Cryptocurrency tax regulations require precise reporting of digital asset transactions, highlighting challenges in compliance and valuation. Tax planning strategies optimize financial outcomes by leveraging deductions, credits, and timing of income recognition. Explore detailed insights to master tax-efficient management of both traditional and crypto assets.

Why it is important

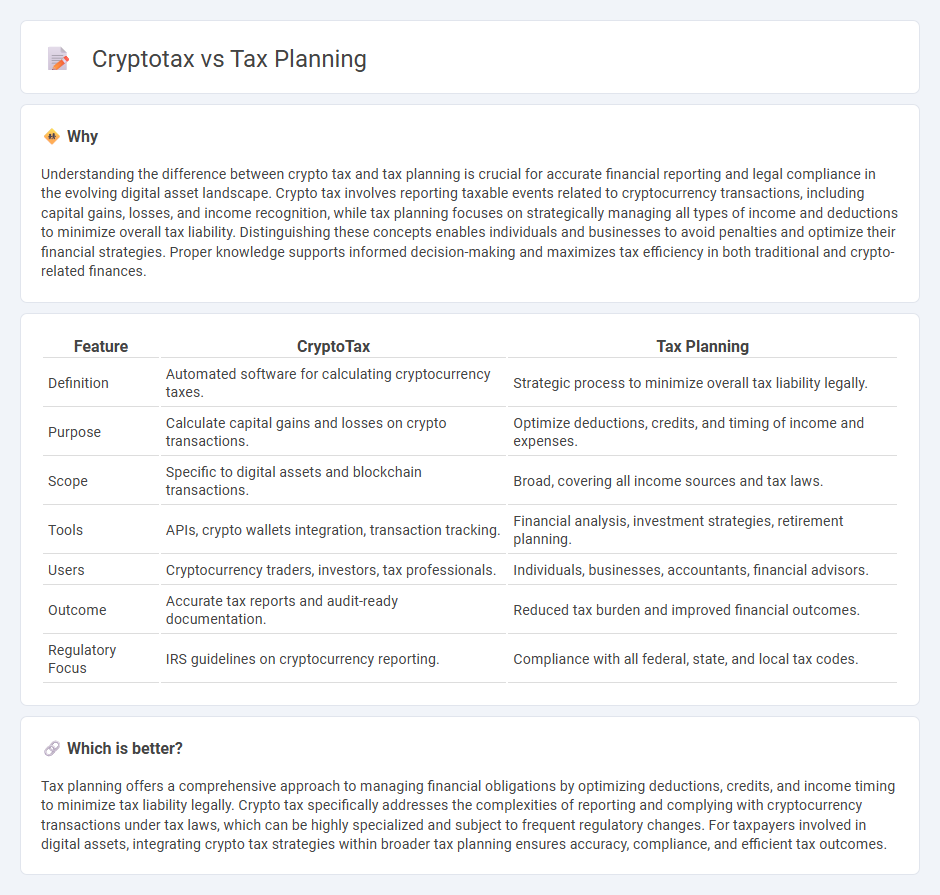

Understanding the difference between crypto tax and tax planning is crucial for accurate financial reporting and legal compliance in the evolving digital asset landscape. Crypto tax involves reporting taxable events related to cryptocurrency transactions, including capital gains, losses, and income recognition, while tax planning focuses on strategically managing all types of income and deductions to minimize overall tax liability. Distinguishing these concepts enables individuals and businesses to avoid penalties and optimize their financial strategies. Proper knowledge supports informed decision-making and maximizes tax efficiency in both traditional and crypto-related finances.

Comparison Table

| Feature | CryptoTax | Tax Planning |

|---|---|---|

| Definition | Automated software for calculating cryptocurrency taxes. | Strategic process to minimize overall tax liability legally. |

| Purpose | Calculate capital gains and losses on crypto transactions. | Optimize deductions, credits, and timing of income and expenses. |

| Scope | Specific to digital assets and blockchain transactions. | Broad, covering all income sources and tax laws. |

| Tools | APIs, crypto wallets integration, transaction tracking. | Financial analysis, investment strategies, retirement planning. |

| Users | Cryptocurrency traders, investors, tax professionals. | Individuals, businesses, accountants, financial advisors. |

| Outcome | Accurate tax reports and audit-ready documentation. | Reduced tax burden and improved financial outcomes. |

| Regulatory Focus | IRS guidelines on cryptocurrency reporting. | Compliance with all federal, state, and local tax codes. |

Which is better?

Tax planning offers a comprehensive approach to managing financial obligations by optimizing deductions, credits, and income timing to minimize tax liability legally. Crypto tax specifically addresses the complexities of reporting and complying with cryptocurrency transactions under tax laws, which can be highly specialized and subject to frequent regulatory changes. For taxpayers involved in digital assets, integrating crypto tax strategies within broader tax planning ensures accuracy, compliance, and efficient tax outcomes.

Connection

Cryptotax management is an essential component of effective tax planning for individuals and businesses dealing with cryptocurrencies, ensuring accurate reporting of digital asset transactions and compliance with tax regulations. Proper tax planning incorporates strategies to minimize tax liabilities from crypto investments through methods like tax-loss harvesting and timing capital gains. Utilizing specialized cryptotax software enhances precision in calculating taxable events, optimizing overall financial outcomes in tax planning frameworks.

Key Terms

**Tax Planning:**

Tax planning involves strategizing financial decisions to minimize tax liability within legal frameworks, leveraging deductions, credits, and timing of income. Effective tax planning enhances cash flow, supports investment growth, and ensures compliance with IRS regulations. Discover more about optimizing your tax strategy and maximizing savings with expert tax planning techniques.

Tax Deductions

Tax planning involves strategically organizing financial activities to maximize tax deductions and minimize liabilities, leveraging credits, allowances, and exemptions available under prevailing tax laws. Crypto tax focuses on the unique tax implications related to digital asset transactions, including capital gains, income from mining, staking, or airdrops, emphasizing accurate reporting and claiming relevant deductions like transaction fees or losses. Explore comprehensive strategies to optimize your tax deductions in both traditional and cryptocurrency tax frameworks.

Income Deferral

Income deferral in tax planning strategically postpones taxable income to future periods, optimizing cash flow and reducing current tax liabilities. Crypto tax strategies emphasize deferring gains by using methods like holding assets long-term or utilizing specific crypto tax software to track and report transactions accurately. Explore effective income deferral techniques to maximize tax benefits in both traditional and cryptocurrency contexts.

Source and External Links

Strategic Tax Planning: Essential Tips for Corporate Tax - This article discusses the importance of strategic tax planning for businesses, including developing a tax policy to manage tax obligations and optimize financial performance.

Tax Planning - This webpage explains that tax planning involves analyzing financial situations to pay the least amount of taxes legally, often by controlling income timing and investments.

How to Start Tax Planning - This article provides tips for starting tax planning, including organizing documents, reviewing deductions early, and using tax-advantaged accounts like IRAs.

dowidth.com

dowidth.com