Cryptocurrency auditing focuses on verifying blockchain transactions, wallet integrity, and compliance with digital asset regulations, ensuring transparency and security in decentralized finance. Management auditing evaluates internal controls, operational efficiency, and strategic risk management within traditional business operations to enhance organizational performance. Explore the distinct methodologies and tools that differentiate cryptocurrency auditing from management auditing to gain deeper insights.

Why it is important

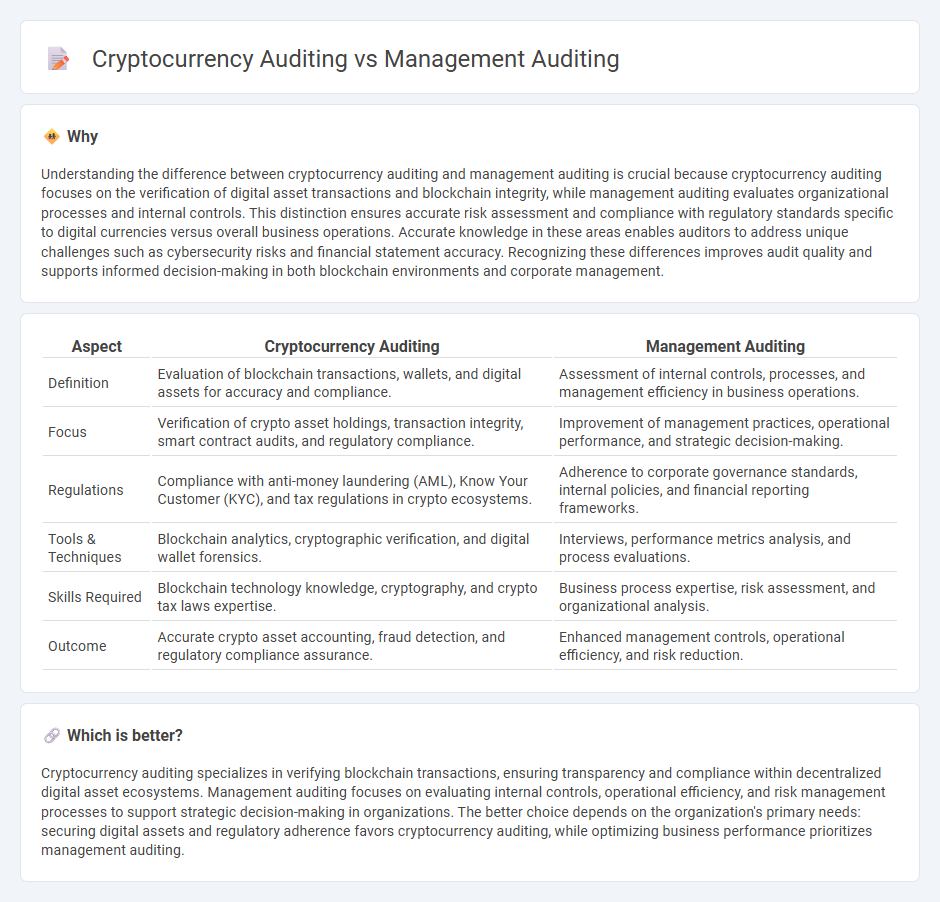

Understanding the difference between cryptocurrency auditing and management auditing is crucial because cryptocurrency auditing focuses on the verification of digital asset transactions and blockchain integrity, while management auditing evaluates organizational processes and internal controls. This distinction ensures accurate risk assessment and compliance with regulatory standards specific to digital currencies versus overall business operations. Accurate knowledge in these areas enables auditors to address unique challenges such as cybersecurity risks and financial statement accuracy. Recognizing these differences improves audit quality and supports informed decision-making in both blockchain environments and corporate management.

Comparison Table

| Aspect | Cryptocurrency Auditing | Management Auditing |

|---|---|---|

| Definition | Evaluation of blockchain transactions, wallets, and digital assets for accuracy and compliance. | Assessment of internal controls, processes, and management efficiency in business operations. |

| Focus | Verification of crypto asset holdings, transaction integrity, smart contract audits, and regulatory compliance. | Improvement of management practices, operational performance, and strategic decision-making. |

| Regulations | Compliance with anti-money laundering (AML), Know Your Customer (KYC), and tax regulations in crypto ecosystems. | Adherence to corporate governance standards, internal policies, and financial reporting frameworks. |

| Tools & Techniques | Blockchain analytics, cryptographic verification, and digital wallet forensics. | Interviews, performance metrics analysis, and process evaluations. |

| Skills Required | Blockchain technology knowledge, cryptography, and crypto tax laws expertise. | Business process expertise, risk assessment, and organizational analysis. |

| Outcome | Accurate crypto asset accounting, fraud detection, and regulatory compliance assurance. | Enhanced management controls, operational efficiency, and risk reduction. |

Which is better?

Cryptocurrency auditing specializes in verifying blockchain transactions, ensuring transparency and compliance within decentralized digital asset ecosystems. Management auditing focuses on evaluating internal controls, operational efficiency, and risk management processes to support strategic decision-making in organizations. The better choice depends on the organization's primary needs: securing digital assets and regulatory adherence favors cryptocurrency auditing, while optimizing business performance prioritizes management auditing.

Connection

Cryptocurrency auditing involves verifying digital asset transactions and ensuring compliance with blockchain protocols, while management auditing evaluates organizational processes and internal controls. Both types of auditing intersect in assessing risk management frameworks and ensuring accurate financial reporting for businesses dealing with digital currencies. Integrating cryptocurrency auditing into management audits enhances transparency and strengthens governance over emerging financial technologies.

Key Terms

**Management Auditing:**

Management auditing evaluates an organization's internal control systems, operational efficiency, and compliance with policies to enhance decision-making and risk management. It systematically reviews financial and operational processes to identify weaknesses, improve accountability, and support strategic objectives. Explore detailed insights into how management auditing drives organizational performance and governance quality.

Internal Controls

Management auditing evaluates the effectiveness of internal controls within an organization's operational processes to ensure compliance, risk management, and financial accuracy. Cryptocurrency auditing focuses specifically on verifying blockchain transactions, security protocols, and smart contract controls to prevent fraud and maintain digital asset integrity. Explore how internal control audits differ in these domains to enhance your understanding of auditing complexities.

Risk Assessment

Management auditing involves evaluating internal controls, financial reporting accuracy, and operational efficiency to identify risks and ensure regulatory compliance. Cryptocurrency auditing emphasizes examining blockchain transactions, smart contract vulnerabilities, and cybersecurity threats to mitigate risks unique to digital assets. Explore detailed methodologies and tools used in both auditing types to enhance risk assessment strategies.

Source and External Links

Management Audit : Meaning, Features, Objectives and Uses - Management audit is a thorough examination of an organisation's managerial actions, policies, and procedures to evaluate the effectiveness and efficiency of management in their responsibilities and to identify improvement areas.

Management auditing - Wikipedia - A management audit is the systematic review of management practices, policies, procedures, and structures to analyze performance and efficiency, focusing on overall management as a team rather than individuals.

What is a Management Audit? (With Uses and Benefits) | Indeed.com - A management audit is a process that assesses the effectiveness of a management team, analyzing processes, leadership strategies, and resource use to help improve organizational goals achievement.

dowidth.com

dowidth.com