Smart contracts accounting automates transaction verification and ledger updates using blockchain technology, reducing errors and increasing transparency compared to traditional financial statement preparation. Financial statement preparation involves manual data aggregation, reconciliation, and compliance with accounting standards to produce accurate reports for stakeholders. Explore how integrating smart contracts can revolutionize your accounting processes and enhance financial reporting accuracy.

Why it is important

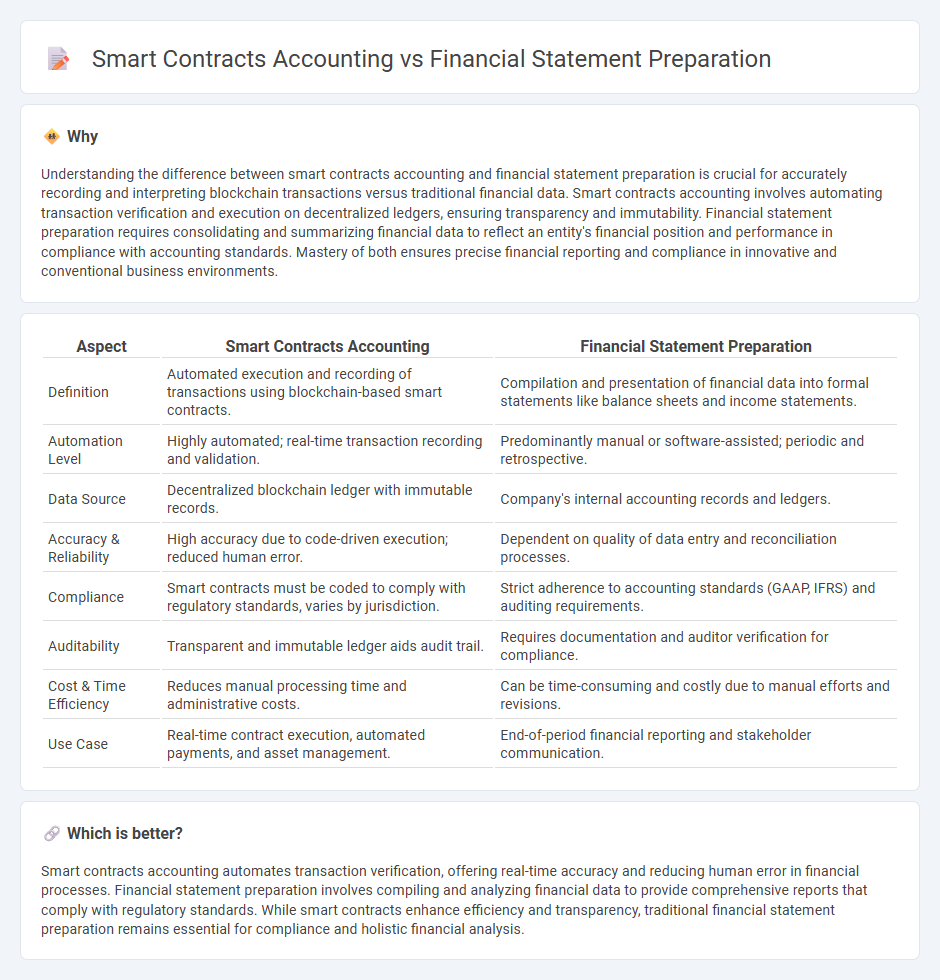

Understanding the difference between smart contracts accounting and financial statement preparation is crucial for accurately recording and interpreting blockchain transactions versus traditional financial data. Smart contracts accounting involves automating transaction verification and execution on decentralized ledgers, ensuring transparency and immutability. Financial statement preparation requires consolidating and summarizing financial data to reflect an entity's financial position and performance in compliance with accounting standards. Mastery of both ensures precise financial reporting and compliance in innovative and conventional business environments.

Comparison Table

| Aspect | Smart Contracts Accounting | Financial Statement Preparation |

|---|---|---|

| Definition | Automated execution and recording of transactions using blockchain-based smart contracts. | Compilation and presentation of financial data into formal statements like balance sheets and income statements. |

| Automation Level | Highly automated; real-time transaction recording and validation. | Predominantly manual or software-assisted; periodic and retrospective. |

| Data Source | Decentralized blockchain ledger with immutable records. | Company's internal accounting records and ledgers. |

| Accuracy & Reliability | High accuracy due to code-driven execution; reduced human error. | Dependent on quality of data entry and reconciliation processes. |

| Compliance | Smart contracts must be coded to comply with regulatory standards, varies by jurisdiction. | Strict adherence to accounting standards (GAAP, IFRS) and auditing requirements. |

| Auditability | Transparent and immutable ledger aids audit trail. | Requires documentation and auditor verification for compliance. |

| Cost & Time Efficiency | Reduces manual processing time and administrative costs. | Can be time-consuming and costly due to manual efforts and revisions. |

| Use Case | Real-time contract execution, automated payments, and asset management. | End-of-period financial reporting and stakeholder communication. |

Which is better?

Smart contracts accounting automates transaction verification, offering real-time accuracy and reducing human error in financial processes. Financial statement preparation involves compiling and analyzing financial data to provide comprehensive reports that comply with regulatory standards. While smart contracts enhance efficiency and transparency, traditional financial statement preparation remains essential for compliance and holistic financial analysis.

Connection

Smart contracts streamline accounting by automating transaction verification and recording, ensuring real-time accuracy and reducing human error. Their integration with financial statement preparation enhances transparency and traceability, enabling auditors to confirm the authenticity of reported data efficiently. Leveraging blockchain technology within smart contracts promotes immutability and compliance, which is critical for reliable financial reporting.

Key Terms

Financial statement preparation:

Financial statement preparation involves systematically recording, summarizing, and presenting financial data to provide a clear overview of a company's financial health, adhering strictly to accounting standards like GAAP or IFRS. This process ensures accuracy, comparability, and compliance, facilitating informed decision-making for stakeholders and regulatory bodies. Explore how integrating automated tools and best practices can enhance the efficiency and reliability of financial statement preparation.

Accrual basis

Financial statement preparation on an accrual basis recognizes revenues and expenses when they are incurred, providing a comprehensive view of a company's financial position. Smart contracts accounting automates these recognition processes by embedding accrual rules directly into blockchain-based agreements, ensuring real-time and tamper-proof financial records. Explore how integrating smart contracts can enhance accuracy and efficiency in accrual accounting practices.

Double-entry bookkeeping

Financial statement preparation relies heavily on traditional double-entry bookkeeping to ensure accurate tracking of debits and credits across accounts, maintaining balanced financial records. Smart contracts accounting integrates blockchain technology to automate transaction entries and enforce financial rules, enabling real-time updates within a decentralized ledger while preserving double-entry principles. Explore how these contrasting approaches redefine accuracy and transparency in financial management.

Source and External Links

How to prepare a financial statement the right way - Expensify - This guide outlines a clear 5-step process to prepare financial statements, starting from gathering all relevant financial data, categorizing it into revenue, expenses, assets, and liabilities, and using software tools to streamline and ensure accuracy before sharing the finalized statements with stakeholders.

2021 Financial Statement Preparation Guide - This comprehensive PDF resource provides detailed requirements, sample financial statements (including balance sheet, statement of operations, cash flows), audit considerations, and notes to ensure a fair presentation in accordance with generally accepted accounting principles (GAAP).

Basic understanding of a company's financial statements - PwC - This publication explains the purpose and components of key financial statements (balance sheet, income statement, cash flow statement), their role in illustrating business activities and financial health, and emphasizes the importance of accuracy and auditing for financial decision-making.

dowidth.com

dowidth.com