Collaborative audit trails enhance transparency by creating a shared ledger that records transactions across multiple parties, improving accuracy and accountability in accounting processes. Real-time transaction monitoring allows continuous oversight, detecting anomalies and irregularities as they occur to prevent fraud and ensure compliance. Explore how integrating these methods can revolutionize financial oversight and risk management.

Why it is important

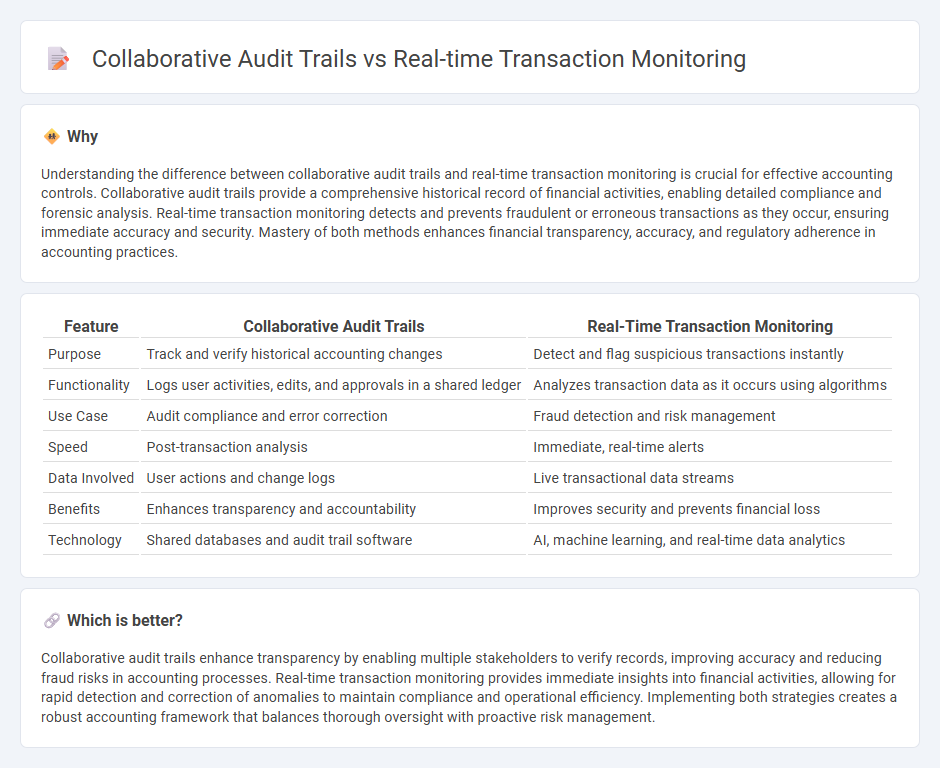

Understanding the difference between collaborative audit trails and real-time transaction monitoring is crucial for effective accounting controls. Collaborative audit trails provide a comprehensive historical record of financial activities, enabling detailed compliance and forensic analysis. Real-time transaction monitoring detects and prevents fraudulent or erroneous transactions as they occur, ensuring immediate accuracy and security. Mastery of both methods enhances financial transparency, accuracy, and regulatory adherence in accounting practices.

Comparison Table

| Feature | Collaborative Audit Trails | Real-Time Transaction Monitoring |

|---|---|---|

| Purpose | Track and verify historical accounting changes | Detect and flag suspicious transactions instantly |

| Functionality | Logs user activities, edits, and approvals in a shared ledger | Analyzes transaction data as it occurs using algorithms |

| Use Case | Audit compliance and error correction | Fraud detection and risk management |

| Speed | Post-transaction analysis | Immediate, real-time alerts |

| Data Involved | User actions and change logs | Live transactional data streams |

| Benefits | Enhances transparency and accountability | Improves security and prevents financial loss |

| Technology | Shared databases and audit trail software | AI, machine learning, and real-time data analytics |

Which is better?

Collaborative audit trails enhance transparency by enabling multiple stakeholders to verify records, improving accuracy and reducing fraud risks in accounting processes. Real-time transaction monitoring provides immediate insights into financial activities, allowing for rapid detection and correction of anomalies to maintain compliance and operational efficiency. Implementing both strategies creates a robust accounting framework that balances thorough oversight with proactive risk management.

Connection

Collaborative audit trails enhance transparency and accuracy by enabling multiple teams to access, review, and verify transaction data simultaneously, which complements real-time transaction monitoring by promptly detecting discrepancies or irregularities. Real-time monitoring systems continuously track financial activities, feeding data into the audit trail to create a dynamic, integrated record that supports timely audits and compliance checks. This synergy strengthens internal controls, reduces fraud risks, and improves the overall reliability of accounting processes.

Key Terms

Data Synchronization

Real-time transaction monitoring continuously captures and analyzes transactions as they occur, ensuring immediate detection of discrepancies for enhanced data synchronization accuracy. Collaborative audit trails integrate inputs from multiple stakeholders to create a unified, transparent record, improving synchronization consistency across distributed systems. Explore how combining both approaches can optimize data synchronization in complex financial environments.

Access Controls

Real-time transaction monitoring enhances access controls by instantly flagging unauthorized activities, reducing fraud risks and ensuring compliance. Collaborative audit trails provide a comprehensive record of access actions, enabling multiple stakeholders to verify and validate user permissions effectively. Explore the best strategies to strengthen access controls through integrated monitoring and audit technologies.

Audit Logging

Real-time transaction monitoring captures and analyzes financial activities instantly to detect suspicious patterns, enhancing fraud prevention in audit logging processes. Collaborative audit trails document multi-user interactions and modifications within systems, ensuring transparency and accountability in compliance audits. Discover how integrating both approaches can strengthen your organization's auditing framework and security posture.

Source and External Links

What is Real-Time Transaction Monitoring: Steps & ... - Real-time transaction monitoring enables financial institutions to quickly identify suspicious transactions by analyzing them as they happen, using pattern recognition, alerts, and even automatic blocking to prevent fraud and ensure regulatory compliance.

Real-Time And Offsite Transaction Monitoring - Real-time transaction monitoring involves analyzing transactions as they occur, using parameters such as transaction amount, origin, type, and timing to detect suspicious activity and prevent processing without review.

What is Transaction Monitoring? - Transaction monitoring continuously analyzes financial transactions by screening against risk criteria and watchlists, scoring risks, detecting anomalies, and generating alerts for compliance review and investigation.

dowidth.com

dowidth.com