Ledger tokenization transforms traditional financial records into secure digital assets, enabling transparent and immutable transaction history management within blockchain environments. Stablecoins maintain price stability by pegging digital currency value to assets like fiat currencies, facilitating reliable and low-volatility digital payments. Explore the distinct roles and advantages of ledger tokenization and stablecoins in modern accounting systems.

Why it is important

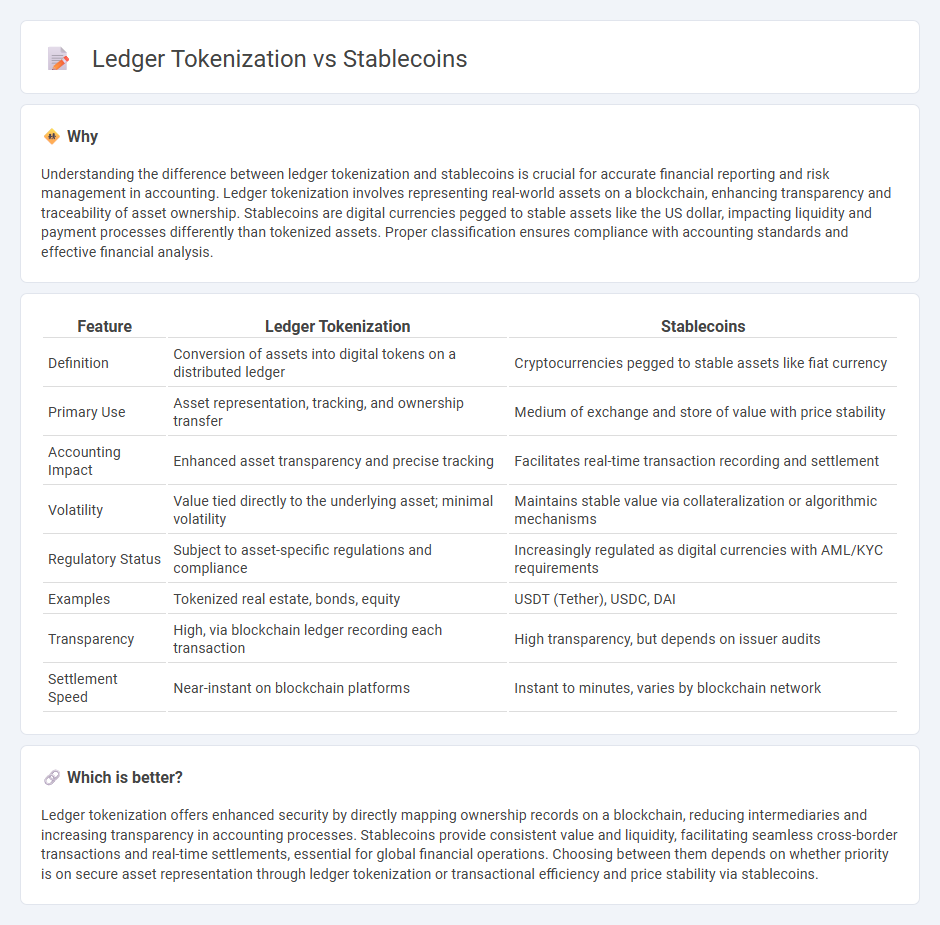

Understanding the difference between ledger tokenization and stablecoins is crucial for accurate financial reporting and risk management in accounting. Ledger tokenization involves representing real-world assets on a blockchain, enhancing transparency and traceability of asset ownership. Stablecoins are digital currencies pegged to stable assets like the US dollar, impacting liquidity and payment processes differently than tokenized assets. Proper classification ensures compliance with accounting standards and effective financial analysis.

Comparison Table

| Feature | Ledger Tokenization | Stablecoins |

|---|---|---|

| Definition | Conversion of assets into digital tokens on a distributed ledger | Cryptocurrencies pegged to stable assets like fiat currency |

| Primary Use | Asset representation, tracking, and ownership transfer | Medium of exchange and store of value with price stability |

| Accounting Impact | Enhanced asset transparency and precise tracking | Facilitates real-time transaction recording and settlement |

| Volatility | Value tied directly to the underlying asset; minimal volatility | Maintains stable value via collateralization or algorithmic mechanisms |

| Regulatory Status | Subject to asset-specific regulations and compliance | Increasingly regulated as digital currencies with AML/KYC requirements |

| Examples | Tokenized real estate, bonds, equity | USDT (Tether), USDC, DAI |

| Transparency | High, via blockchain ledger recording each transaction | High transparency, but depends on issuer audits |

| Settlement Speed | Near-instant on blockchain platforms | Instant to minutes, varies by blockchain network |

Which is better?

Ledger tokenization offers enhanced security by directly mapping ownership records on a blockchain, reducing intermediaries and increasing transparency in accounting processes. Stablecoins provide consistent value and liquidity, facilitating seamless cross-border transactions and real-time settlements, essential for global financial operations. Choosing between them depends on whether priority is on secure asset representation through ledger tokenization or transactional efficiency and price stability via stablecoins.

Connection

Ledger tokenization enhances accounting accuracy by transforming traditional transaction records into secure, immutable digital tokens on a blockchain, facilitating transparent and tamper-proof financial data management. Stablecoins provide a consistent valuation benchmark for these tokens, minimizing volatility risks in accounting processes and ensuring reliable financial reporting. The integration of ledger tokenization with stablecoins streamlines audit trails and improves compliance by enabling real-time verification of assets and liabilities.

Key Terms

Valuation

Stablecoins maintain value by pegging to fiat currencies, ensuring minimal price volatility and facilitating reliable transactions. Ledger tokenization represents assets digitally on a blockchain, offering fractional ownership and enhanced liquidity while subject to market-driven valuation fluctuations. Explore further to understand how each approach impacts asset valuation and investment strategies.

Auditing

Stablecoins offer transparent transaction records on public blockchains, facilitating straightforward auditing processes through immutable ledger data and automated smart contract verifications. Ledger tokenization, while enabling asset digitization and fractional ownership, requires enhanced audit trails and compliance controls to ensure accurate recording and regulatory adherence across private or consortium blockchains. Explore deeper insights into auditing standards and best practices for stablecoins and ledger tokenization frameworks.

Compliance

Stablecoins provide a compliant digital asset solution by maintaining price stability and adhering to regulatory standards such as KYC and AML protocols in jurisdictions like the US and EU. Ledger tokenization enhances compliance by enabling secure, transparent, and auditable asset representation on blockchain platforms, ensuring regulatory alignment with securities laws and data privacy requirements. Explore our detailed analysis to understand how compliance frameworks shape the future of digital asset innovation.

Source and External Links

What is a stablecoin? - Coinbase Learn - Stablecoins are cryptocurrencies whose value is pegged to another asset, like a fiat currency or gold, to provide a stable alternative to the volatility of typical cryptocurrencies like Bitcoin.

What are stablecoins, and how are they regulated? - Brookings Institution - Stablecoins are digital tokens whose value is tied to a reference asset such as the U.S. dollar, and they operate on decentralized blockchains where transactions are verified by network participants, not a central authority.

What Are Stablecoins and How Do They Work? - Gemini Cryptopedia - Algorithmic stablecoins use smart contracts and algorithms instead of collateral to maintain price stability, balancing token supply in response to market demand.

dowidth.com

dowidth.com