ESG reporting focuses on environmental, social, and governance metrics to provide transparency on a company's sustainability and ethical impact, aligning with stakeholder and regulatory expectations. Management reporting emphasizes internal financial and operational data to support decision-making, performance evaluation, and strategic planning within the organization. Explore the distinctions between ESG and management reporting to understand their unique roles in modern accounting practices.

Why it is important

Understanding the difference between ESG reporting and management reporting is crucial because ESG reporting focuses on environmental, social, and governance metrics that impact long-term sustainability and investor relations, while management reporting centers on financial performance and operational insights for internal decision-making. ESG reports help companies comply with regulatory requirements and attract socially responsible investors, whereas management reports drive strategic planning and resource allocation. Accurate differentiation ensures that relevant data is communicated to stakeholders effectively without conflating external accountability with internal monitoring. This clarity enhances transparency, supports risk management, and aligns corporate strategies with both financial goals and sustainability commitments.

Comparison Table

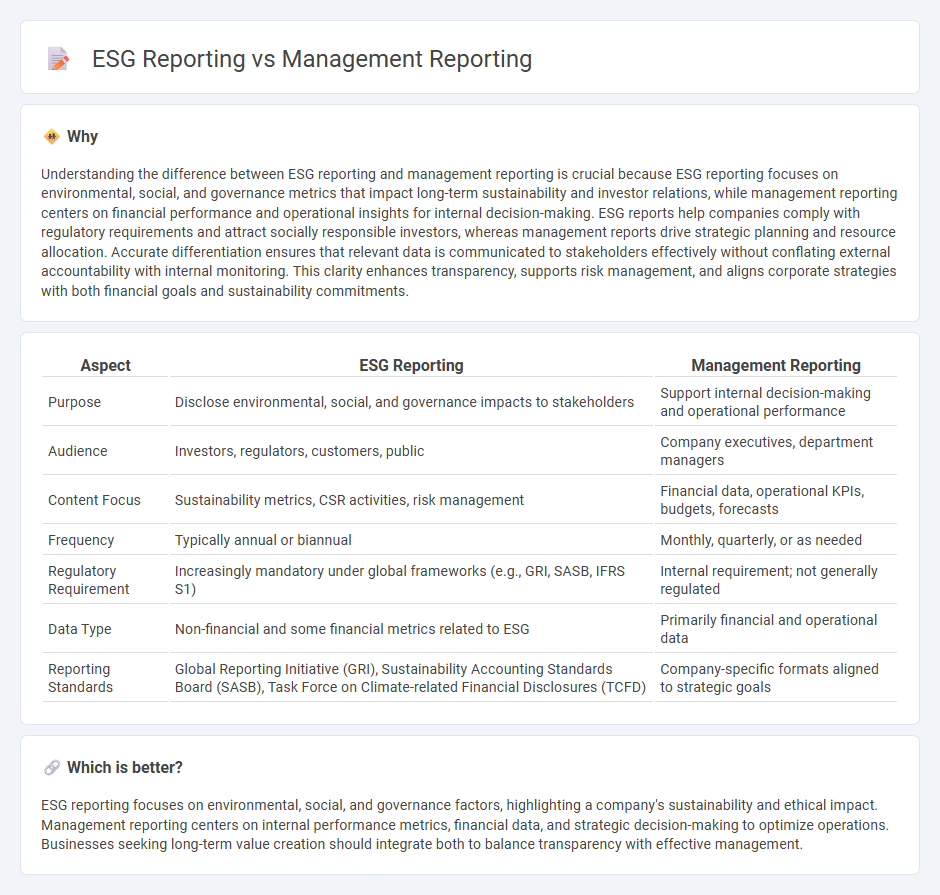

| Aspect | ESG Reporting | Management Reporting |

|---|---|---|

| Purpose | Disclose environmental, social, and governance impacts to stakeholders | Support internal decision-making and operational performance |

| Audience | Investors, regulators, customers, public | Company executives, department managers |

| Content Focus | Sustainability metrics, CSR activities, risk management | Financial data, operational KPIs, budgets, forecasts |

| Frequency | Typically annual or biannual | Monthly, quarterly, or as needed |

| Regulatory Requirement | Increasingly mandatory under global frameworks (e.g., GRI, SASB, IFRS S1) | Internal requirement; not generally regulated |

| Data Type | Non-financial and some financial metrics related to ESG | Primarily financial and operational data |

| Reporting Standards | Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), Task Force on Climate-related Financial Disclosures (TCFD) | Company-specific formats aligned to strategic goals |

Which is better?

ESG reporting focuses on environmental, social, and governance factors, highlighting a company's sustainability and ethical impact. Management reporting centers on internal performance metrics, financial data, and strategic decision-making to optimize operations. Businesses seeking long-term value creation should integrate both to balance transparency with effective management.

Connection

ESG reporting integrates environmental, social, and governance metrics into the financial analysis framework, enhancing management reporting by providing a comprehensive view of non-financial risks and opportunities. Management reporting leverages ESG data to inform strategic decision-making, improve stakeholder communication, and ensure compliance with emerging regulatory requirements. The convergence of ESG and management reporting drives transparency, accountability, and long-term value creation within corporate governance and accounting practices.

Key Terms

**Management reporting:**

Management reporting primarily centers on providing internal stakeholders with accurate financial data, operational metrics, and strategic insights to support decision-making and performance tracking. It integrates various data sources to generate timely reports on budgets, forecasts, and key performance indicators (KPIs) critical for effective corporate governance. Discover how robust management reporting frameworks can enhance business agility and strategic planning processes.

Key Performance Indicators (KPIs)

Management reporting prioritizes financial KPIs such as revenue growth, profit margins, and operational efficiency to drive strategic decision-making. ESG reporting emphasizes non-financial KPIs including carbon emissions, water usage, diversity metrics, and social impact to meet sustainability goals and stakeholder expectations. Explore detailed differences and how integrating both enhances comprehensive organizational performance.

Budget Variance

Budget variance analysis in management reporting emphasizes tracking deviations between actual and planned financial performance to optimize resource allocation and cost control. ESG reporting, however, integrates budget variance by assessing financial implications of environmental, social, and governance initiatives, aligning fiscal discipline with sustainability goals. Explore detailed strategies for balancing budget variance in both reporting frameworks to enhance organizational transparency and accountability.

Source and External Links

Management reporting - CCH Tagetik - Wolters Kluwer - Management reporting provides confidential, internal financial and operational information to help company leaders monitor performance, make decisions, and guide business strategy--distinct from regulatory or external reports, with no fixed format or external deadlines.

Essential Elements for Effective Monthly Management Reports - Monthly management reports collect and present departmental data in an accessible way, enabling leadership to track progress, adjust strategies, maintain accountability, and align all parts of the business with overall goals.

Managerial Reporting: Definition, Purpose and Best Practices - Managerial reporting tailors data collection and presentation to department needs, empowering managers with actionable insights on KPIs, team performance, and resource allocation for effective, data-driven decision-making.

dowidth.com

dowidth.com