Environmental, Social, and Governance (ESG) integration in accounting emphasizes non-financial factors such as sustainability, ethical practices, and corporate social responsibility, alongside traditional financial metrics. Traditional financial accounting primarily focuses on quantifying and reporting financial performance through standardized measures like revenue, expenses, and profits. Discover how incorporating ESG criteria transforms decision-making and reporting in modern accounting frameworks.

Why it is important

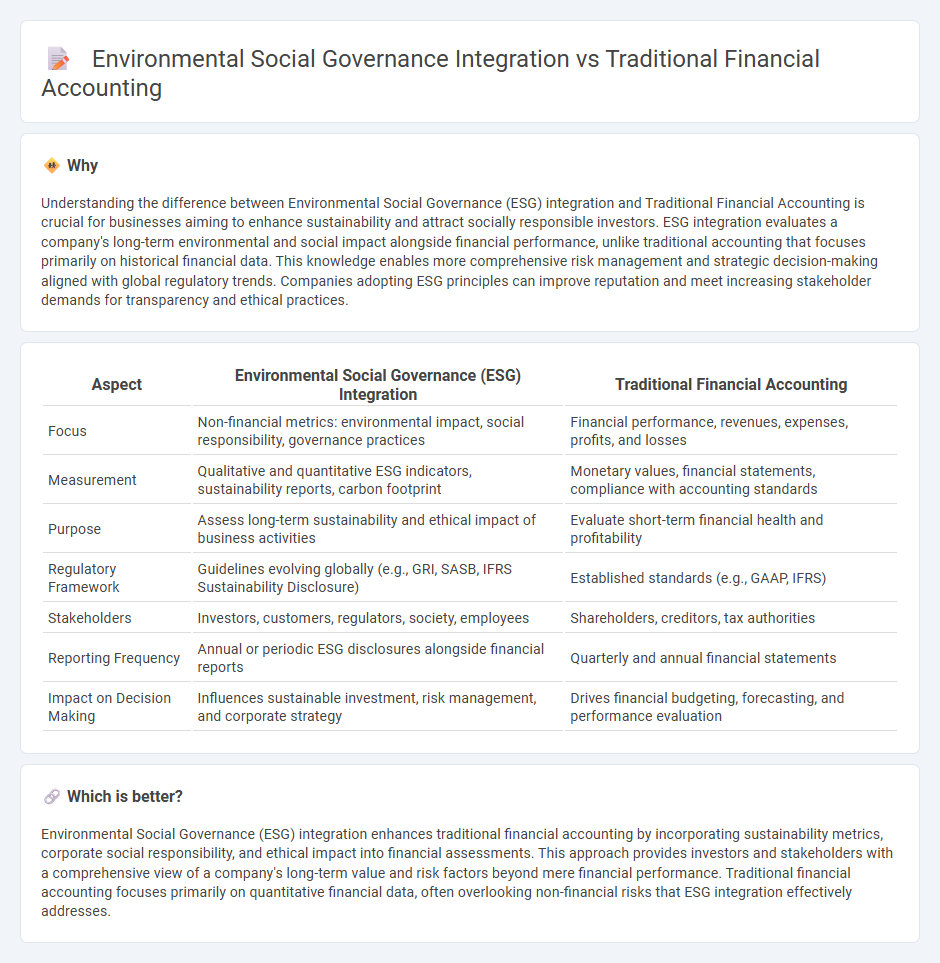

Understanding the difference between Environmental Social Governance (ESG) integration and Traditional Financial Accounting is crucial for businesses aiming to enhance sustainability and attract socially responsible investors. ESG integration evaluates a company's long-term environmental and social impact alongside financial performance, unlike traditional accounting that focuses primarily on historical financial data. This knowledge enables more comprehensive risk management and strategic decision-making aligned with global regulatory trends. Companies adopting ESG principles can improve reputation and meet increasing stakeholder demands for transparency and ethical practices.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Integration | Traditional Financial Accounting |

|---|---|---|

| Focus | Non-financial metrics: environmental impact, social responsibility, governance practices | Financial performance, revenues, expenses, profits, and losses |

| Measurement | Qualitative and quantitative ESG indicators, sustainability reports, carbon footprint | Monetary values, financial statements, compliance with accounting standards |

| Purpose | Assess long-term sustainability and ethical impact of business activities | Evaluate short-term financial health and profitability |

| Regulatory Framework | Guidelines evolving globally (e.g., GRI, SASB, IFRS Sustainability Disclosure) | Established standards (e.g., GAAP, IFRS) |

| Stakeholders | Investors, customers, regulators, society, employees | Shareholders, creditors, tax authorities |

| Reporting Frequency | Annual or periodic ESG disclosures alongside financial reports | Quarterly and annual financial statements |

| Impact on Decision Making | Influences sustainable investment, risk management, and corporate strategy | Drives financial budgeting, forecasting, and performance evaluation |

Which is better?

Environmental Social Governance (ESG) integration enhances traditional financial accounting by incorporating sustainability metrics, corporate social responsibility, and ethical impact into financial assessments. This approach provides investors and stakeholders with a comprehensive view of a company's long-term value and risk factors beyond mere financial performance. Traditional financial accounting focuses primarily on quantitative financial data, often overlooking non-financial risks that ESG integration effectively addresses.

Connection

Environmental, Social, and Governance (ESG) integration enhances traditional financial accounting by incorporating non-financial metrics such as carbon emissions, labor practices, and board diversity into financial analysis. This connection promotes comprehensive risk assessment and long-term value creation by aligning sustainability factors with financial performance indicators. Companies adopting ESG frameworks often improve transparency and accountability, which supports more accurate and impactful financial reporting.

Key Terms

Financial Statements

Traditional financial accounting emphasizes historical financial data in financial statements, primarily focusing on balance sheets, income statements, and cash flow statements to assess company performance. Environmental, Social, and Governance (ESG) integration incorporates non-financial metrics into financial reports, highlighting sustainability risks and social responsibility, which are increasingly recognized by investors and regulators. Explore how evolving frameworks reshape financial transparency to better align with ESG principles.

ESG Reporting

Environmental Social Governance (ESG) reporting integrates sustainability metrics with traditional financial accounting, emphasizing environmental impact, social responsibility, and corporate governance alongside financial performance. This approach requires companies to disclose non-financial data, such as carbon emissions, labor practices, and board diversity, improving transparency and stakeholder trust. Explore how ESG reporting transforms corporate accountability and investment decisions to enhance sustainable business practices.

Double Materiality

Traditional financial accounting prioritizes financial performance metrics for investors, often overlooking environmental and social impacts. Environmental, Social, and Governance (ESG) integration emphasizes Double Materiality by assessing both financial risks and the broader societal and environmental effects of business activities. Explore how Double Materiality reshapes reporting standards and drives corporate sustainability strategies.

Source and External Links

Cash Basis vs Traditional Accounting for Inventory - Traditional (accrual) accounting records income when it is earned and expenses when they are incurred, regardless of when cash is exchanged, to provide a more accurate picture of a business's financial position.

The Pros and Cons of Traditional vs. Digital Accounting for Event Companies - Traditional accounting relies on physical ledgers and manual double-entry bookkeeping to record, summarize, and report financial transactions, rather than using automated digital systems.

What is Traditional accounting? - Traditional accounting, also called accrual basis accounting, calculates profits based on invoiced income and expenses rather than actual cash receipts and payments.

dowidth.com

dowidth.com