Fractional CFO services provide businesses with part-time financial leadership, offering expert strategic guidance and financial planning without the cost of a full-time executive. Interim CFO services deliver temporary full-time financial management during periods of transition, such as mergers, acquisitions, or executive departures, ensuring uninterrupted fiscal oversight. Discover how choosing the right CFO service can optimize financial performance and support business growth.

Why it is important

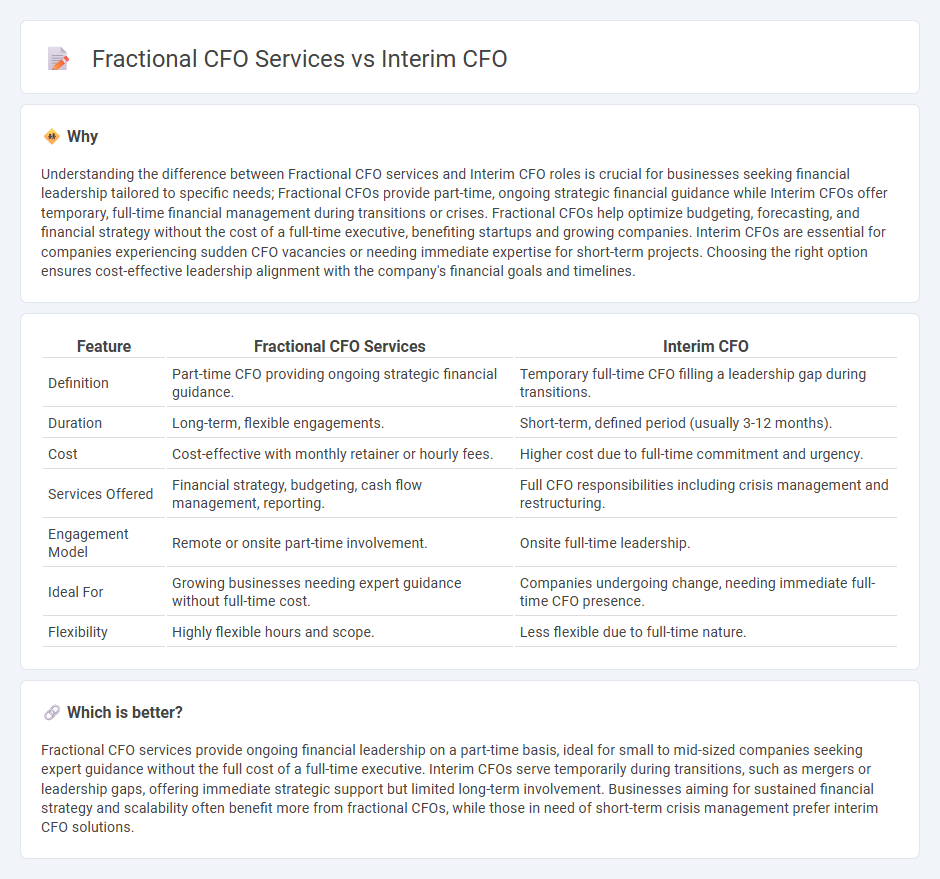

Understanding the difference between Fractional CFO services and Interim CFO roles is crucial for businesses seeking financial leadership tailored to specific needs; Fractional CFOs provide part-time, ongoing strategic financial guidance while Interim CFOs offer temporary, full-time financial management during transitions or crises. Fractional CFOs help optimize budgeting, forecasting, and financial strategy without the cost of a full-time executive, benefiting startups and growing companies. Interim CFOs are essential for companies experiencing sudden CFO vacancies or needing immediate expertise for short-term projects. Choosing the right option ensures cost-effective leadership alignment with the company's financial goals and timelines.

Comparison Table

| Feature | Fractional CFO Services | Interim CFO |

|---|---|---|

| Definition | Part-time CFO providing ongoing strategic financial guidance. | Temporary full-time CFO filling a leadership gap during transitions. |

| Duration | Long-term, flexible engagements. | Short-term, defined period (usually 3-12 months). |

| Cost | Cost-effective with monthly retainer or hourly fees. | Higher cost due to full-time commitment and urgency. |

| Services Offered | Financial strategy, budgeting, cash flow management, reporting. | Full CFO responsibilities including crisis management and restructuring. |

| Engagement Model | Remote or onsite part-time involvement. | Onsite full-time leadership. |

| Ideal For | Growing businesses needing expert guidance without full-time cost. | Companies undergoing change, needing immediate full-time CFO presence. |

| Flexibility | Highly flexible hours and scope. | Less flexible due to full-time nature. |

Which is better?

Fractional CFO services provide ongoing financial leadership on a part-time basis, ideal for small to mid-sized companies seeking expert guidance without the full cost of a full-time executive. Interim CFOs serve temporarily during transitions, such as mergers or leadership gaps, offering immediate strategic support but limited long-term involvement. Businesses aiming for sustained financial strategy and scalability often benefit more from fractional CFOs, while those in need of short-term crisis management prefer interim CFO solutions.

Connection

Fractional CFO services and Interim CFO roles both provide flexible financial leadership tailored to business needs, offering expert guidance without the commitment of a full-time hire. Fractional CFOs typically work part-time across multiple clients, delivering strategic financial planning, budgeting, and cash flow management, while Interim CFOs serve temporarily during transitions such as executive departures or mergers. Both solutions enhance financial decision-making, risk management, and operational efficiency, making them crucial for companies seeking scalable CFO expertise.

Key Terms

Engagement Scope

Interim CFO services provide temporary, full-time financial leadership during transitions or crises, managing comprehensive financial operations and strategic planning. Fractional CFO services offer part-time, ongoing financial expertise tailored to specific business needs, focusing on targeted projects or advisory roles. Explore the differences to determine which CFO engagement best suits your company's financial goals.

Time Commitment

Interim CFO services involve a full-time, temporary executive commitment often required during critical transitions or financial restructuring, typically spanning several months. Fractional CFO services offer part-time expertise, allowing businesses to access high-level financial guidance on a flexible schedule without the long-term obligation. Explore key differences in time commitment and how each model aligns with your company's financial strategy.

Strategic Involvement

Interim CFO services provide temporary financial leadership during periods of transition, often focused on immediate operational financial management and stabilization. Fractional CFOs offer ongoing strategic involvement, contributing to long-term financial planning, growth strategies, and executive decision-making on a part-time basis. Discover how each role can align with your company's specific strategic needs.

Source and External Links

Interim CFO vs. Interim CFO - This article discusses the roles of an interim CFO, highlighting their strategic and operational differences, particularly in ensuring continuity or driving transformation within a company.

Interim CFO vs. Fractional CFO - This blog post compares interim and fractional CFOs, focusing on their roles in providing financial leadership during transition periods without the need for a long-term commitment.

A Month in the Life: Interim CFO Roles and Best Practices - This article provides insights into the daily life and responsibilities of an interim CFO, emphasizing the importance of the first 30 days in setting up a successful strategy for the company.

dowidth.com

dowidth.com