Triple entry accounting integrates cryptographic verification into financial records, enhancing transparency and security beyond traditional double entry methods. Managerial accounting focuses on internal financial analysis, budgeting, and decision-making to optimize organizational performance. Explore further to understand how these distinct accounting systems impact business strategy and reporting accuracy.

Why it is important

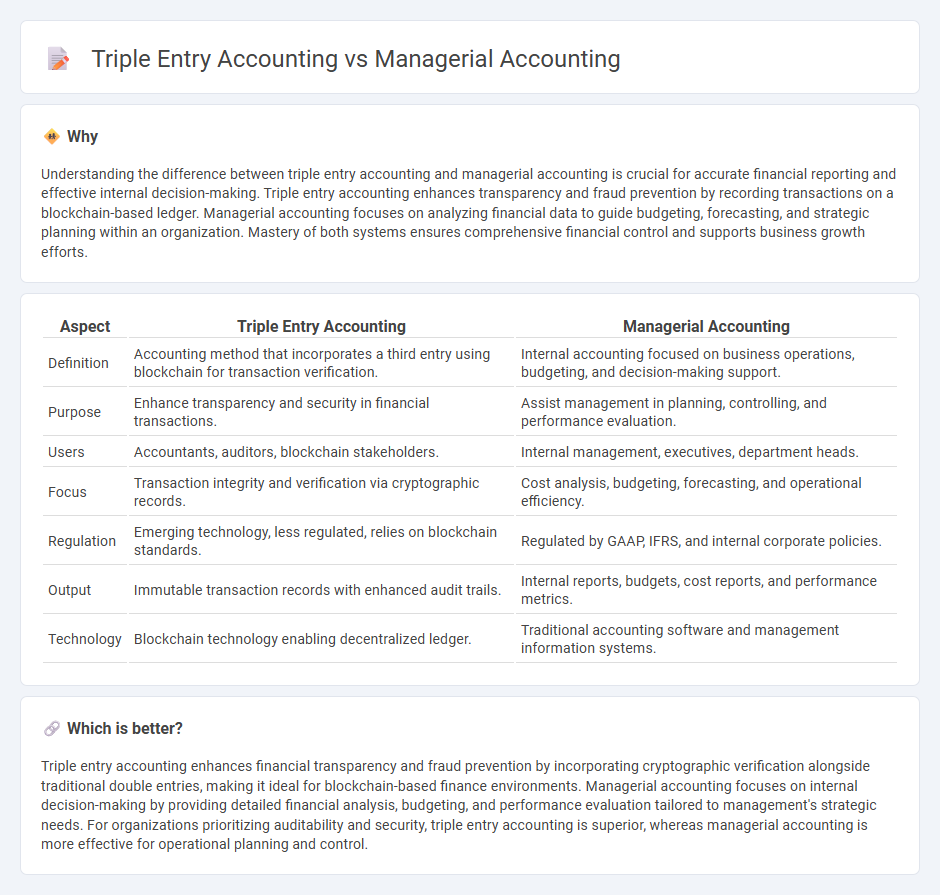

Understanding the difference between triple entry accounting and managerial accounting is crucial for accurate financial reporting and effective internal decision-making. Triple entry accounting enhances transparency and fraud prevention by recording transactions on a blockchain-based ledger. Managerial accounting focuses on analyzing financial data to guide budgeting, forecasting, and strategic planning within an organization. Mastery of both systems ensures comprehensive financial control and supports business growth efforts.

Comparison Table

| Aspect | Triple Entry Accounting | Managerial Accounting |

|---|---|---|

| Definition | Accounting method that incorporates a third entry using blockchain for transaction verification. | Internal accounting focused on business operations, budgeting, and decision-making support. |

| Purpose | Enhance transparency and security in financial transactions. | Assist management in planning, controlling, and performance evaluation. |

| Users | Accountants, auditors, blockchain stakeholders. | Internal management, executives, department heads. |

| Focus | Transaction integrity and verification via cryptographic records. | Cost analysis, budgeting, forecasting, and operational efficiency. |

| Regulation | Emerging technology, less regulated, relies on blockchain standards. | Regulated by GAAP, IFRS, and internal corporate policies. |

| Output | Immutable transaction records with enhanced audit trails. | Internal reports, budgets, cost reports, and performance metrics. |

| Technology | Blockchain technology enabling decentralized ledger. | Traditional accounting software and management information systems. |

Which is better?

Triple entry accounting enhances financial transparency and fraud prevention by incorporating cryptographic verification alongside traditional double entries, making it ideal for blockchain-based finance environments. Managerial accounting focuses on internal decision-making by providing detailed financial analysis, budgeting, and performance evaluation tailored to management's strategic needs. For organizations prioritizing auditability and security, triple entry accounting is superior, whereas managerial accounting is more effective for operational planning and control.

Connection

Triple entry accounting enhances managerial accounting by providing real-time, tamper-proof transaction records through blockchain technology, improving accuracy in financial reporting and decision-making. Managerial accounting leverages these verified entries to analyze cost behavior, budgeting, and performance metrics with greater reliability. This integration supports more effective strategic planning and resource allocation within organizations.

Key Terms

Cost Analysis

Managerial accounting centers on detailed cost analysis to support internal decision-making, budgeting, and performance evaluation, utilizing methods like standard costing and variance analysis to track expenses and optimize resource allocation. Triple entry accounting integrates blockchain technology to enhance transparency and accuracy by recording transactions with an immutable third entry, improving auditability but less focused on granular cost analysis. Explore how combining managerial accounting with triple entry systems can revolutionize cost management and financial reliability.

Blockchain Ledger

Managerial accounting involves internal financial analysis and decision-making, while triple entry accounting integrates blockchain technology to enhance transparency and security by recording transactions with cryptographic verification on a decentralized ledger. The blockchain ledger's immutable and tamper-proof nature significantly reduces fraud risks and improves the reliability of financial records compared to traditional accounting methods. Explore how triple entry accounting is transforming managerial accounting practices in the blockchain era.

Decision Making

Managerial accounting emphasizes internal decision-making by providing detailed financial reports, cost analysis, and budget forecasts to optimize operational efficiency and strategic planning. Triple entry accounting enhances transparency and trust through blockchain technology, enabling real-time verification and immutable financial records that support informed decision-making. Explore how integrating these methods can revolutionize your business insights and decision accuracy.

Source and External Links

Managerial Accounting: Everything You Need To Know - Managerial accounting involves skilled accountants using financial data and analysis to support internal business decision-making, including cost management, budgeting, forecasting, performance metrics, and capital investment decisions to direct a company toward its financial goals.

Managerial Accounting Made Easy - NetSuite - Managerial accounting is focused on providing relevant financial information to support company decisions through planning, controlling, problem-solving strategies, and evaluating performance, often involving "what-if" scenarios and segment analysis for internal management.

What Is Managerial Accounting | Salesforce ANZ - Managerial accounting helps managers understand financial performance through detailed reports, budgets, and cost analysis to facilitate planning, budgeting, risk management, and opportunity identification, enabling smarter resource allocation and strategic decision-making.

dowidth.com

dowidth.com