Environmental Social Governance (ESG) accounting focuses on measuring a company's sustainability and ethical impact through standardized criteria, emphasizing transparency and regulatory compliance. Impact accounting goes further by quantifying the direct social and environmental outcomes of business activities, aiming to reflect true value creation beyond financial performance. Discover how these accounting methodologies shape responsible business practices and stakeholder engagement.

Why it is important

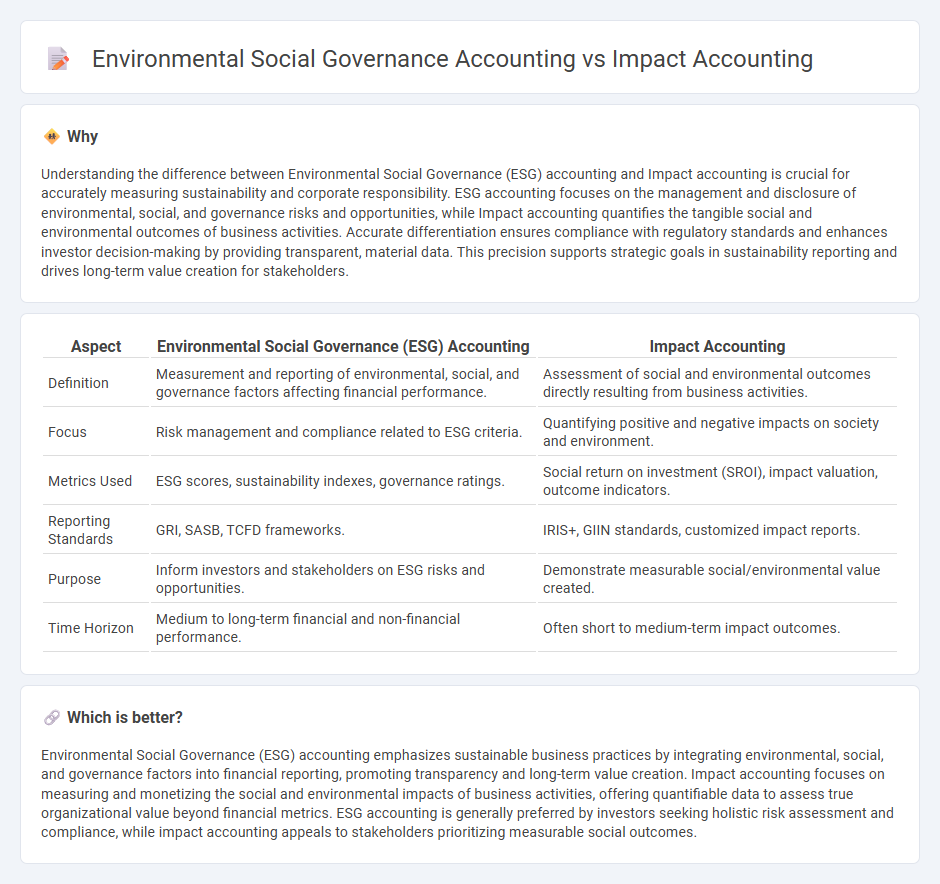

Understanding the difference between Environmental Social Governance (ESG) accounting and Impact accounting is crucial for accurately measuring sustainability and corporate responsibility. ESG accounting focuses on the management and disclosure of environmental, social, and governance risks and opportunities, while Impact accounting quantifies the tangible social and environmental outcomes of business activities. Accurate differentiation ensures compliance with regulatory standards and enhances investor decision-making by providing transparent, material data. This precision supports strategic goals in sustainability reporting and drives long-term value creation for stakeholders.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Impact Accounting |

|---|---|---|

| Definition | Measurement and reporting of environmental, social, and governance factors affecting financial performance. | Assessment of social and environmental outcomes directly resulting from business activities. |

| Focus | Risk management and compliance related to ESG criteria. | Quantifying positive and negative impacts on society and environment. |

| Metrics Used | ESG scores, sustainability indexes, governance ratings. | Social return on investment (SROI), impact valuation, outcome indicators. |

| Reporting Standards | GRI, SASB, TCFD frameworks. | IRIS+, GIIN standards, customized impact reports. |

| Purpose | Inform investors and stakeholders on ESG risks and opportunities. | Demonstrate measurable social/environmental value created. |

| Time Horizon | Medium to long-term financial and non-financial performance. | Often short to medium-term impact outcomes. |

Which is better?

Environmental Social Governance (ESG) accounting emphasizes sustainable business practices by integrating environmental, social, and governance factors into financial reporting, promoting transparency and long-term value creation. Impact accounting focuses on measuring and monetizing the social and environmental impacts of business activities, offering quantifiable data to assess true organizational value beyond financial metrics. ESG accounting is generally preferred by investors seeking holistic risk assessment and compliance, while impact accounting appeals to stakeholders prioritizing measurable social outcomes.

Connection

Environmental Social Governance (ESG) accounting integrates sustainability metrics into financial reporting, emphasizing a company's environmental impact, social responsibility, and governance practices. Impact accounting quantifies the tangible and intangible effects of business activities on society and the environment, aligning closely with ESG principles by providing measurable data for stakeholders. Both frameworks drive transparency and accountability, enabling investors to assess long-term value creation beyond traditional financial performance.

Key Terms

Materiality

Impact accounting emphasizes quantifying specific social and environmental outcomes to measure true value creation, focusing on material impacts that directly affect stakeholders and communities. Environmental, Social, and Governance (ESG) accounting prioritizes materiality from a financial risk perspective, integrating key environmental and social factors that influence corporate performance and investor decisions. Explore how materiality shapes reporting frameworks and drives strategic business insights.

Double materiality

Impact accounting measures an organization's direct environmental and social effects, emphasizing quantifiable outcomes such as carbon emissions and social impact metrics. Environmental, Social, and Governance (ESG) accounting incorporates double materiality by assessing both the financial materiality of sustainability factors to the company and the company's impact on society and environment, reflecting reciprocal influences. Explore how double materiality transforms corporate responsibility and investment strategies by delving deeper into these accounting frameworks.

Stakeholder engagement

Impact accounting emphasizes measuring and managing the quantifiable social and environmental effects of business activities, integrating stakeholder feedback to align company goals with community and environmental well-being. Environmental Social Governance (ESG) accounting prioritizes transparency in corporate governance and ethical practices, with stakeholder engagement focusing on meeting investor, regulatory, and societal expectations related to sustainability criteria. Explore how these approaches shape stakeholder relations and accountability in corporate sustainability frameworks.

Source and External Links

Measuring What Matters: How Impact Accounting Redefines Sustainability Measurement - Impact accounting is a system that measures and values the impacts of corporate entities, generating impact information to inform sustainability-related decisions.

The Case for Impact Accounting - Impact accounting translates social and environmental impacts into monetary terms, making them comparable and decision-useful for businesses and investors.

Emergence of Impact Accounting - Impact accounting is an emerging discipline that applies monetary values to environmental, social, and human capital, enhancing ESG reporting through standardized principles.

dowidth.com

dowidth.com