Supply chain finance accounting focuses on optimizing cash flow between buyers and suppliers by managing short-term credit and payment terms, enhancing working capital efficiency. Accounts payable accounting involves tracking and recording company obligations to suppliers for goods and services received, ensuring accurate and timely payments. Explore how these two accounting practices interact to improve financial operations in your business.

Why it is important

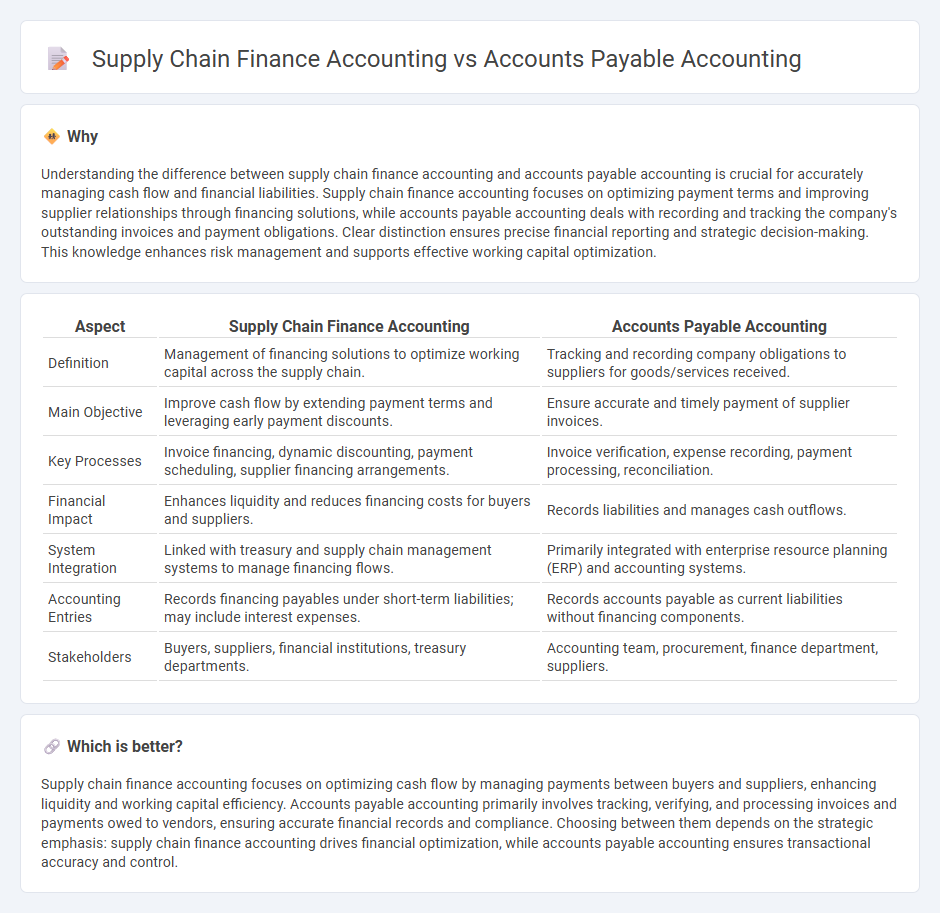

Understanding the difference between supply chain finance accounting and accounts payable accounting is crucial for accurately managing cash flow and financial liabilities. Supply chain finance accounting focuses on optimizing payment terms and improving supplier relationships through financing solutions, while accounts payable accounting deals with recording and tracking the company's outstanding invoices and payment obligations. Clear distinction ensures precise financial reporting and strategic decision-making. This knowledge enhances risk management and supports effective working capital optimization.

Comparison Table

| Aspect | Supply Chain Finance Accounting | Accounts Payable Accounting |

|---|---|---|

| Definition | Management of financing solutions to optimize working capital across the supply chain. | Tracking and recording company obligations to suppliers for goods/services received. |

| Main Objective | Improve cash flow by extending payment terms and leveraging early payment discounts. | Ensure accurate and timely payment of supplier invoices. |

| Key Processes | Invoice financing, dynamic discounting, payment scheduling, supplier financing arrangements. | Invoice verification, expense recording, payment processing, reconciliation. |

| Financial Impact | Enhances liquidity and reduces financing costs for buyers and suppliers. | Records liabilities and manages cash outflows. |

| System Integration | Linked with treasury and supply chain management systems to manage financing flows. | Primarily integrated with enterprise resource planning (ERP) and accounting systems. |

| Accounting Entries | Records financing payables under short-term liabilities; may include interest expenses. | Records accounts payable as current liabilities without financing components. |

| Stakeholders | Buyers, suppliers, financial institutions, treasury departments. | Accounting team, procurement, finance department, suppliers. |

Which is better?

Supply chain finance accounting focuses on optimizing cash flow by managing payments between buyers and suppliers, enhancing liquidity and working capital efficiency. Accounts payable accounting primarily involves tracking, verifying, and processing invoices and payments owed to vendors, ensuring accurate financial records and compliance. Choosing between them depends on the strategic emphasis: supply chain finance accounting drives financial optimization, while accounts payable accounting ensures transactional accuracy and control.

Connection

Supply chain finance accounting and accounts payable accounting are interconnected through the management of payment obligations and cash flow optimization within a company's supply chain. Supply chain finance accounting tracks financing arrangements that improve supplier payment terms, while accounts payable accounting records and controls outstanding liabilities to suppliers. Together, these functions streamline working capital management and enhance supplier relationships by ensuring timely payment processes.

Key Terms

**Accounts Payable Accounting:**

Accounts payable accounting manages outstanding obligations that a company owes to its suppliers for goods and services received, focusing on invoice processing, payment scheduling, and accurate ledger entries to maintain financial accuracy. It ensures timely payments to vendors while optimizing cash flow and maintaining healthy supplier relationships, critical for operational efficiency. Explore more about how accounts payable accounting supports financial stability and procurement strategies in business operations.

Invoice Processing

Accounts payable accounting centers on managing and recording supplier invoices, ensuring timely payments, and maintaining accurate financial records. Supply chain finance accounting emphasizes optimizing cash flow by leveraging invoice processing data to facilitate early payments and financing solutions between buyers and suppliers. Explore how these invoice processing approaches enhance financial efficiency and collaboration in business operations.

Trade Credit

Trade credit in accounts payable accounting involves recording short-term liabilities incurred when a company purchases goods or services on credit, impacting cash flow and working capital management. Supply chain finance accounting emphasizes optimizing payment terms and leveraging financial solutions to improve the entire supply chain's liquidity and reduce financing costs. Explore how integrating trade credit strategies within these accounting frameworks can enhance financial efficiency.

Source and External Links

What is Accounts Payable - Meaning, Process, Examples, Formula - Accounts payable (AP) is the money a business owes its suppliers for goods and services purchased on credit, recorded as a current liability, with processes including invoice matching, approval, entry, and payment scheduling in accounting systems.

What is Accounts Payable? Steps and Examples - Tipalti - Accounts payable refers to short-term debts a company owes to vendors, tracked via accrual accounting and double-entry bookkeeping, and is important for cash flow management and avoiding late payments or interest.

What is accounts payable? | Definition & Meaning | SAP Taulia - Accounts payable is a current liability showing amounts owed to suppliers on credit purchases, appearing on the balance sheet, distinct from accounts receivable, and measured with metrics like Days Payable Outstanding (DPO).

dowidth.com

dowidth.com