability.

Comparison Table

| Aspect | Greenwashing Detection | Integrated Reporting Evaluation |

|---|---|---|

| Definition | Process of identifying misleading or false environmental claims by companies. | Assessment of the quality and completeness of a company's integrated report combining financial and sustainability data. |

| Primary Focus | Environmental claims accuracy and authenticity. | Holistic disclosure covering financial, environmental, social, and governance (ESG) factors. |

| Key Metrics | Claims verification, consistency with actual environmental impact, third-party audits. | Completeness, connectivity of information, stakeholder inclusiveness, materiality, strategic focus. |

| Purpose | Prevent deception and enhance environmental transparency. | Improve corporate accountability and decision-useful information for stakeholders. |

| Data Sources | Public disclosures, marketing materials, environmental performance data. | Financial statements, sustainability reports, management commentary. |

| Analytical Methods | Text analysis, data validation, third-party verification, regulatory standards comparison. | Qualitative analysis, framework adherence (e.g., IIRC), stakeholder engagement analysis. |

| Outcome | Identification of greenwashing practices and recommendations for correction. | Evaluation report indicating report quality and suggestions for improvement. |

Which is better?

Greenwashing detection focuses on identifying false or misleading claims about a company's environmental practices, which is crucial for ensuring transparency and accountability in sustainability reporting. Integrated reporting evaluation assesses the quality and completeness of financial and non-financial disclosures, promoting a holistic view of an organization's strategy, governance, and performance. Both approaches enhance corporate accountability, but integrated reporting evaluation provides a broader framework for stakeholders to understand long-term value creation beyond environmental claims alone.

Connection

Greenwashing detection relies on analyzing corporate disclosures and financial statements to identify inconsistencies between claimed sustainability practices and actual performance, which is integral to the evaluation of integrated reporting. Integrated reporting combines financial data with environmental, social, and governance (ESG) metrics, providing a comprehensive view that facilitates transparency and accountability in sustainability claims. Effective detection of greenwashing enhances the credibility of integrated reports by ensuring that ESG information aligns accurately with corporate financial disclosures.

Key Terms

Materiality assessment

Materiality assessment in integrated reporting evaluation prioritizes the disclosure of financially significant environmental, social, and governance (ESG) information that impacts long-term value creation for stakeholders. In contrast, greenwashing detection scrutinizes the authenticity and transparency of sustainability claims to prevent misleading stakeholders with superficial or exaggerated environmental benefits. Explore deeper insights into how materiality shapes credible sustainability communication and supports responsible business practices.

Assurance standards

Integrated reporting evaluation relies on international assurance standards like ISAE 3000 to verify the accuracy and completeness of sustainability disclosures, enhancing corporate transparency. Greenwashing detection involves scrutinizing claims against established frameworks such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) to identify misleading or exaggerated environmental commitments. Discover how these assurance standards shape credible sustainability communication and investor trust.

Stakeholder engagement

Integrated reporting evaluation emphasizes transparent disclosure and meaningful stakeholder engagement to enhance corporate accountability and build trust. Greenwashing detection scrutinizes environmental claims to identify misleading information that can undermine genuine stakeholder communication. Explore effective strategies to differentiate authentic reporting from greenwashing in stakeholder dialogues.

Source and External Links

Frequently asked questions - Integrated Reporting - IFRS Foundation - Provides insights into the fundamental concepts and guiding principles of integrated reporting, emphasizing its role in showcasing an organization's value creation over time.

INTERNATIONAL

What is integrated reporting? - Highlights the holistic approach of integrated reporting in evaluating a company's performance and value creation through both financial and non-financial metrics.

dowidth.com

dowidth.com