Digital asset valuation focuses on determining the market value of assets like cryptocurrencies, non-fungible tokens (NFTs), and digital intellectual property, which often exhibit high volatility and unique ownership characteristics. Intangible asset measurement involves assessing assets such as patents, trademarks, and goodwill using standardized accounting frameworks like IFRS and GAAP to ensure accurate financial reporting. Discover more about the methodologies and challenges involved in these distinct yet interconnected valuation processes.

Why it is important

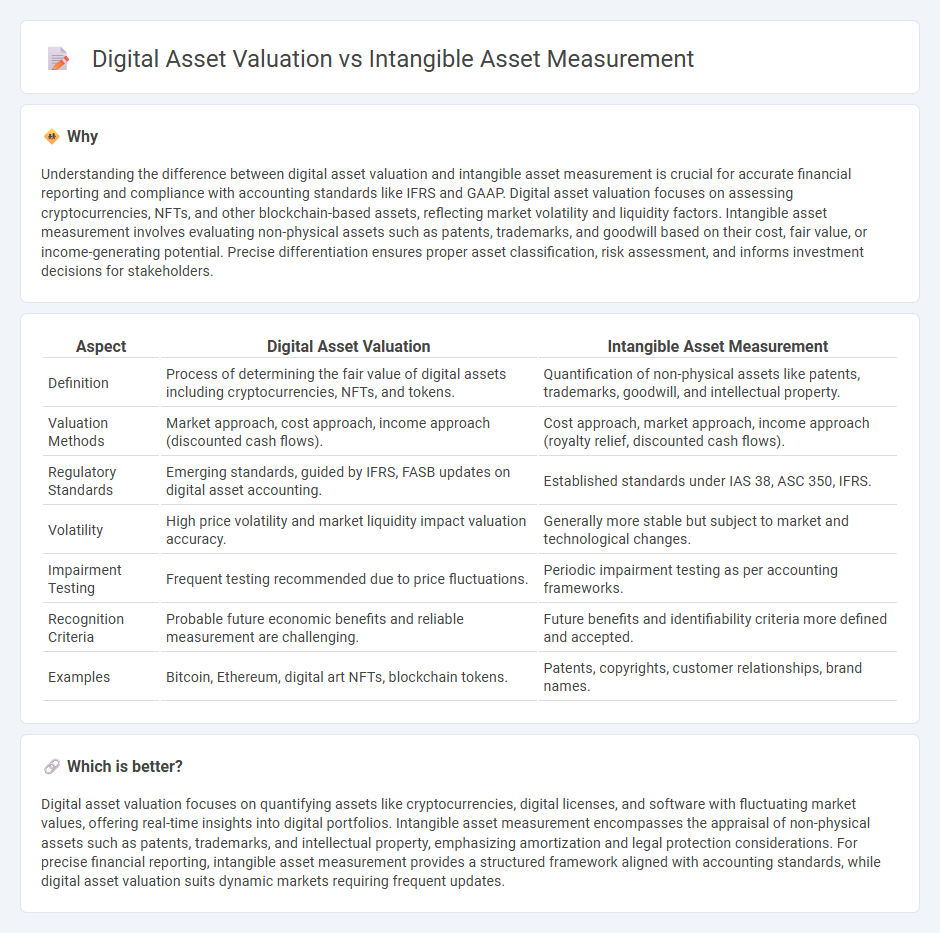

Understanding the difference between digital asset valuation and intangible asset measurement is crucial for accurate financial reporting and compliance with accounting standards like IFRS and GAAP. Digital asset valuation focuses on assessing cryptocurrencies, NFTs, and other blockchain-based assets, reflecting market volatility and liquidity factors. Intangible asset measurement involves evaluating non-physical assets such as patents, trademarks, and goodwill based on their cost, fair value, or income-generating potential. Precise differentiation ensures proper asset classification, risk assessment, and informs investment decisions for stakeholders.

Comparison Table

| Aspect | Digital Asset Valuation | Intangible Asset Measurement |

|---|---|---|

| Definition | Process of determining the fair value of digital assets including cryptocurrencies, NFTs, and tokens. | Quantification of non-physical assets like patents, trademarks, goodwill, and intellectual property. |

| Valuation Methods | Market approach, cost approach, income approach (discounted cash flows). | Cost approach, market approach, income approach (royalty relief, discounted cash flows). |

| Regulatory Standards | Emerging standards, guided by IFRS, FASB updates on digital asset accounting. | Established standards under IAS 38, ASC 350, IFRS. |

| Volatility | High price volatility and market liquidity impact valuation accuracy. | Generally more stable but subject to market and technological changes. |

| Impairment Testing | Frequent testing recommended due to price fluctuations. | Periodic impairment testing as per accounting frameworks. |

| Recognition Criteria | Probable future economic benefits and reliable measurement are challenging. | Future benefits and identifiability criteria more defined and accepted. |

| Examples | Bitcoin, Ethereum, digital art NFTs, blockchain tokens. | Patents, copyrights, customer relationships, brand names. |

Which is better?

Digital asset valuation focuses on quantifying assets like cryptocurrencies, digital licenses, and software with fluctuating market values, offering real-time insights into digital portfolios. Intangible asset measurement encompasses the appraisal of non-physical assets such as patents, trademarks, and intellectual property, emphasizing amortization and legal protection considerations. For precise financial reporting, intangible asset measurement provides a structured framework aligned with accounting standards, while digital asset valuation suits dynamic markets requiring frequent updates.

Connection

Digital asset valuation and intangible asset measurement are interconnected through their reliance on specialized accounting methodologies to assess non-physical assets like patents, trademarks, and cryptocurrencies. Both processes use fair value approaches, discounted cash flow models, and market comparisons to determine accurate financial representations on balance sheets. Accurate measurement of these assets enhances financial transparency, supports regulatory compliance, and informs strategic business decisions.

Key Terms

**Intangible asset measurement:**

Intangible asset measurement involves quantifying non-physical assets such as intellectual property, brand reputation, and patents using methods like cost, market, and income approaches to determine their economic value. Accurate measurement ensures compliance with accounting standards like IFRS and GAAP, supporting financial reporting and strategic decision-making. Explore further to understand how precise intangible asset measurement impacts business valuation and performance.

Fair Value

Fair value measurement for intangible assets involves estimating the exit price in an orderly transaction between market participants, relying on market, income, or cost approaches as prescribed by accounting standards such as IFRS 13 and ASC 820. Digital asset valuation, particularly for cryptocurrencies and NFTs, requires consideration of market volatility, liquidity, and regulatory factors to determine a fair value that accurately reflects current market conditions. Explore the latest methodologies and best practices to enhance your understanding of fair value applications in these asset categories.

Amortization

Intangible asset measurement involves systematic amortization to allocate the cost of assets like patents or trademarks over their useful lives, reflecting their consumption and declining value. Digital asset valuation often considers market-driven factors and may not consistently apply amortization due to fluctuating values in cryptocurrencies or NFTs. Explore the nuanced differences between amortization practices in intangible and digital asset valuation for comprehensive financial insights.

Source and External Links

IAS 38 Intangible Assets - IFRS Foundation - Intangible assets are initially measured at cost, then usually measured at cost less amortization and impairment, with fair value measurement rare and only when an active market exists; finite-lived assets are amortized, indefinite-lived are not but tested annually for impairment.

Intangible Asset - Definition, Formula & Example - Financial Edge - Intangible asset measurement involves reporting assets on the balance sheet, amortizing them over their useful lives, and using impairment testing for indefinite lived assets, with valuation often based on the difference between market value and net tangible assets.

Intangible assets - can't touch this | ACCA Global - Subsequent measurement of intangible assets can follow either the cost model (cost less amortisation and impairment) or the revaluation model (fair value), similar to IAS 16 for property, plant, and equipment.

dowidth.com

dowidth.com