Dynamic allocation tracing identifies memory usage patterns during program execution, optimizing resource management within accounting software systems. Real-time transaction monitoring continuously analyzes accounting entries and financial data to detect anomalies and ensure compliance instantly. Explore more to understand how these technologies enhance accounting accuracy and efficiency.

Why it is important

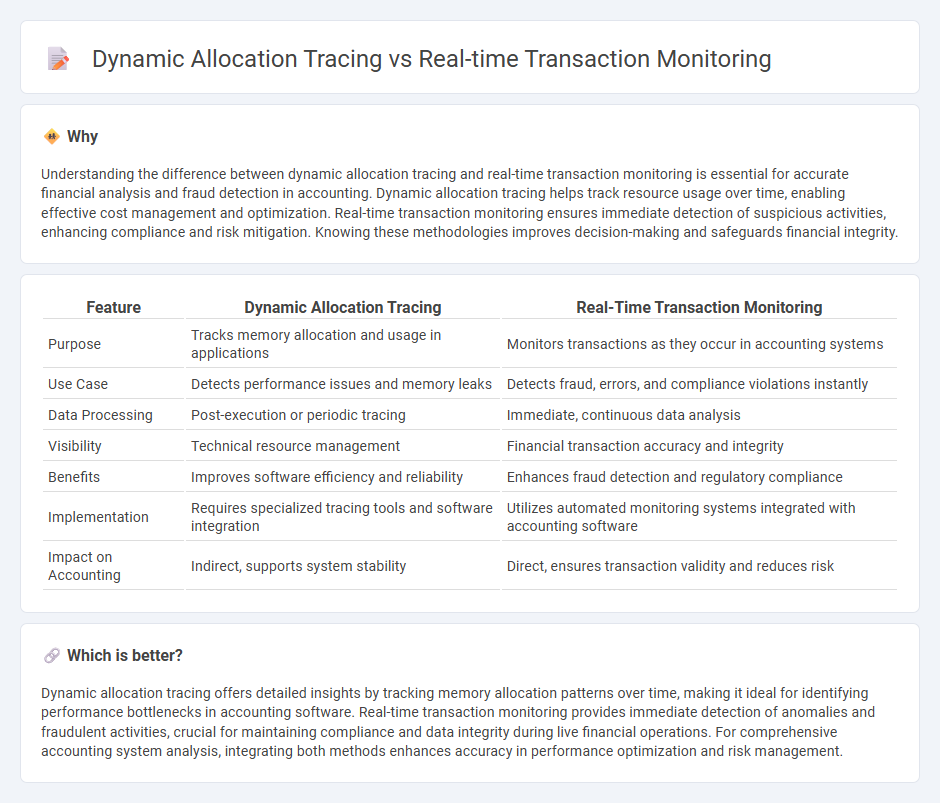

Understanding the difference between dynamic allocation tracing and real-time transaction monitoring is essential for accurate financial analysis and fraud detection in accounting. Dynamic allocation tracing helps track resource usage over time, enabling effective cost management and optimization. Real-time transaction monitoring ensures immediate detection of suspicious activities, enhancing compliance and risk mitigation. Knowing these methodologies improves decision-making and safeguards financial integrity.

Comparison Table

| Feature | Dynamic Allocation Tracing | Real-Time Transaction Monitoring |

|---|---|---|

| Purpose | Tracks memory allocation and usage in applications | Monitors transactions as they occur in accounting systems |

| Use Case | Detects performance issues and memory leaks | Detects fraud, errors, and compliance violations instantly |

| Data Processing | Post-execution or periodic tracing | Immediate, continuous data analysis |

| Visibility | Technical resource management | Financial transaction accuracy and integrity |

| Benefits | Improves software efficiency and reliability | Enhances fraud detection and regulatory compliance |

| Implementation | Requires specialized tracing tools and software integration | Utilizes automated monitoring systems integrated with accounting software |

| Impact on Accounting | Indirect, supports system stability | Direct, ensures transaction validity and reduces risk |

Which is better?

Dynamic allocation tracing offers detailed insights by tracking memory allocation patterns over time, making it ideal for identifying performance bottlenecks in accounting software. Real-time transaction monitoring provides immediate detection of anomalies and fraudulent activities, crucial for maintaining compliance and data integrity during live financial operations. For comprehensive accounting system analysis, integrating both methods enhances accuracy in performance optimization and risk management.

Connection

Dynamic allocation tracing enhances real-time transaction monitoring by providing detailed insights into memory usage and resource allocation during accounting software operations. Real-time transaction monitoring leverages this data to identify unusual patterns or anomalies in financial transactions, enabling immediate detection of potential fraud or errors. Integrating these technologies improves the accuracy and efficiency of accounting systems in tracking and validating transaction integrity.

Key Terms

Transaction Logs

Real-time transaction monitoring captures and analyzes transaction logs instantly to detect anomalies and ensure compliance, improving financial integrity and operational efficiency. Dynamic allocation tracing delves deeper into memory management by tracking resource distribution linked to transaction processes, optimizing system performance and preventing bottlenecks. Explore further to understand how leveraging transaction logs enhances both monitoring accuracy and system resource allocation.

Resource Allocation

Real-time transaction monitoring captures resource allocation by tracking live data flow, identifying bottlenecks instantly during operations. Dynamic allocation tracing provides a detailed historical map of how resources are assigned and re-assigned over time, uncovering hidden inefficiencies. Explore the nuances of resource allocation in these methods to enhance system performance insights.

Audit Trail

Real-time transaction monitoring captures and analyzes financial activities instantly to detect anomalies and ensure compliance, providing an unbroken audit trail for transparency and accountability. Dynamic allocation tracing tracks resource allocation and usage over time, enhancing the audit trail by mapping changes and their impacts on system performance. Explore the benefits of integrating both methods to strengthen your audit trail management and compliance strategies.

Source and External Links

What is Real-Time Transaction Monitoring: Steps & ... - Real-time transaction monitoring enables financial institutions to swiftly identify and tackle suspicious transactions through immediate detection, pattern recognition, alerting, blocking suspicious transactions, compliance checks, and adaptability to emerging threats using machine learning and AI.

Real-Time And Offsite Transaction Monitoring - Real-time transaction monitoring checks transactions as they occur, based on parameters like transaction thresholds, origin, type, purpose, and beneficiary, providing instant alerts to prevent processing suspicious transactions.

Understanding Real-Time Transaction Monitoring - Real-time transaction monitoring helps detect financial crimes early by analyzing transactions and behaviors, supporting AML and counter-terrorism financing efforts and enabling financial institutions to manage customer risk effectively.

dowidth.com

dowidth.com