Microtransaction accounting focuses on recording and managing numerous small-value financial transactions typical in digital payments and online services. Digital asset accounting, on the other hand, deals with tracking, valuing, and reporting blockchain-based assets such as cryptocurrencies and NFTs, requiring specialized approaches for volatility and ownership verification. Explore the distinct methodologies and regulatory considerations shaping both fields to enhance your financial reporting accuracy.

Why it is important

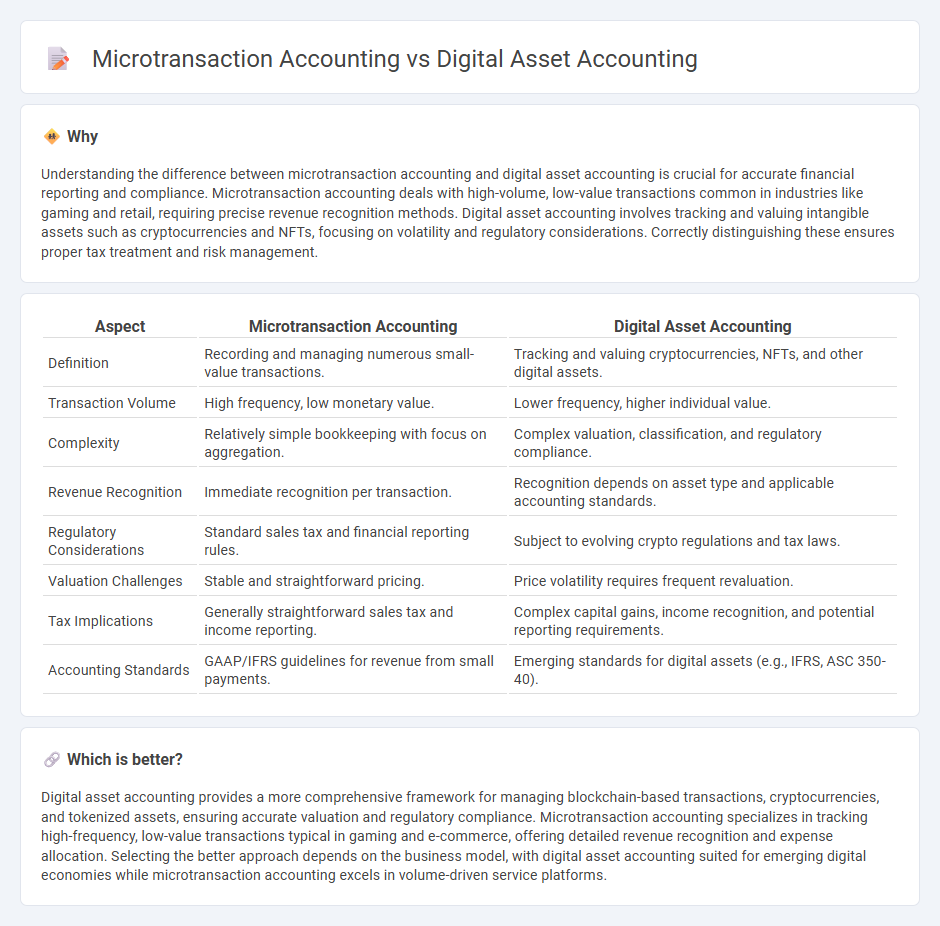

Understanding the difference between microtransaction accounting and digital asset accounting is crucial for accurate financial reporting and compliance. Microtransaction accounting deals with high-volume, low-value transactions common in industries like gaming and retail, requiring precise revenue recognition methods. Digital asset accounting involves tracking and valuing intangible assets such as cryptocurrencies and NFTs, focusing on volatility and regulatory considerations. Correctly distinguishing these ensures proper tax treatment and risk management.

Comparison Table

| Aspect | Microtransaction Accounting | Digital Asset Accounting |

|---|---|---|

| Definition | Recording and managing numerous small-value transactions. | Tracking and valuing cryptocurrencies, NFTs, and other digital assets. |

| Transaction Volume | High frequency, low monetary value. | Lower frequency, higher individual value. |

| Complexity | Relatively simple bookkeeping with focus on aggregation. | Complex valuation, classification, and regulatory compliance. |

| Revenue Recognition | Immediate recognition per transaction. | Recognition depends on asset type and applicable accounting standards. |

| Regulatory Considerations | Standard sales tax and financial reporting rules. | Subject to evolving crypto regulations and tax laws. |

| Valuation Challenges | Stable and straightforward pricing. | Price volatility requires frequent revaluation. |

| Tax Implications | Generally straightforward sales tax and income reporting. | Complex capital gains, income recognition, and potential reporting requirements. |

| Accounting Standards | GAAP/IFRS guidelines for revenue from small payments. | Emerging standards for digital assets (e.g., IFRS, ASC 350-40). |

Which is better?

Digital asset accounting provides a more comprehensive framework for managing blockchain-based transactions, cryptocurrencies, and tokenized assets, ensuring accurate valuation and regulatory compliance. Microtransaction accounting specializes in tracking high-frequency, low-value transactions typical in gaming and e-commerce, offering detailed revenue recognition and expense allocation. Selecting the better approach depends on the business model, with digital asset accounting suited for emerging digital economies while microtransaction accounting excels in volume-driven service platforms.

Connection

Microtransaction accounting and digital asset accounting intersect through detailed tracking and reporting of high-volume, small-scale transactions involving digital assets. Both require robust ledger systems to manage fractional ownership, crypto payments, and real-time valuation changes within blockchain environments. Accurate recording of microtransactions ensures compliance and transparency in broader digital asset portfolios, enhancing financial accountability in decentralized finance ecosystems.

Key Terms

**Digital asset accounting:**

Digital asset accounting involves tracking and managing the value, acquisition, depreciation, and disposal of digital assets such as cryptocurrencies, NFTs, and software licenses, ensuring compliance with financial regulations and accurate reporting. It requires specialized tools and methodologies to handle volatility, blockchain verification, and secure record-keeping. Explore in-depth strategies and best practices in digital asset accounting to enhance financial transparency and control.

Blockchain ledger

Digital asset accounting on blockchain ledgers ensures transparent and immutable tracking of ownership, transfers, and valuations, critical for cryptocurrencies and tokenized assets. Microtransaction accounting emphasizes high-frequency, low-value transactions recorded efficiently on blockchain to minimize fees and optimize scalability. Explore further to understand how blockchain technology revolutionizes accounting frameworks for digital and microtransaction environments.

Asset valuation

Digital asset accounting emphasizes precise asset valuation through blockchain transparency, ensuring accurate tracking and reporting of cryptocurrencies and NFTs. Microtransaction accounting focuses on aggregating and valuing numerous small, high-frequency transactions to maintain financial accuracy and compliance. Explore detailed methodologies and best practices for optimizing asset valuation in both domains.

Source and External Links

Accounting treatments for your digital assets - Ocorian - Digital asset accounting under IFRS includes treating assets as inventory under IAS 2 or as intangible assets under IAS 38, with measurement models based on cost or fair value depending on active markets and asset life assumptions.

The United States' First Digital Asset Accounting Rules - Law Review - The US FASB now requires fair value accounting for cryptocurrencies at year-end, allowing entities to report unrealized gains and losses, enhancing transparency and promoting long-term holding of digital assets.

Digital assets | Internal Revenue Service - For tax purposes in the US, digital asset transactions must be reported with detailed records, and gains or losses from sale or disposition are treated as capital gains or losses.

dowidth.com

dowidth.com