Tokenized assets accounting involves recording digital representations of ownership on a blockchain, emphasizing transparency and real-time valuation, while lease accounting focuses on the identification, classification, and measurement of lease contracts under standards like IFRS 16 or ASC 842. Tokenized assets require recognition of intangible digital rights and compliance with emerging regulatory frameworks, contrasting with lease accounting's systematic expense recognition and balance sheet presentation of lease liabilities and right-of-use assets. Explore further to understand how these accounting paradigms shape financial reporting in evolving digital and contractual environments.

Why it is important

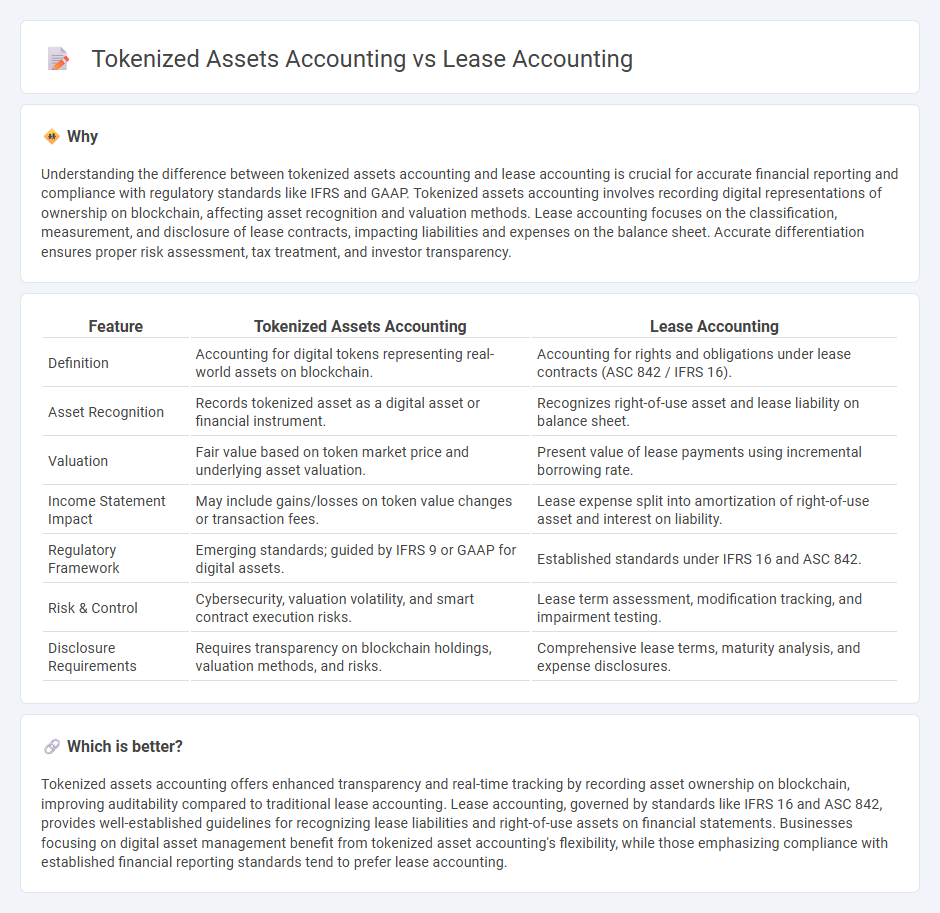

Understanding the difference between tokenized assets accounting and lease accounting is crucial for accurate financial reporting and compliance with regulatory standards like IFRS and GAAP. Tokenized assets accounting involves recording digital representations of ownership on blockchain, affecting asset recognition and valuation methods. Lease accounting focuses on the classification, measurement, and disclosure of lease contracts, impacting liabilities and expenses on the balance sheet. Accurate differentiation ensures proper risk assessment, tax treatment, and investor transparency.

Comparison Table

| Feature | Tokenized Assets Accounting | Lease Accounting |

|---|---|---|

| Definition | Accounting for digital tokens representing real-world assets on blockchain. | Accounting for rights and obligations under lease contracts (ASC 842 / IFRS 16). |

| Asset Recognition | Records tokenized asset as a digital asset or financial instrument. | Recognizes right-of-use asset and lease liability on balance sheet. |

| Valuation | Fair value based on token market price and underlying asset valuation. | Present value of lease payments using incremental borrowing rate. |

| Income Statement Impact | May include gains/losses on token value changes or transaction fees. | Lease expense split into amortization of right-of-use asset and interest on liability. |

| Regulatory Framework | Emerging standards; guided by IFRS 9 or GAAP for digital assets. | Established standards under IFRS 16 and ASC 842. |

| Risk & Control | Cybersecurity, valuation volatility, and smart contract execution risks. | Lease term assessment, modification tracking, and impairment testing. |

| Disclosure Requirements | Requires transparency on blockchain holdings, valuation methods, and risks. | Comprehensive lease terms, maturity analysis, and expense disclosures. |

Which is better?

Tokenized assets accounting offers enhanced transparency and real-time tracking by recording asset ownership on blockchain, improving auditability compared to traditional lease accounting. Lease accounting, governed by standards like IFRS 16 and ASC 842, provides well-established guidelines for recognizing lease liabilities and right-of-use assets on financial statements. Businesses focusing on digital asset management benefit from tokenized asset accounting's flexibility, while those emphasizing compliance with established financial reporting standards tend to prefer lease accounting.

Connection

Tokenized assets accounting and lease accounting intersect through the application of blockchain technology in recording lease agreements as digital tokens, enhancing transparency and traceability. Both frameworks require precise recognition of rights and obligations, with tokenized representations enabling real-time verification of lease liabilities and asset ownership. This integration streamlines compliance with accounting standards such as IFRS 16 and ASC 842 by automating lease payments and asset depreciation schedules on distributed ledgers.

Key Terms

Right-of-Use Asset (Lease)

Right-of-use (ROU) assets in lease accounting represent a lessee's right to use an underlying asset over the lease term, requiring recognition on the balance sheet per IFRS 16 and ASC 842 standards. Tokenized assets accounting involves digitizing asset rights on a blockchain, enhancing transparency and liquidity but lacking standardized treatment for ROU assets compared to traditional lease accounting frameworks. Explore the evolving intersection of lease accounting and tokenized asset management to understand the future of asset recognition and financial reporting.

Token Valuation (Tokenized Assets)

Token valuation in tokenized assets accounting relies heavily on blockchain-based transparency, real-time market data, and decentralized appraisal methods to determine asset worth, contrasting with lease accounting's use of fixed schedules and historical cost metrics. Unlike lease accounting, which follows ASC 842 or IFRS 16 standards, tokenized asset valuation requires integrating smart contract data and fluctuating token prices to reflect market dynamics accurately. Explore deeper insights into how token valuation transforms asset management and financial reporting in emerging digital economies.

Lease Liability (Lease)

Lease accounting requires recognizing lease liability based on the present value of lease payments, reflecting contractual obligations under ASC 842 or IFRS 16 standards. Tokenized assets accounting for lease liabilities incorporates blockchain records and smart contracts to automate tracking and valuation, enhancing transparency and real-time updates. Explore the evolving landscape of lease liability treatment to understand how combined technologies improve accuracy and compliance.

Source and External Links

Lease Accounting Explained - Corporate Finance Institute - Lease accounting requires companies to recognize lease obligations on the balance sheet, improving transparency by recording most leases as finance-type leases under IFRS and US GAAP, replacing prior off-balance-sheet reporting practices.

What Is Lease Accounting & Why Is It Important? - Accruent - Lease accounting rules like ASC 842 require lessees to record both operating and finance leases on the balance sheet as an asset and corresponding liability, aiming for clearer financial representation of lease commitments.

Lease Accounting Explained: New Standards, Lessee/Lessor & More - Under new standards, lessees calculate the present value of future lease payments to record a lease liability and right-of-use asset, requiring detailed amortization schedules to ensure accurate financial reporting of lease obligations.

dowidth.com

dowidth.com