Embedded lease accounting focuses on leases integrated within broader contracts, requiring identification and separate recognition of lease components under IFRS 16 or ASC 842 standards. Leveraged lease accounting involves a lessor financing an asset acquisition primarily through debt, creating unique tax and reporting considerations under GAAP and IFRS frameworks. Explore more about how these lease accounting methods impact financial statements and compliance.

Why it is important

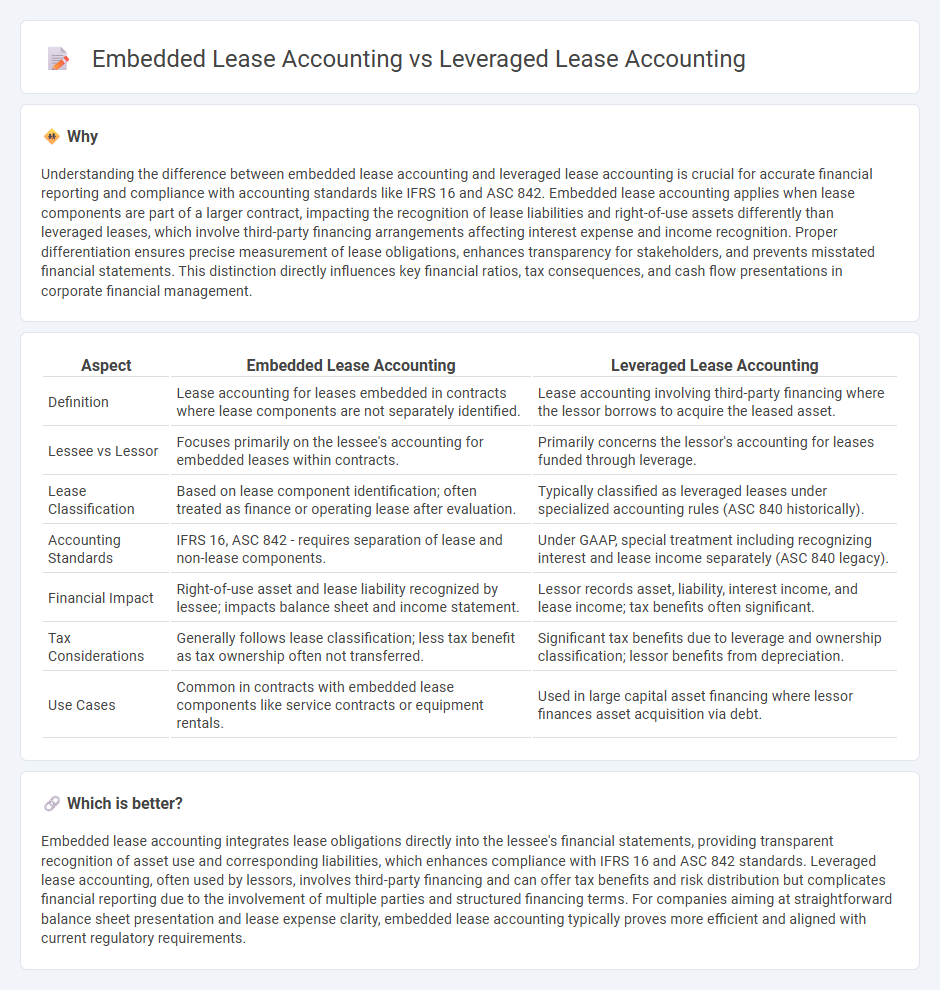

Understanding the difference between embedded lease accounting and leveraged lease accounting is crucial for accurate financial reporting and compliance with accounting standards like IFRS 16 and ASC 842. Embedded lease accounting applies when lease components are part of a larger contract, impacting the recognition of lease liabilities and right-of-use assets differently than leveraged leases, which involve third-party financing arrangements affecting interest expense and income recognition. Proper differentiation ensures precise measurement of lease obligations, enhances transparency for stakeholders, and prevents misstated financial statements. This distinction directly influences key financial ratios, tax consequences, and cash flow presentations in corporate financial management.

Comparison Table

| Aspect | Embedded Lease Accounting | Leveraged Lease Accounting |

|---|---|---|

| Definition | Lease accounting for leases embedded in contracts where lease components are not separately identified. | Lease accounting involving third-party financing where the lessor borrows to acquire the leased asset. |

| Lessee vs Lessor | Focuses primarily on the lessee's accounting for embedded leases within contracts. | Primarily concerns the lessor's accounting for leases funded through leverage. |

| Lease Classification | Based on lease component identification; often treated as finance or operating lease after evaluation. | Typically classified as leveraged leases under specialized accounting rules (ASC 840 historically). |

| Accounting Standards | IFRS 16, ASC 842 - requires separation of lease and non-lease components. | Under GAAP, special treatment including recognizing interest and lease income separately (ASC 840 legacy). |

| Financial Impact | Right-of-use asset and lease liability recognized by lessee; impacts balance sheet and income statement. | Lessor records asset, liability, interest income, and lease income; tax benefits often significant. |

| Tax Considerations | Generally follows lease classification; less tax benefit as tax ownership often not transferred. | Significant tax benefits due to leverage and ownership classification; lessor benefits from depreciation. |

| Use Cases | Common in contracts with embedded lease components like service contracts or equipment rentals. | Used in large capital asset financing where lessor finances asset acquisition via debt. |

Which is better?

Embedded lease accounting integrates lease obligations directly into the lessee's financial statements, providing transparent recognition of asset use and corresponding liabilities, which enhances compliance with IFRS 16 and ASC 842 standards. Leveraged lease accounting, often used by lessors, involves third-party financing and can offer tax benefits and risk distribution but complicates financial reporting due to the involvement of multiple parties and structured financing terms. For companies aiming at straightforward balance sheet presentation and lease expense clarity, embedded lease accounting typically proves more efficient and aligned with current regulatory requirements.

Connection

Embedded lease accounting involves identifying and accounting for lease components within contracts that include non-lease elements, ensuring compliance with ASC 842 or IFRS 16. Leveraged lease accounting applies when a lease involves nonrecourse financing, requiring specific accounting treatment under ASC 840 for lessors, focusing on recording lease payments and residual asset valuation. Both approaches address lease recognition and measurement complexities, highlighting distinctions between embedded lease components in contracts and financing structures influencing lessor accounting.

Key Terms

Lessor's investment

Leveraged lease accounting records the lessor's investment by reflecting the financed portion through nonrecourse debt, thereby highlighting the lessee's obligation and the lessor's equity stake separately. Embedded lease accounting consolidates lease terms within broader contractual agreements, requiring detailed asset and liability recognition to capture the lessor's exposure accurately. Explore comprehensive analyses to understand the financial and reporting impact on lessor investments.

Minimum lease payments

Minimum lease payments in leveraged lease accounting often include lease rental payments plus amounts guaranteed by the lessee, highlighting the lessor's risk exposure. In embedded lease accounting, these payments are identified within a larger contract and must be separated to determine lease obligations accurately under ASC 842 or IFRS 16. Explore detailed distinctions to optimize lease classification and reporting compliance.

Embedded derivatives

Leveraged lease accounting involves a lessor using third-party financing to purchase an asset, with lease payments structured to cover loan obligations and provide returns, while embedded lease accounting focuses on identifying lease components within broader contracts that may include embedded derivatives such as options or price adjustments. Embedded derivatives in leases require careful evaluation under ASC 815 or IFRS 9 to determine whether they need to be separated from the host lease agreement due to their distinct risk and cash flow characteristics. Explore deeper insights into how these accounting treatments impact financial reporting and compliance in lease contracts.

Source and External Links

Leveraged lease definition - AccountingTools - A leveraged lease is a tax-advantaged lease where the lessor borrows most of the asset's cost to lease it, the lender holds title, the lessor claims depreciation for tax purposes, and the lessee deducts lease payments; such leases typically involve debt financing covering most of the acquisition cost and allow both parties specific tax benefits.

ASC 842 Lease Accounting Guide: Examples, Effective Dates & More - Under ASC 840, leveraged leases were recognized as arrangements with lender title-holding and payments directed to the lender, but ASC 842 has eliminated the leveraged lease classification for new leases starting after its effective date, requiring new leases to follow ASC 842 lessor accounting rules.

9.5 Leveraged Lease Accounting | DART - Leveraged lease accounting under ASC 840 applied to a special direct financing lease structure involving nonrecourse financing and a cash flow pattern allowing early recovery of investment plus tax benefits; these complex rules required classification criteria including involvement of at least three parties and a nonrecourse creditor, but this accounting treatment is superseded by ASC 842.

dowidth.com

dowidth.com