Taxonomy alignment ensures consistent classification and tagging of financial data according to regulatory standards, improving interoperability and accuracy in financial reporting. Financial statement presentation organizes this data into structured formats like balance sheets, income statements, and cash flow statements for clear stakeholder communication. Explore more to understand how these components enhance transparency and compliance in accounting.

Why it is important

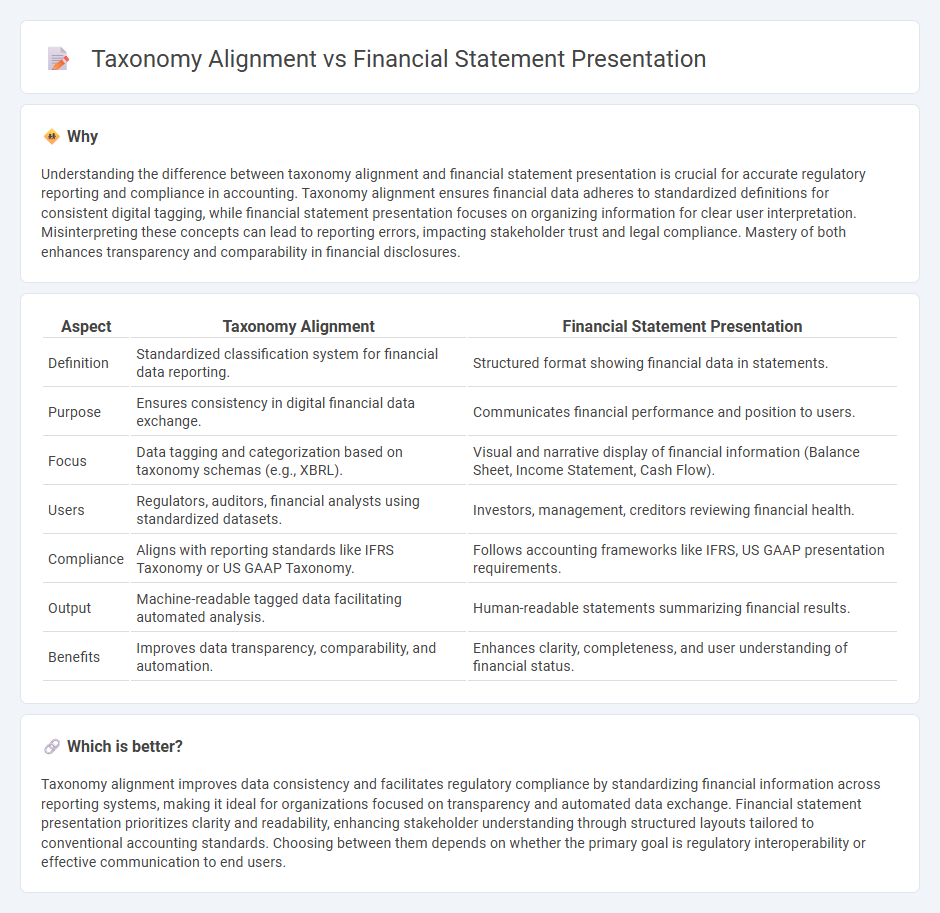

Understanding the difference between taxonomy alignment and financial statement presentation is crucial for accurate regulatory reporting and compliance in accounting. Taxonomy alignment ensures financial data adheres to standardized definitions for consistent digital tagging, while financial statement presentation focuses on organizing information for clear user interpretation. Misinterpreting these concepts can lead to reporting errors, impacting stakeholder trust and legal compliance. Mastery of both enhances transparency and comparability in financial disclosures.

Comparison Table

| Aspect | Taxonomy Alignment | Financial Statement Presentation |

|---|---|---|

| Definition | Standardized classification system for financial data reporting. | Structured format showing financial data in statements. |

| Purpose | Ensures consistency in digital financial data exchange. | Communicates financial performance and position to users. |

| Focus | Data tagging and categorization based on taxonomy schemas (e.g., XBRL). | Visual and narrative display of financial information (Balance Sheet, Income Statement, Cash Flow). |

| Users | Regulators, auditors, financial analysts using standardized datasets. | Investors, management, creditors reviewing financial health. |

| Compliance | Aligns with reporting standards like IFRS Taxonomy or US GAAP Taxonomy. | Follows accounting frameworks like IFRS, US GAAP presentation requirements. |

| Output | Machine-readable tagged data facilitating automated analysis. | Human-readable statements summarizing financial results. |

| Benefits | Improves data transparency, comparability, and automation. | Enhances clarity, completeness, and user understanding of financial status. |

Which is better?

Taxonomy alignment improves data consistency and facilitates regulatory compliance by standardizing financial information across reporting systems, making it ideal for organizations focused on transparency and automated data exchange. Financial statement presentation prioritizes clarity and readability, enhancing stakeholder understanding through structured layouts tailored to conventional accounting standards. Choosing between them depends on whether the primary goal is regulatory interoperability or effective communication to end users.

Connection

Taxonomy alignment ensures that financial data is consistently categorized according to regulatory standards, enhancing the accuracy of financial statement presentation. Precise taxonomy alignment facilitates clear, comparable, and transparent reporting in financial statements, meeting compliance requirements. This connection streamlines data analysis and supports audit processes by standardizing the presentation format.

Key Terms

Chart of Accounts

The presentation of financial statements involves organizing accounts in a structured format that reflects the company's financial position, while taxonomy alignment ensures that these accounts correspond accurately to standardized classification systems such as IFRS or GAAP taxonomies. A well-designed Chart of Accounts (CoA) serves as the backbone for both processes, enabling seamless mapping between internal account codes and external reporting requirements. Explore how optimizing your Chart of Accounts can enhance compliance and reporting efficiency.

XBRL (eXtensible Business Reporting Language)

XBRL (eXtensible Business Reporting Language) enhances financial statement presentation by standardizing data tagging, ensuring consistency and accuracy in regulatory filings. Taxonomy alignment in XBRL involves mapping financial data elements to predefined industry-standard taxonomies like IFRS or US GAAP, improving comparability and transparency across reports. Explore deeper insights into how XBRL taxonomy alignment transforms financial reporting accuracy and efficiency.

Mapping

Mapping serves as the critical link between financial statement presentation and taxonomy alignment, ensuring data consistency and regulatory compliance. Effective mapping translates complex accounting data into standardized taxonomy elements, facilitating accurate financial reporting and easier data aggregation. Explore more to understand the nuances of mapping techniques and best practices in taxonomy alignment.

Source and External Links

KPMG Handbook: Financial Statement Presentation - This handbook provides guidance on the presentation and disclosure of financial statements, focusing on transparency and consistency in financial reporting.

PwC Financial Statement Presentation Guide - This guide compiles presentation and disclosure requirements under US GAAP, offering insights and examples for financial statement preparation.

DFIN Guide to Presenting Financial Reports - This guide helps in presenting financial statements to boards by emphasizing clarity and decision-making support tailored to the audience's financial literacy.

dowidth.com

dowidth.com