Neobank reconciliation involves matching digital banking transactions with internal records to ensure accuracy and detect discrepancies in real time. Payroll reconciliation focuses on verifying employee compensation data against payroll disbursements, tax withholdings, and benefits to maintain compliance and financial integrity. Explore detailed processes and best practices for both types of reconciliation to optimize your accounting workflow.

Why it is important

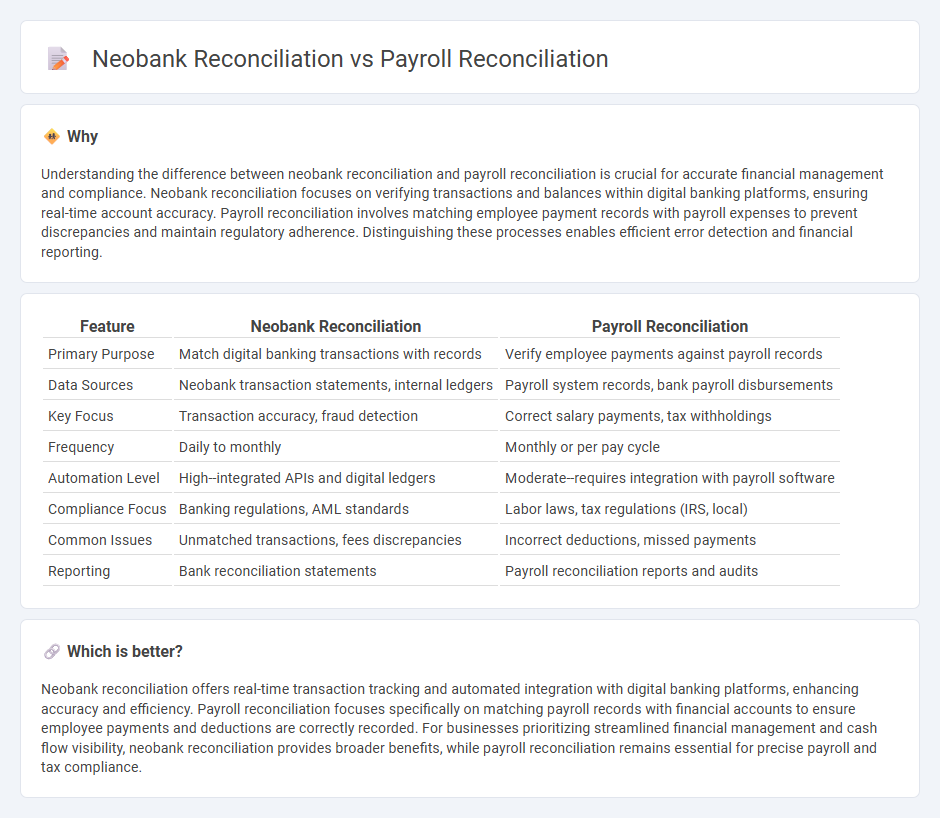

Understanding the difference between neobank reconciliation and payroll reconciliation is crucial for accurate financial management and compliance. Neobank reconciliation focuses on verifying transactions and balances within digital banking platforms, ensuring real-time account accuracy. Payroll reconciliation involves matching employee payment records with payroll expenses to prevent discrepancies and maintain regulatory adherence. Distinguishing these processes enables efficient error detection and financial reporting.

Comparison Table

| Feature | Neobank Reconciliation | Payroll Reconciliation |

|---|---|---|

| Primary Purpose | Match digital banking transactions with records | Verify employee payments against payroll records |

| Data Sources | Neobank transaction statements, internal ledgers | Payroll system records, bank payroll disbursements |

| Key Focus | Transaction accuracy, fraud detection | Correct salary payments, tax withholdings |

| Frequency | Daily to monthly | Monthly or per pay cycle |

| Automation Level | High--integrated APIs and digital ledgers | Moderate--requires integration with payroll software |

| Compliance Focus | Banking regulations, AML standards | Labor laws, tax regulations (IRS, local) |

| Common Issues | Unmatched transactions, fees discrepancies | Incorrect deductions, missed payments |

| Reporting | Bank reconciliation statements | Payroll reconciliation reports and audits |

Which is better?

Neobank reconciliation offers real-time transaction tracking and automated integration with digital banking platforms, enhancing accuracy and efficiency. Payroll reconciliation focuses specifically on matching payroll records with financial accounts to ensure employee payments and deductions are correctly recorded. For businesses prioritizing streamlined financial management and cash flow visibility, neobank reconciliation provides broader benefits, while payroll reconciliation remains essential for precise payroll and tax compliance.

Connection

Neobank reconciliation and payroll reconciliation are connected through their role in ensuring accurate financial records by matching digital banking transactions with payroll disbursements. Automated reconciliation processes in neobanks facilitate timely verification of salary payments, reducing discrepancies and improving cash flow management. This integration enhances transparency and compliance within accounting systems by synchronizing employee payments with bank statements.

Key Terms

**Payroll Reconciliation:**

Payroll reconciliation involves verifying and matching employee compensation records with payroll disbursements, ensuring accuracy in salary payments, tax deductions, and benefits allocation. This process helps organizations identify discrepancies between payroll reports and bank statements to prevent financial errors and compliance issues. Discover more about how payroll reconciliation streamlines financial operations and safeguards employee trust.

Gross Pay

Payroll reconciliation involves verifying the accuracy of gross pay amounts by comparing payroll records with accounting entries to ensure employee compensation is correctly processed. Neobank reconciliation, on the other hand, focuses on matching gross pay disbursements with transactions reflected in digital banking statements for seamless financial tracking. Discover how these reconciliation processes impact your financial reporting and cash flow management.

Deductions

Payroll reconciliation ensures accurate alignment of employee deductions such as taxes, retirement contributions, and benefits, matching payroll records with actual disbursements to prevent discrepancies. Neobank reconciliation focuses on verifying deductions related to fees, transfers, and payments within digital banking platforms to maintain precise account balances. Explore detailed insights to optimize deduction management in both payroll and neobank reconciliation processes.

Source and External Links

What is Payroll Reconciliation | F&A Glossary - BlackLine - Payroll reconciliation is the process of verifying that all records and information supporting employee compensation--including hours worked, pay rates, deductions, and net pay--are accurate and match between the payroll register and time sheet data.

A detailed Guide on Payroll Reconciliation Process - Payroll reconciliation involves comparing and verifying financial records related to employee compensation and benefits with other data sources to ensure compliance, identify discrepancies, and prevent errors or fraud.

What Is Payroll Reconciliation? A How-To Guide - NetSuite - Payroll reconciliation is the detailed process of ensuring that amounts paid to employees and deductions for taxes and withholdings are accurately reflected in a company's financial records, helping maintain compliance and financial integrity.

dowidth.com

dowidth.com