Integrated ESG reporting combines environmental, social, and governance metrics with traditional financial data to present a comprehensive view of a company's performance and impact. Non-financial reporting focuses solely on qualitative and quantitative data related to sustainability and corporate responsibility without merging it with financial results. Explore how integrated ESG reporting enhances transparency and decision-making in modern accounting practices.

Why it is important

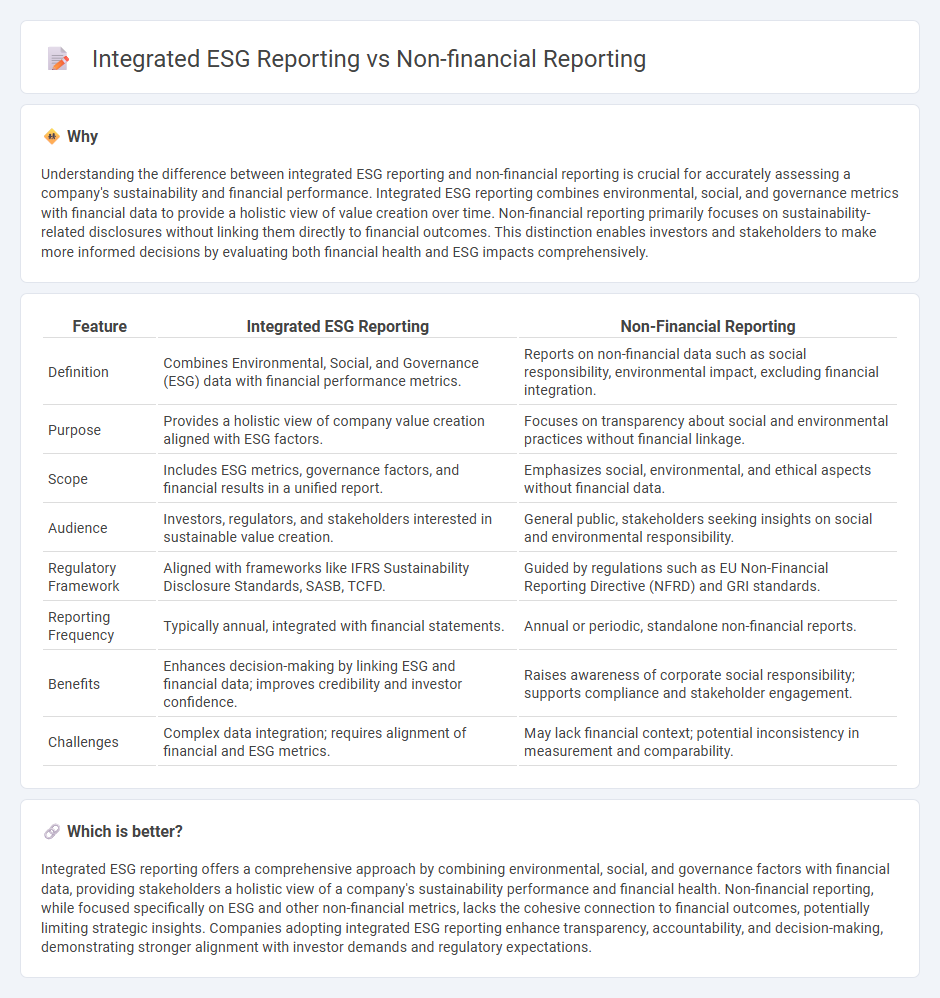

Understanding the difference between integrated ESG reporting and non-financial reporting is crucial for accurately assessing a company's sustainability and financial performance. Integrated ESG reporting combines environmental, social, and governance metrics with financial data to provide a holistic view of value creation over time. Non-financial reporting primarily focuses on sustainability-related disclosures without linking them directly to financial outcomes. This distinction enables investors and stakeholders to make more informed decisions by evaluating both financial health and ESG impacts comprehensively.

Comparison Table

| Feature | Integrated ESG Reporting | Non-Financial Reporting |

|---|---|---|

| Definition | Combines Environmental, Social, and Governance (ESG) data with financial performance metrics. | Reports on non-financial data such as social responsibility, environmental impact, excluding financial integration. |

| Purpose | Provides a holistic view of company value creation aligned with ESG factors. | Focuses on transparency about social and environmental practices without financial linkage. |

| Scope | Includes ESG metrics, governance factors, and financial results in a unified report. | Emphasizes social, environmental, and ethical aspects without financial data. |

| Audience | Investors, regulators, and stakeholders interested in sustainable value creation. | General public, stakeholders seeking insights on social and environmental responsibility. |

| Regulatory Framework | Aligned with frameworks like IFRS Sustainability Disclosure Standards, SASB, TCFD. | Guided by regulations such as EU Non-Financial Reporting Directive (NFRD) and GRI standards. |

| Reporting Frequency | Typically annual, integrated with financial statements. | Annual or periodic, standalone non-financial reports. |

| Benefits | Enhances decision-making by linking ESG and financial data; improves credibility and investor confidence. | Raises awareness of corporate social responsibility; supports compliance and stakeholder engagement. |

| Challenges | Complex data integration; requires alignment of financial and ESG metrics. | May lack financial context; potential inconsistency in measurement and comparability. |

Which is better?

Integrated ESG reporting offers a comprehensive approach by combining environmental, social, and governance factors with financial data, providing stakeholders a holistic view of a company's sustainability performance and financial health. Non-financial reporting, while focused specifically on ESG and other non-financial metrics, lacks the cohesive connection to financial outcomes, potentially limiting strategic insights. Companies adopting integrated ESG reporting enhance transparency, accountability, and decision-making, demonstrating stronger alignment with investor demands and regulatory expectations.

Connection

Integrated ESG reporting combines environmental, social, and governance metrics with traditional financial statements to provide a holistic view of a company's performance. Non-financial reporting includes sustainability data, social impact, and corporate governance disclosures that align with ESG criteria. This connection enhances transparency and helps investors assess long-term risks and opportunities beyond conventional accounting metrics.

Key Terms

Sustainability Disclosure

Non-financial reporting emphasizes environmental, social, and governance (ESG) factors separately from financial data, providing qualitative and quantitative insights primarily for compliance and stakeholder transparency. Integrated ESG reporting combines financial and sustainability information into a single framework, offering a holistic view of how sustainability impacts business performance and long-term value creation. Explore the evolving standards and best practices in sustainability disclosure to enhance your organization's ESG communication.

Triple Bottom Line

Non-financial reporting primarily emphasizes environmental, social, and governance (ESG) disclosures without integrating financial data, focusing on sustainability metrics aligned with the Triple Bottom Line: people, planet, and profit. Integrated ESG reporting combines financial and non-financial data into a comprehensive framework, providing stakeholders with a holistic view of an organization's performance and long-term value creation. Explore how integrated ESG reporting enhances transparency and supports sustainable business strategies.

Materiality Assessment

Materiality assessment in non-financial reporting emphasizes identifying significant environmental, social, and governance (ESG) issues that impact a company's stakeholders, often focusing on compliance and risk management. Integrated ESG reporting advances this approach by embedding materiality into strategic decision-making, reflecting how ESG factors influence financial performance and long-term value creation. Explore how adopting integrated ESG reporting transforms transparency, accountability, and stakeholder engagement.

dowidth.com

dowidth.com