Digital twin accounting leverages real-time data replication and advanced analytics to provide accurate financial insights, enhancing decision-making and reducing errors compared to traditional manual bookkeeping methods. Incorporating automation and artificial intelligence, digital twin accounting streamlines transaction processing and improves audit readiness. Explore further to understand how digital twin technology transforms financial management.

Why it is important

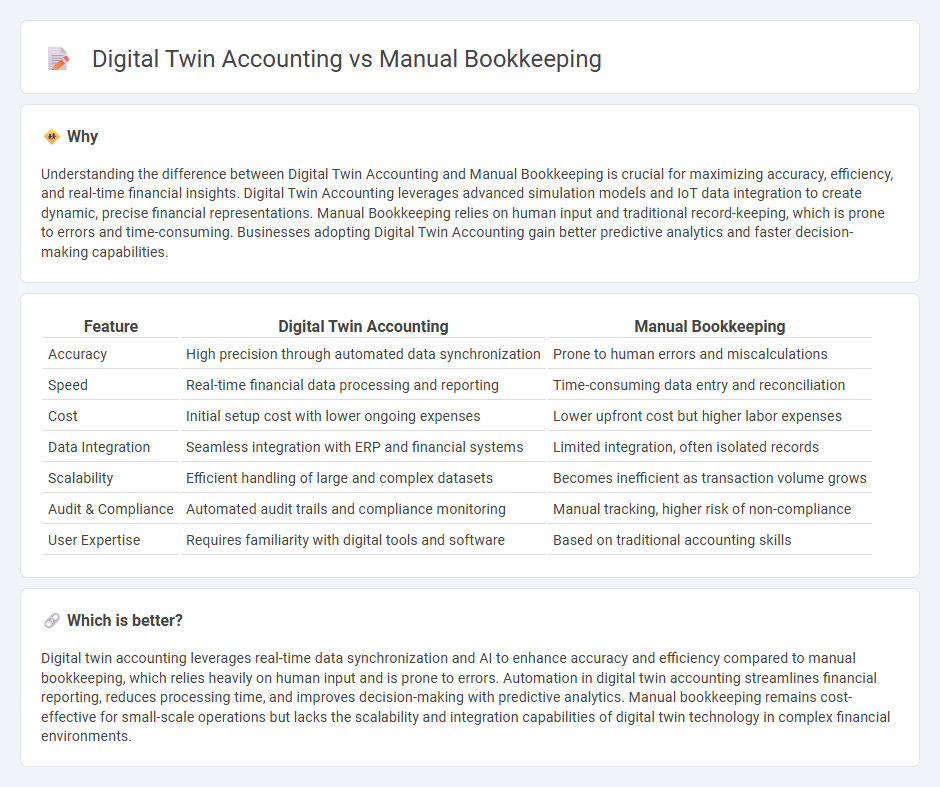

Understanding the difference between Digital Twin Accounting and Manual Bookkeeping is crucial for maximizing accuracy, efficiency, and real-time financial insights. Digital Twin Accounting leverages advanced simulation models and IoT data integration to create dynamic, precise financial representations. Manual Bookkeeping relies on human input and traditional record-keeping, which is prone to errors and time-consuming. Businesses adopting Digital Twin Accounting gain better predictive analytics and faster decision-making capabilities.

Comparison Table

| Feature | Digital Twin Accounting | Manual Bookkeeping |

|---|---|---|

| Accuracy | High precision through automated data synchronization | Prone to human errors and miscalculations |

| Speed | Real-time financial data processing and reporting | Time-consuming data entry and reconciliation |

| Cost | Initial setup cost with lower ongoing expenses | Lower upfront cost but higher labor expenses |

| Data Integration | Seamless integration with ERP and financial systems | Limited integration, often isolated records |

| Scalability | Efficient handling of large and complex datasets | Becomes inefficient as transaction volume grows |

| Audit & Compliance | Automated audit trails and compliance monitoring | Manual tracking, higher risk of non-compliance |

| User Expertise | Requires familiarity with digital tools and software | Based on traditional accounting skills |

Which is better?

Digital twin accounting leverages real-time data synchronization and AI to enhance accuracy and efficiency compared to manual bookkeeping, which relies heavily on human input and is prone to errors. Automation in digital twin accounting streamlines financial reporting, reduces processing time, and improves decision-making with predictive analytics. Manual bookkeeping remains cost-effective for small-scale operations but lacks the scalability and integration capabilities of digital twin technology in complex financial environments.

Connection

Digital twin accounting integrates real-time digital replicas of financial processes, enhancing accuracy and predictive analysis in bookkeeping tasks traditionally managed manually. Manual bookkeeping provides the foundational data that digital twins simulate, enabling continuous monitoring and error detection in financial records. This synergy improves decision-making by combining the reliability of human input with the efficiency of automated, dynamic financial modeling.

Key Terms

Ledger

Manual bookkeeping relies on physical ledgers and handwritten entries, increasing the risk of errors and time-consuming reconciliation. Digital twin accounting uses virtual replicas of financial ledgers to provide real-time data accuracy, automated transaction recording, and enhanced audit trails. Discover how digital twin accounting transforms ledger management for efficiency and precision.

Automation

Manual bookkeeping relies heavily on physical records and human data entry, often leading to time-consuming processes and increased risk of errors. Digital twin accounting leverages real-time data integration, automation, and AI-driven analysis to streamline financial monitoring and decision-making. Explore how automation transforms accounting accuracy and efficiency by learning more about digital twin solutions.

Real-time reconciliation

Manual bookkeeping often causes delays and errors in real-time reconciliation due to reliance on physical records and manual data entry. Digital twin accounting leverages real-time data integration, enabling instant updates and accurate financial alignment across multiple systems. Explore how digital twin technology transforms reconciliation speed and accuracy in modern accounting.

Source and External Links

An Easy-to-Use Manual Bookkeeping System - Manual bookkeeping involves organizing income and expenses with folders and paper records, using simple supplies to track paid invoices, checks, deposits, and bank statements without software.

Is Manual Bookkeeping a Thing of the Past? - Manual bookkeeping is a traditional, paper-based method relying on human judgment to record financial transactions using journals and spreadsheets, beneficial for small businesses and offering personal interaction that automation lacks.

The Complete Guide to Manual Bookkeeping - Manual bookkeeping requires entering transaction data from source documents into various physical journals and ledgers, including the General Ledger and General Journal, by hand to keep accurate financial records.

dowidth.com

dowidth.com