Forensic accounting software specializes in detecting financial fraud, analyzing legal cases, and supporting litigation with detailed audit trails and investigative tools. Management accounting software focuses on budgeting, forecasting, and performance analysis to aid strategic business decision-making and operational efficiency. Explore the key features and benefits of both software types to determine the best solution for your accounting needs.

Why it is important

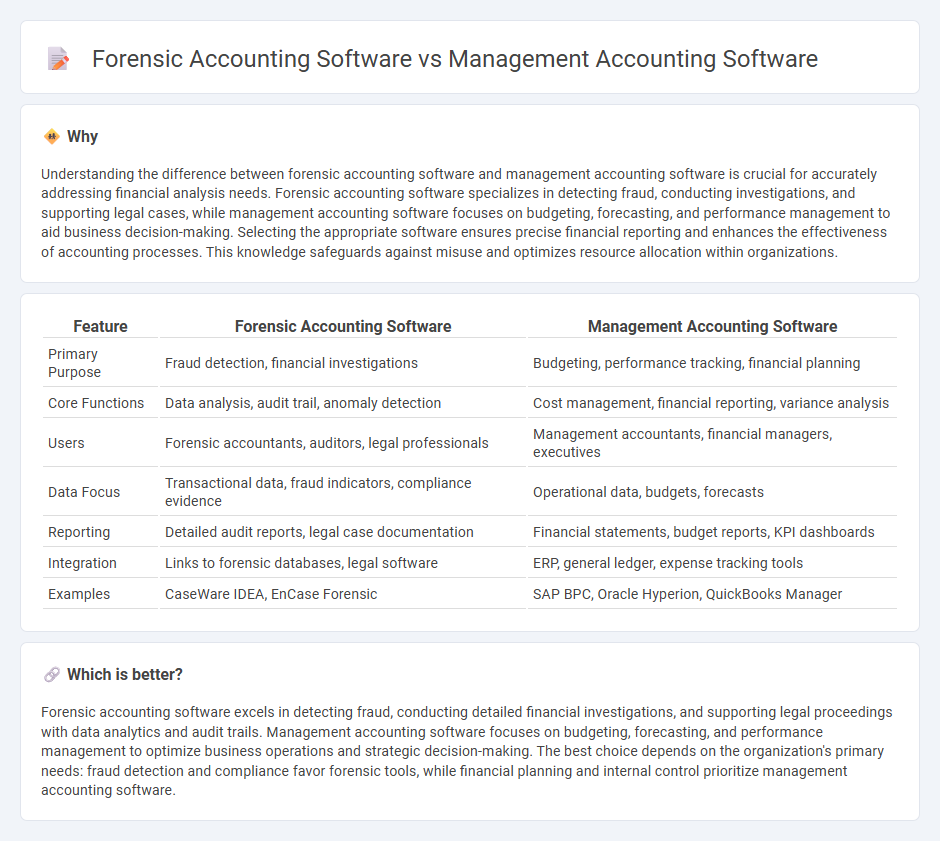

Understanding the difference between forensic accounting software and management accounting software is crucial for accurately addressing financial analysis needs. Forensic accounting software specializes in detecting fraud, conducting investigations, and supporting legal cases, while management accounting software focuses on budgeting, forecasting, and performance management to aid business decision-making. Selecting the appropriate software ensures precise financial reporting and enhances the effectiveness of accounting processes. This knowledge safeguards against misuse and optimizes resource allocation within organizations.

Comparison Table

| Feature | Forensic Accounting Software | Management Accounting Software |

|---|---|---|

| Primary Purpose | Fraud detection, financial investigations | Budgeting, performance tracking, financial planning |

| Core Functions | Data analysis, audit trail, anomaly detection | Cost management, financial reporting, variance analysis |

| Users | Forensic accountants, auditors, legal professionals | Management accountants, financial managers, executives |

| Data Focus | Transactional data, fraud indicators, compliance evidence | Operational data, budgets, forecasts |

| Reporting | Detailed audit reports, legal case documentation | Financial statements, budget reports, KPI dashboards |

| Integration | Links to forensic databases, legal software | ERP, general ledger, expense tracking tools |

| Examples | CaseWare IDEA, EnCase Forensic | SAP BPC, Oracle Hyperion, QuickBooks Manager |

Which is better?

Forensic accounting software excels in detecting fraud, conducting detailed financial investigations, and supporting legal proceedings with data analytics and audit trails. Management accounting software focuses on budgeting, forecasting, and performance management to optimize business operations and strategic decision-making. The best choice depends on the organization's primary needs: fraud detection and compliance favor forensic tools, while financial planning and internal control prioritize management accounting software.

Connection

Forensic accounting software and management accounting software intersect by enhancing financial analysis accuracy and fraud detection within organizations, enabling comprehensive oversight of financial transactions. Forensic accounting tools specialize in identifying discrepancies and irregularities through data mining and pattern recognition, while management accounting software focuses on budgeting, cost control, and performance evaluation, providing actionable insights for strategic decision-making. Their integration strengthens financial integrity and risk management by combining investigative capabilities with real-time financial planning and reporting.

Key Terms

Budgeting

Management accounting software excels in budgeting by offering real-time cost tracking, variance analysis, and detailed financial forecasting tools that help businesses plan and control expenses effectively. Forensic accounting software, while less focused on budgeting, provides specialized functions for detecting fraud and analyzing financial discrepancies through data mining and audit trail features. Explore further to understand how each software type can optimize your organization's budgeting strategies and financial oversight.

Fraud detection

Management accounting software primarily streamlines financial reporting and budgeting, whereas forensic accounting software specializes in detecting and investigating fraud through transaction analysis and anomaly detection algorithms. Forensic tools leverage advanced data mining, pattern recognition, and audit trail tracking to identify fraudulent activities that traditional management systems may overlook. Explore key features and benefits of forensic accounting software to enhance your fraud detection capabilities.

Reporting

Management accounting software offers robust reporting tools designed for internal budgeting, cost analysis, and performance measurement, enabling real-time financial insights tailored to organizational decision-making. Forensic accounting software specializes in detailed, audit-focused reporting that tracks financial discrepancies, fraud detection, and legal compliance documentation essential for investigations and litigation support. Explore the differences and benefits of each software to optimize your financial reporting needs.

Source and External Links

Sage Accounting Software - Offers a range of accounting solutions from simple tools for small businesses to more advanced ERP systems for larger enterprises, designed to streamline financial management across all business sizes.

Karbon Practice Management Software - Provides a comprehensive platform for accounting firms to manage client relationships, automate workflows, and enhance team collaboration, while driving profitability and efficiency.

Brightpearl Accounting and Inventory Software - Combines real-time accounting with robust inventory management, offering seamless integration with leading accounting systems and sales channels, ideal for retail and wholesale sectors.

dowidth.com

dowidth.com