Outcome-based budgeting focuses on allocating resources based on the expected results and performance metrics, enhancing efficiency and accountability in financial management. Line-item budgeting categorizes expenses by specific accounts, emphasizing control over individual expenditure items rather than overall outcomes. Explore the differences and benefits of these budgeting methods to optimize your organization's financial strategy.

Why it is important

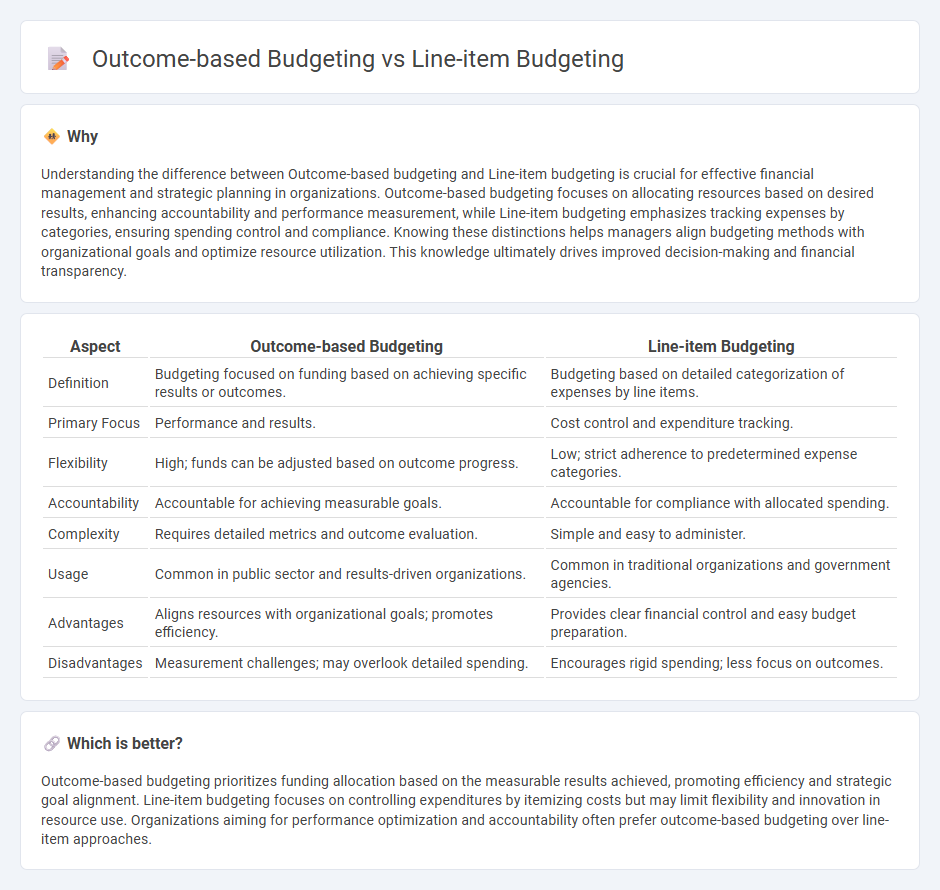

Understanding the difference between Outcome-based budgeting and Line-item budgeting is crucial for effective financial management and strategic planning in organizations. Outcome-based budgeting focuses on allocating resources based on desired results, enhancing accountability and performance measurement, while Line-item budgeting emphasizes tracking expenses by categories, ensuring spending control and compliance. Knowing these distinctions helps managers align budgeting methods with organizational goals and optimize resource utilization. This knowledge ultimately drives improved decision-making and financial transparency.

Comparison Table

| Aspect | Outcome-based Budgeting | Line-item Budgeting |

|---|---|---|

| Definition | Budgeting focused on funding based on achieving specific results or outcomes. | Budgeting based on detailed categorization of expenses by line items. |

| Primary Focus | Performance and results. | Cost control and expenditure tracking. |

| Flexibility | High; funds can be adjusted based on outcome progress. | Low; strict adherence to predetermined expense categories. |

| Accountability | Accountable for achieving measurable goals. | Accountable for compliance with allocated spending. |

| Complexity | Requires detailed metrics and outcome evaluation. | Simple and easy to administer. |

| Usage | Common in public sector and results-driven organizations. | Common in traditional organizations and government agencies. |

| Advantages | Aligns resources with organizational goals; promotes efficiency. | Provides clear financial control and easy budget preparation. |

| Disadvantages | Measurement challenges; may overlook detailed spending. | Encourages rigid spending; less focus on outcomes. |

Which is better?

Outcome-based budgeting prioritizes funding allocation based on the measurable results achieved, promoting efficiency and strategic goal alignment. Line-item budgeting focuses on controlling expenditures by itemizing costs but may limit flexibility and innovation in resource use. Organizations aiming for performance optimization and accountability often prefer outcome-based budgeting over line-item approaches.

Connection

Outcome-based budgeting and line-item budgeting are connected through their shared goal of enhancing financial accountability and resource allocation efficiency. Outcome-based budgeting focuses on funding programs based on expected results, while line-item budgeting details specific expenditure categories to ensure transparency. Integrating both approaches allows organizations to track how allocated funds in line items directly contribute to achieving targeted outcomes.

Key Terms

Expenditure categories

Line-item budgeting allocates funds based on specific expenditure categories such as salaries, equipment, and utilities, emphasizing control and accountability over spending. Outcome-based budgeting prioritizes funding according to program results and performance metrics, linking expenditure categories directly to desired outcomes and effectiveness. Explore how these budgeting approaches impact financial planning and resource allocation strategies.

Performance metrics

Line-item budgeting allocates funds to specific categories such as salaries, equipment, and materials, emphasizing expenditure control rather than results. Outcome-based budgeting prioritizes linking resources to measurable performance metrics like program effectiveness, customer satisfaction, and achievement of strategic goals. Explore how these budgeting approaches impact organizational efficiency and decision-making effectiveness.

Financial accountability

Line-item budgeting emphasizes tracking specific expenses by categorizing costs to ensure precise financial accountability and control over allocated funds. Outcome-based budgeting links financial inputs directly to measurable results, enhancing transparency and accountability by evaluating the effectiveness of spending in achieving organizational goals. Discover more about how each budgeting approach impacts financial management and decision-making.

Source and External Links

What is a Line Item Budget: A Comprehensive Guide - This webpage provides a detailed overview of line item budgeting, including its applications, advantages, and implementation steps.

Budgeting -- Budgetary Approaches - This chapter discusses line-item budgeting as a method that offers simplicity, ease of preparation, and enhances organizational control by categorizing expenses by unit and object.

What is a Line Item Budget and What Are Their Advantages? - This article explains the components and advantages of line item budgets, particularly for small and medium-sized businesses, highlighting their simplicity and effectiveness in tracking expenses.

dowidth.com

dowidth.com