Tax equity financing leverages tax credits and incentives, primarily used in renewable energy projects to attract investors seeking tax benefits, while mezzanine financing combines debt and equity features to provide flexible capital for business expansion with higher risk and return profiles. Mezzanine financing typically involves subordinated debt with warrants or conversion options, offering companies access to capital without immediate ownership dilution. Explore further to understand which financing option suits your project's financial strategy best.

Why it is important

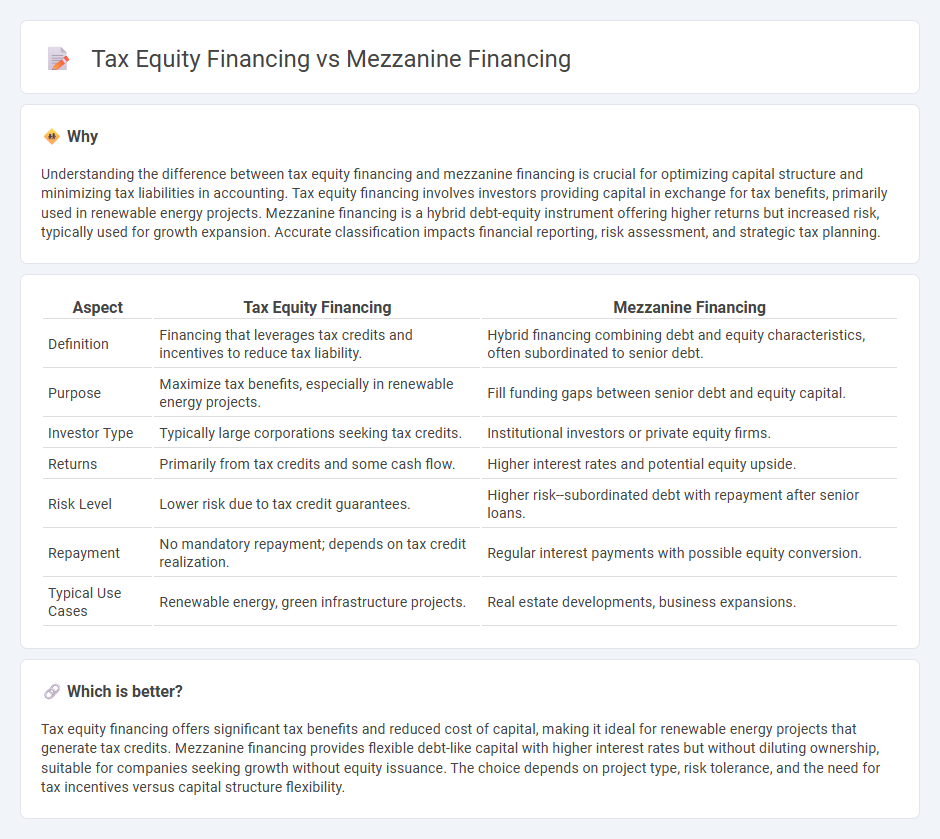

Understanding the difference between tax equity financing and mezzanine financing is crucial for optimizing capital structure and minimizing tax liabilities in accounting. Tax equity financing involves investors providing capital in exchange for tax benefits, primarily used in renewable energy projects. Mezzanine financing is a hybrid debt-equity instrument offering higher returns but increased risk, typically used for growth expansion. Accurate classification impacts financial reporting, risk assessment, and strategic tax planning.

Comparison Table

| Aspect | Tax Equity Financing | Mezzanine Financing |

|---|---|---|

| Definition | Financing that leverages tax credits and incentives to reduce tax liability. | Hybrid financing combining debt and equity characteristics, often subordinated to senior debt. |

| Purpose | Maximize tax benefits, especially in renewable energy projects. | Fill funding gaps between senior debt and equity capital. |

| Investor Type | Typically large corporations seeking tax credits. | Institutional investors or private equity firms. |

| Returns | Primarily from tax credits and some cash flow. | Higher interest rates and potential equity upside. |

| Risk Level | Lower risk due to tax credit guarantees. | Higher risk--subordinated debt with repayment after senior loans. |

| Repayment | No mandatory repayment; depends on tax credit realization. | Regular interest payments with possible equity conversion. |

| Typical Use Cases | Renewable energy, green infrastructure projects. | Real estate developments, business expansions. |

Which is better?

Tax equity financing offers significant tax benefits and reduced cost of capital, making it ideal for renewable energy projects that generate tax credits. Mezzanine financing provides flexible debt-like capital with higher interest rates but without diluting ownership, suitable for companies seeking growth without equity issuance. The choice depends on project type, risk tolerance, and the need for tax incentives versus capital structure flexibility.

Connection

Tax equity financing and mezzanine financing intersect in structuring capital for projects, particularly in renewable energy. Tax equity investors provide funds in exchange for tax benefits, while mezzanine financing offers subordinated debt or preferred equity, bridging the gap between equity and senior debt. This combination optimizes capital stacks, enhancing project viability and investor returns.

Key Terms

Capital Structure

Mezzanine financing fills the gap between senior debt and equity, offering higher returns through subordinated debt or preferred equity, often with warrants or conversion options to enhance capital structure flexibility. Tax equity financing, primarily used in renewable energy projects, provides tax benefits to investors in exchange for equity, significantly reducing the project's weighted average cost of capital (WACC) by leveraging tax credits and depreciation. Explore how these financing methods reshape your capital strategy by balancing risk, return, and tax incentives.

Subordinated Debt

Mezzanine financing involves subordinated debt positioned below senior debt but above equity in the capital stack, offering higher returns due to increased risk. Tax equity financing, common in renewable energy projects, typically includes equity stakes that leverage tax credits with less emphasis on subordinated debt. Explore detailed comparisons and strategic uses of subordinated debt in each financing method to optimize investment outcomes.

Tax Credits

Tax equity financing leverages federal tax credits, like the Investment Tax Credit (ITC) and Production Tax Credit (PTC), to attract investors seeking tax benefits from renewable energy projects. Mezzanine financing involves subordinated debt or preferred equity that fills the capital gap between senior debt and equity but does not directly utilize tax credits. Explore the detailed differences and advantages of using tax credits in financing structures for renewable energy projects.

Source and External Links

What is Mezzanine Financing | BDC.ca - Mezzanine financing is a hybrid form of business loan combining debt and equity features with flexible repayment terms, typically unsecured and subordinated to senior debt, used to fund working capital, acquisitions, or business transfers, and treated as equity on the balance sheet to improve leverage ratios.

What is Mezzanine Financing? - PGIM Private Capital - Mezzanine financing is a capital source sitting between senior debt and equity, often used for leveraged buyouts, growth capital, and acquisitions, priced as a blend of debt and equity with higher costs than senior debt and commonly structured with cash interest plus equity warrants.

Mezzanine Debt & Financing: The Complete Guide - Mezzanine debt bridges the gap between senior debt and equity, usually providing 5-25% of total capital, offering flexible financing that can later be refinanced into cheaper senior debt and functionally operates as subordinated debt with tax-deductible interest.

dowidth.com

dowidth.com