Dynamic allocation tracing enhances accounting accuracy by tracking resource usage in real-time, providing detailed insights into expense distribution and cost centers. Automated bookkeeping streamlines financial data entry and reconciliation, reducing human error and increasing efficiency across payroll, invoicing, and reporting tasks. Explore how integrating these technologies can transform your accounting processes and drive better financial management.

Why it is important

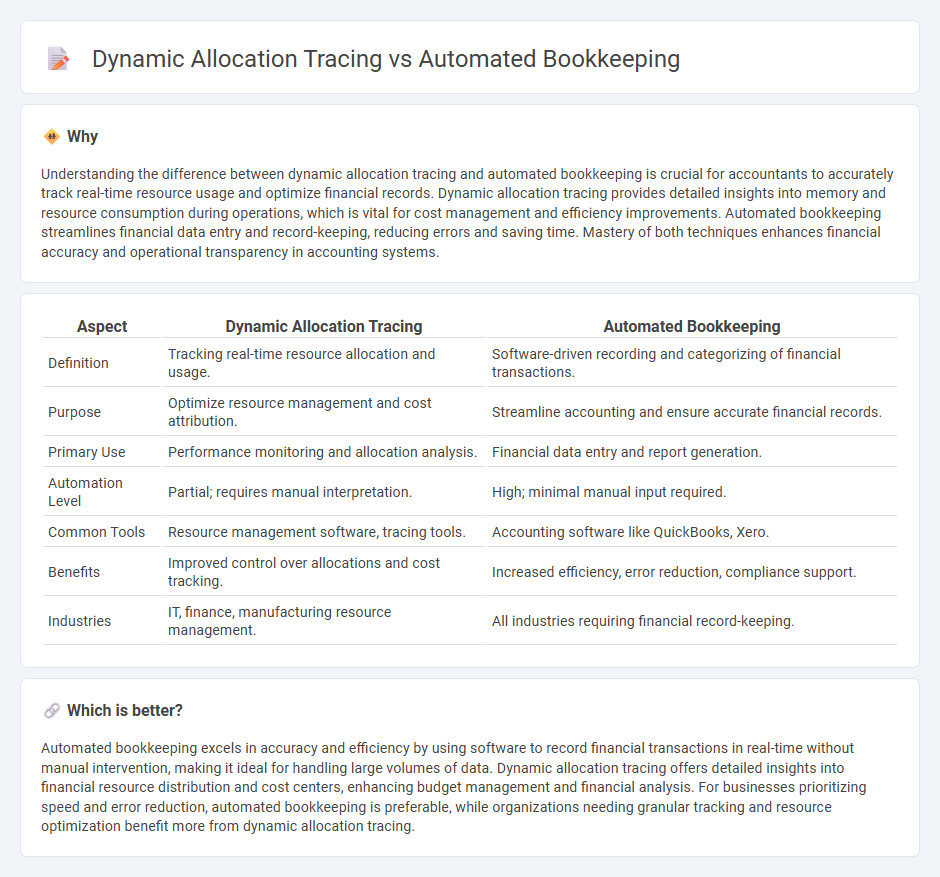

Understanding the difference between dynamic allocation tracing and automated bookkeeping is crucial for accountants to accurately track real-time resource usage and optimize financial records. Dynamic allocation tracing provides detailed insights into memory and resource consumption during operations, which is vital for cost management and efficiency improvements. Automated bookkeeping streamlines financial data entry and record-keeping, reducing errors and saving time. Mastery of both techniques enhances financial accuracy and operational transparency in accounting systems.

Comparison Table

| Aspect | Dynamic Allocation Tracing | Automated Bookkeeping |

|---|---|---|

| Definition | Tracking real-time resource allocation and usage. | Software-driven recording and categorizing of financial transactions. |

| Purpose | Optimize resource management and cost attribution. | Streamline accounting and ensure accurate financial records. |

| Primary Use | Performance monitoring and allocation analysis. | Financial data entry and report generation. |

| Automation Level | Partial; requires manual interpretation. | High; minimal manual input required. |

| Common Tools | Resource management software, tracing tools. | Accounting software like QuickBooks, Xero. |

| Benefits | Improved control over allocations and cost tracking. | Increased efficiency, error reduction, compliance support. |

| Industries | IT, finance, manufacturing resource management. | All industries requiring financial record-keeping. |

Which is better?

Automated bookkeeping excels in accuracy and efficiency by using software to record financial transactions in real-time without manual intervention, making it ideal for handling large volumes of data. Dynamic allocation tracing offers detailed insights into financial resource distribution and cost centers, enhancing budget management and financial analysis. For businesses prioritizing speed and error reduction, automated bookkeeping is preferable, while organizations needing granular tracking and resource optimization benefit more from dynamic allocation tracing.

Connection

Dynamic allocation tracing enhances automated bookkeeping by providing precise tracking of resource usage and financial transactions in real-time, improving accuracy in expense allocation. Automated bookkeeping systems utilize this detailed data to categorize and record financial events efficiently, reducing errors associated with manual entry. This integration supports more accurate financial reporting and streamlined audit processes within accounting practices.

Key Terms

Double-entry system

Automated bookkeeping leverages software to efficiently record transactions within the double-entry system, ensuring accurate debit and credit entries for financial clarity. Dynamic allocation tracing tracks resource usage in real-time but lacks the transactional precision inherent to double-entry bookkeeping. Explore how these methods impact financial accuracy and operational transparency in accounting systems.

Resource tracking

Automated bookkeeping streamlines resource tracking by continuously recording asset usage and financial transactions, ensuring accurate and up-to-date data management. Dynamic allocation tracing enhances this process by monitoring real-time resource distribution and usage patterns, enabling precise identification of inefficiencies and optimization opportunities. Explore detailed comparisons and best practices to optimize your resource tracking strategies effectively.

Real-time reconciliation

Automated bookkeeping enhances financial accuracy by systematically recording transactions, enabling efficient real-time reconciliation across multiple accounts. Dynamic allocation tracing monitors resource distribution with precision, providing immediate insights into allocation shifts that impact financial statements instantaneously. Explore how integrating these technologies can revolutionize your real-time reconciliation processes.

Source and External Links

How to Automate Your Bookkeeping - Accounting - Ramp - Automated bookkeeping uses software to reduce manual data entry, streamline financial tasks like expense tracking and reconciliation, and offers real-time transaction syncing and financial insights, saving businesses significant time and minimizing errors.

Booke AI: Automate your bookkeeping with an AI-driven single app - Booke AI provides AI-driven automation for bookkeeping tasks such as reconciliation, categorization, and smart document data extraction in platforms like QuickBooks Online and Xero, continuously detecting errors and minimizing manual work.

How to Automate Your Bookkeeping | Bench Accounting - Automated bookkeeping reduces human error and gives real-time financial insights, enabling faster business decisions and freeing entrepreneurs from repetitive bookkeeping tasks for higher-value work.

dowidth.com

dowidth.com