Digital asset valuation requires precise methods to assess cryptocurrencies and token-based holdings, reflecting real-time market prices and regulatory compliance. Lease accounting focuses on recognizing lease liabilities and right-of-use assets under standards like IFRS 16 or ASC 842, ensuring accurate financial reporting for leased properties and equipment. Explore the distinctions and implications of these accounting practices to enhance financial accuracy and decision-making.

Why it is important

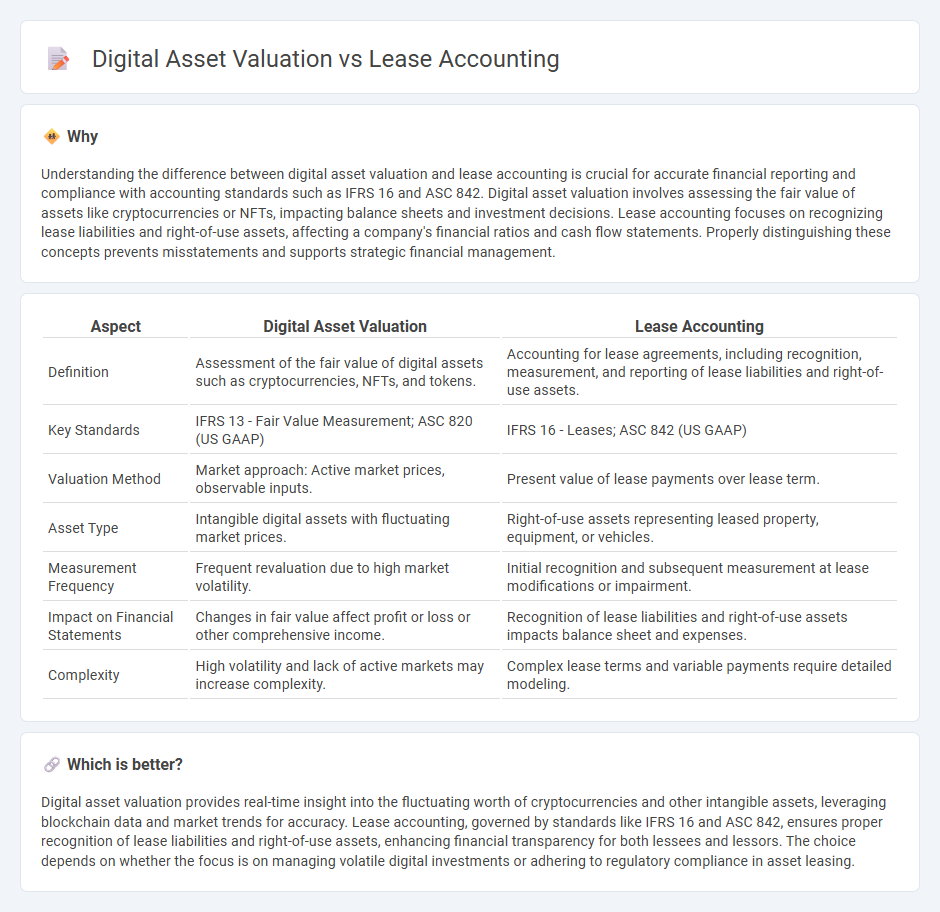

Understanding the difference between digital asset valuation and lease accounting is crucial for accurate financial reporting and compliance with accounting standards such as IFRS 16 and ASC 842. Digital asset valuation involves assessing the fair value of assets like cryptocurrencies or NFTs, impacting balance sheets and investment decisions. Lease accounting focuses on recognizing lease liabilities and right-of-use assets, affecting a company's financial ratios and cash flow statements. Properly distinguishing these concepts prevents misstatements and supports strategic financial management.

Comparison Table

| Aspect | Digital Asset Valuation | Lease Accounting |

|---|---|---|

| Definition | Assessment of the fair value of digital assets such as cryptocurrencies, NFTs, and tokens. | Accounting for lease agreements, including recognition, measurement, and reporting of lease liabilities and right-of-use assets. |

| Key Standards | IFRS 13 - Fair Value Measurement; ASC 820 (US GAAP) | IFRS 16 - Leases; ASC 842 (US GAAP) |

| Valuation Method | Market approach: Active market prices, observable inputs. | Present value of lease payments over lease term. |

| Asset Type | Intangible digital assets with fluctuating market prices. | Right-of-use assets representing leased property, equipment, or vehicles. |

| Measurement Frequency | Frequent revaluation due to high market volatility. | Initial recognition and subsequent measurement at lease modifications or impairment. |

| Impact on Financial Statements | Changes in fair value affect profit or loss or other comprehensive income. | Recognition of lease liabilities and right-of-use assets impacts balance sheet and expenses. |

| Complexity | High volatility and lack of active markets may increase complexity. | Complex lease terms and variable payments require detailed modeling. |

Which is better?

Digital asset valuation provides real-time insight into the fluctuating worth of cryptocurrencies and other intangible assets, leveraging blockchain data and market trends for accuracy. Lease accounting, governed by standards like IFRS 16 and ASC 842, ensures proper recognition of lease liabilities and right-of-use assets, enhancing financial transparency for both lessees and lessors. The choice depends on whether the focus is on managing volatile digital investments or adhering to regulatory compliance in asset leasing.

Connection

Digital asset valuation directly impacts lease accounting by determining the fair value of digital assets used as underlying lease components, affecting lease liabilities and right-of-use assets on the balance sheet. Accurate valuation methodologies ensure compliance with accounting standards such as IFRS 16 and ASC 842, which require precise measurement of lease-related digital assets. Integrating digital asset valuation with lease accounting enhances financial statement transparency and supports informed decision-making in asset management.

Key Terms

Right-of-Use Asset

Lease accounting requires recognizing the Right-of-Use (ROU) asset on the balance sheet, reflecting the lessee's control over the leased asset during the lease term according to IFRS 16 and ASC 842 standards. Digital asset valuation involves assessing intangible assets like cryptocurrencies or NFTs, where the concept of ROU assets is not applicable, focusing instead on market value and volatility. Explore the detailed differences in methodologies and reporting requirements to better understand their impact on financial statements.

Fair Value Measurement

Lease accounting under ASC 842 and IFRS 16 requires fair value measurement of lease liabilities and right-of-use assets, emphasizing present value calculations based on lease terms and discount rates. Digital asset valuation involves fair value assessments using market data, including transaction prices, bid-ask spreads, and underlying technology risk factors, often governed by ASC 820 or IFRS 13 standards. Explore deeper insights into the nuances of fair value measurement across these domains to enhance financial reporting accuracy.

Amortization

In lease accounting, amortization refers to the systematic allocation of lease liabilities and right-of-use assets over the lease term, impacting financial statements and tax reports. Digital asset valuation amortization involves spreading the cost of intangible assets like software or blockchain tokens over their useful life, affecting balance sheets and earnings. Explore detailed methodologies and regulatory impacts to better understand amortization differences in these fields.

Source and External Links

Lease Accounting Explained - This guide covers the basics of lease accounting according to IFRS and US GAAP, focusing on the distinction and reporting requirements for leases.

What Is Lease Accounting & Why Is It Important? - This overview explains the importance of lease accounting, highlighting how it provides transparency by requiring lessees to recognize both operating and finance leases on the balance sheet.

Lease Accounting Explained: New Standards, Lessee/Lessor & More - This article discusses lease accounting as a process to record the financial impact of leases, emphasizing the need for complex calculations like present value of lease payments.

dowidth.com

dowidth.com